Central Bank Digital Currencies: What Is a CBDC and Why Should You Care?

What Is a CBDC? In 2025, money is no longer just paper, coins, or a balance in a private bank account. Around the world, governments are now building something new: Central Bank Digital Currencies, better known as CBDCs.

These are not just digital versions of your regular bank account. A CBDC is a state-issued digital currency, designed to be legal tender. That means it can be used for everyday payments, savings, or even receiving public benefits. But unlike cash, CBDCs are entirely electronic, stored in digital wallets and backed by a central bank.

So, what is a CBDC really? How is it different from cryptocurrencies or the money in your e-wallet? And why are so many countries rushing to develop them?

“What Is a CBDC?” What Makes a CBDC Different?

Credit from Frost & Sullivan

At a basic level, a CBDC is digital money—but not just any digital money. It’s money created and guaranteed by a country’s central bank, like the Federal Reserve in the U.S., or the European Central Bank in the Eurozone.

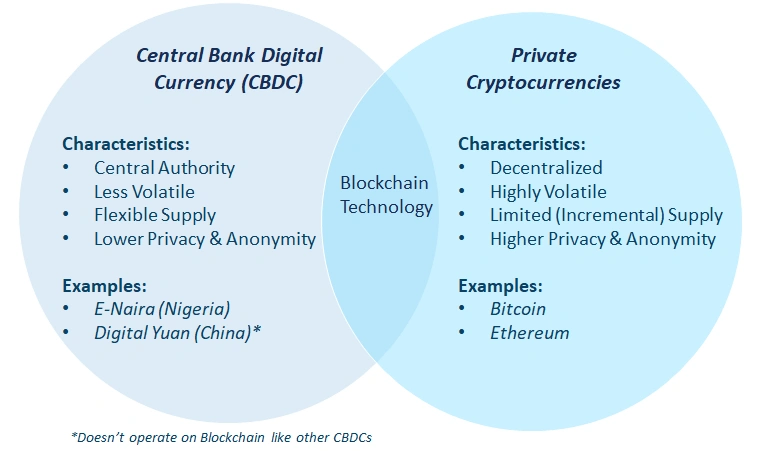

This makes it completely different from Bitcoin or other cryptocurrencies, which are typically decentralized and not issued by any government. It’s also different from the balance you see in your bank account, which is money created by private banks.

CBDCs aim to modernize the way we use and transfer money, by offering a trusted, stable, and secure alternative to both cash and cryptocurrencies.

“What Is a CBDC?” Two Main Types of CBDCs

Credit from Invesmate Blog

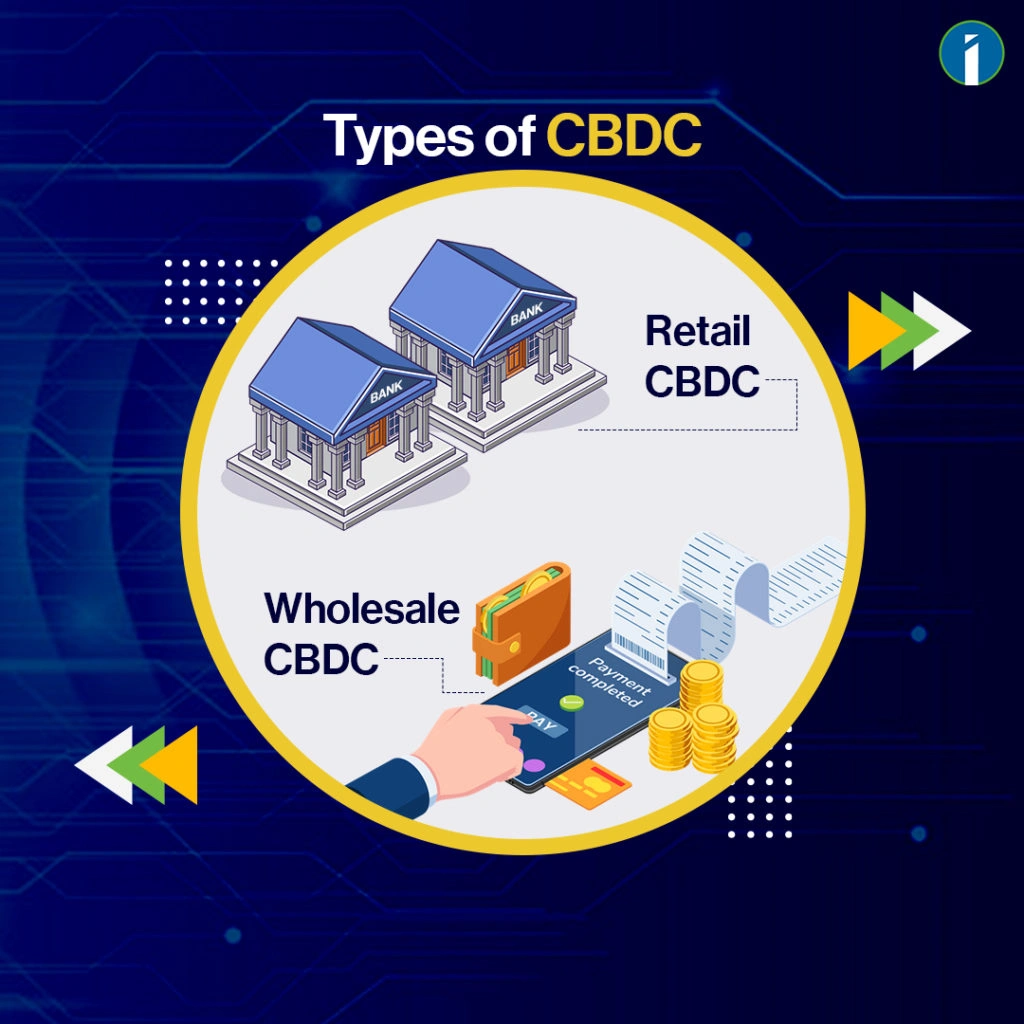

CBDCs are typically designed in two formats: retail and wholesale. Each serves a different purpose.

- Retail CBDCs are intended for the public. You might use a retail CBDC to pay at a store, send money to a friend, or receive a salary or tax refund. It’s like using digital cash.

- Wholesale CBDCs are only used between financial institutions, such as central banks and commercial banks. These help settle large transactions securely and efficiently.

Here’s a simple comparison:

| Type of CBDC | Used By | Purpose | Similar To |

|---|---|---|---|

| Retail CBDC | General public & businesses | Everyday transactions, digital payments | Cash, mobile payments |

| Wholesale CBDC | Banks & financial entities | Interbank settlements, liquidity tools | Central bank reserves |

Why Are Governments Exploring CBDCs?

Around the globe, governments are asking how digital currencies can improve their economies. CBDCs offer a number of potential advantages, especially as societies rely more on digital technology for payments.

Here are some key motivations:

- Declining Cash Usage

In many countries, people are using less physical cash. A CBDC provides a digital alternative that is still official, stable, and widely accepted. - Improved Payment Systems

Digital payments are often fast but dominated by private platforms. A CBDC would give people access to public digital money with fewer fees and less dependence on tech companies. - Inclusion for the Unbanked

Not everyone has a bank account, especially in rural areas or developing nations. CBDCs could provide financial access using only a smartphone. - Faster Government Payments

During emergencies like COVID-19, distributing aid digitally proved challenging. CBDCs could allow direct transfers to citizens, bypassing slow or inefficient systems. - Cross-Border Innovation

Sending money internationally is often slow and expensive. CBDCs could streamline cross-border transactions by connecting central banks directly.

Global Adoption: Who’s Leading the Way?

Credit from Statista

As of mid-2025, over 130 countries are actively researching or developing CBDCs. A few have already launched live systems, while others are conducting pilot programs or early testing.

| Country/Region | Project Name | Status | Notes |

|---|---|---|---|

| Bahamas | Sand Dollar | Live (since 2020) | First CBDC launched globally |

| Nigeria | eNaira | Live (since 2021) | Focused on inclusion and reducing cash use |

| Jamaica | JAM-DEX | Live (since 2022) | Offered to the public via government wallet |

| China | Digital Yuan | Advanced Pilot | Tested in over 200 million wallets across cities |

| European Union | Digital Euro | Prototype Phase | Legal frameworks and infrastructure in progress |

| United States | Not named | Research Only | Evaluating risks, privacy, and banking impact |

Each country approaches CBDCs based on its own needs. In emerging economies, financial access and digital infrastructure are top priorities. In wealthier nations, the focus is on privacy, efficiency, and monetary stability.

How CBDCs Differ from Cryptocurrencies and Stablecoins

It’s easy to confuse CBDCs with other forms of digital money—but there are major differences.

Cryptocurrencies like Bitcoin or Ethereum are decentralized. They are not issued by any government and their value can rise or fall dramatically.

Stablecoins, such as USDC or Tether, are digital tokens issued by private companies. These aim to maintain a stable value by being pegged to assets like the U.S. dollar. But they still rely on private reserves and often face regulatory scrutiny.

CBDCs, on the other hand, are:

- Issued and controlled by central banks

- Backed by the national government

- Considered legal tender

- Designed for long-term monetary policy and payment infrastructure

In short, CBDCs are digital public money, while cryptocurrencies and stablecoins are private digital assets.

“What Is a CBDC?” Key Advantages of CBDCs

Credit from Pixelplex.io

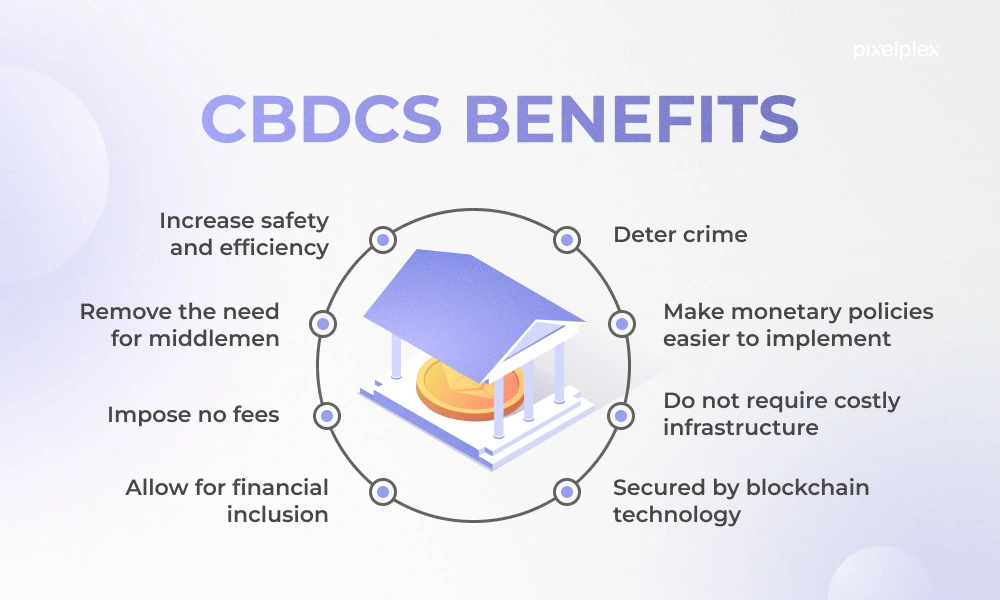

Supporters of CBDCs believe they could strengthen the financial system in multiple ways.

- Trust and Stability: As government-backed currencies, CBDCs are far less volatile than crypto.

- Lower Transaction Costs: Especially for cross-border payments, CBDCs can reduce fees.

- Transparency: CBDCs can improve compliance with anti-money laundering (AML) and anti-fraud policies.

- Policy Tools: Central banks could use programmable CBDCs to deliver interest rates or enforce restrictions (such as spending limits during inflation).

These advantages, however, also come with new concerns.

Risks and Unanswered Questions

Despite growing interest, CBDCs raise serious questions that countries must address before launching at scale.

- Privacy and Surveillance

If all transactions go through the central bank, how much financial privacy do people really have? Countries will need to decide whether to make CBDCs anonymous like cash—or traceable for oversight. - Disruption to Commercial Banks

If people keep CBDC directly with the central bank, they might withdraw money from regular banks, reducing their ability to lend. This could change the balance of the financial system. - Cybersecurity and Reliability

Any national digital currency system must be extremely secure and resilient. Hacks or outages could disrupt entire economies. - Technology Access

Will older populations, rural areas, or people without smartphones be left behind? CBDC systems need to ensure broad access and usability.

What Could CBDCs Look Like in Daily Life?

Imagine this: you walk into a store and pay with a digital wallet issued by your central bank. The money leaves your CBDC account instantly and goes to the store’s account—with no card fees, no third-party payment platform, and instant settlement.

Or you receive your tax refund directly into your CBDC wallet. No need to wait for bank processing times or worry about checks getting lost.

In developing countries, a small business owner might use a basic mobile phone to receive payments, apply for micro-loans, or save securely—without needing a traditional bank.

The potential applications are wide—but success depends on careful policy and smart design.

Final Thoughts: Why CBDCs Deserve Your Attention

You don’t need to be an economist to understand why CBDCs matter. They represent a shift in how governments deliver money, how economies are managed, and how people interact with public financial systems.

If done well, CBDCs could bring safer, more inclusive, and more efficient ways to pay and save. If mismanaged, they could raise concerns about privacy, control, and inequality in access.

So the next time you hear the term CBDC, think of it not as just another digital coin—but as a fundamental transformation of modern money.