What Are Meme Coins? A New Investor’s Guide to the Viral Crypto Trend

What Are Meme Coins? Understanding the Craze in 2025

In the world of cryptocurrency, meme coins are hard to ignore. They grab attention with absurd names, dog mascots, and viral hype. But beyond the internet jokes, many new investors are asking a serious question: What are meme coins, and are they worth the risk?

While Bitcoin and Ethereum aim to solve technical or financial problems, meme coins often begin with humor—and yet, some have grown into large communities and even billion-dollar market caps. This guide explores how meme coin work, what makes them tick, and what beginners should watch out for in 2025.

Defining Meme Coins: More Than Just a Joke?

Credit from Antier Solutions

At their core, meme coins are cryptocurrencies inspired by memes, internet trends, or social commentary. They typically don’t begin with serious goals or complex blockchain use cases. However, their success often lies in how well they engage online communities.

Dogecoin was the first true meme coin, created in 2013 by software engineers as a satire of the crypto market. Its logo featured the popular “Doge” meme—a Shiba Inu with Comic Sans text. Despite its parody origins, Dogecoin eventually gained mainstream popularity, helped by figures like Elon Musk and Reddit communities.

Since then, meme coins like Shiba Inu (SHIB), Pepe (PEPE), and FLOKI have followed. Each brings its own spin, but all rely heavily on community support, internet virality, and speculative energy.

A Timeline of Key Meme Coins

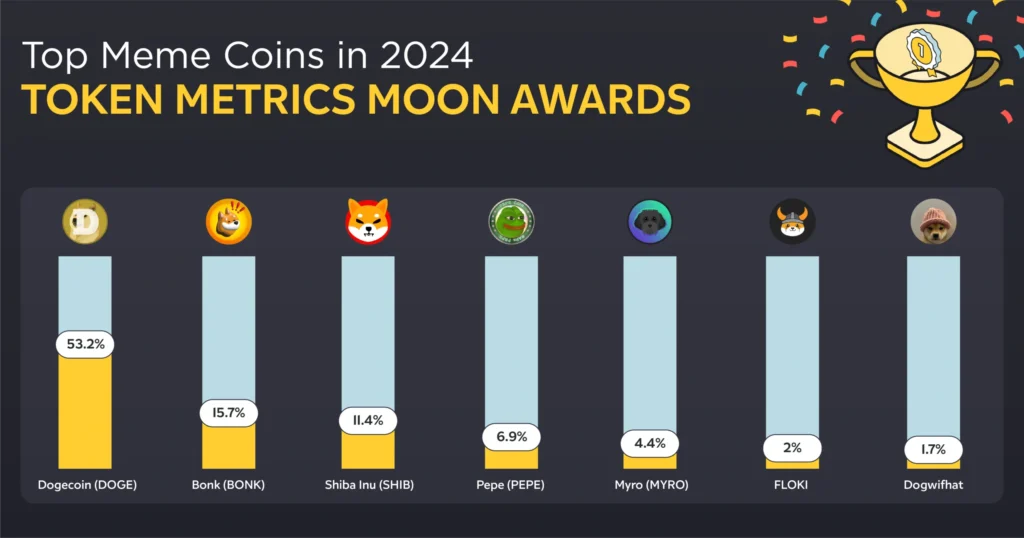

Credit from Token Metrics

To better understand their growth, here’s a comparison of five well-known meme coins:

| Coin Name | Launch Year | Inspiration/Theme | Blockchain | Peak Market Cap |

|---|---|---|---|---|

| Dogecoin | 2013 | Doge meme | Own chain | $88 billion (May 2021) |

| Shiba Inu | 2020 | Doge parody (Shiba dog) | Ethereum | $41 billion (Oct 2021) |

| FLOKI | 2021 | Elon Musk’s dog | Ethereum, BNB | ~$3.5 billion (2021) |

| PEPE | 2023 | Pepe the Frog meme | Ethereum | ~$1.8 billion (2023) |

| BONK | 2022 | Solana meme ecosystem | Solana | ~$1 billion (Jan 2024) |

These coins show that meme coin can attract massive attention and funding, even when they start with no clear utility. However, most also suffer from extreme price volatility and limited lifespan.

Why Meme Coins Are Popular

There are several reasons meme coins thrive—especially among newcomers to crypto.

First, they are culturally accessible. You don’t need to understand complex technology to understand a meme. This simplicity brings in retail investors who may not feel ready for serious crypto projects.

Second, meme coins often have low price points. A coin priced at $0.00001 feels “cheap,” which psychologically attracts those looking for big percentage gains. While the actual value depends on supply, this perception remains strong.

Third, these coins rely on community-driven marketing. Telegram groups, X threads, TikTok videos, and viral memes all work together to drive attention and hype. A successful meme coin may build momentum quickly—not because of utility, but because people enjoy participating.

Lastly, there’s the “lottery ticket” mindset. For many retail investors, meme coins are seen as high-risk, high-reward plays. It’s not uncommon for early investors to make significant gains—although the opposite is far more frequent.

How It Work Behind the Scenes

Most meme coins are built on existing blockchains like Ethereum (as ERC-20 tokens) or Solana (as SPL tokens). They rely on smart contracts to manage supply, transactions, and features like token burning or redistribution.

Unlike Bitcoin or Solana, they don’t usually operate their own networks. Instead, they use decentralized exchanges (DEXs) such as Uniswap or PancakeSwap for trading. This means anyone can list a meme coin—even anonymously.

Some meme coins also implement:

- Burn mechanics (reducing total supply to increase scarcity)

- Holder rewards (redistributing part of the transaction fee)

- DAO voting (community governance proposals)

However, many do none of these. Meme coin often exist in name and branding only, with minimal development or future plans.

The Risks: What Beginners Must Watch Out For

While meme coin can be fun, they are among the riskiest crypto assets. Here’s why:

- Rug pulls and scams: Some meme coins are launched by anonymous developers who later vanish after collecting funds.

- Lack of fundamentals: Many have no working product, no roadmap, and no technical innovation.

- Market manipulation: Prices are often influenced by hype cycles, influencer endorsements, or even pump-and-dump groups.

- Liquidity issues: Some coins have low trading volumes or locked liquidity pools, making it hard to sell without major losses.

If you’re new to crypto, these risks are easy to overlook. It’s tempting to follow the crowd, especially when coins appear to be “going to the moon.” But without a clear understanding of tokenomics and risk management, losses can be swift and painful.

Meme Coins vs Regular Cryptocurrencies

To understand meme coins better, it helps to contrast them with mainstream cryptocurrencies like Ethereum or Solana.

| Category | Meme Coins | Traditional Cryptos |

|---|---|---|

| Purpose | Cultural joke, speculative | Infrastructure, utility, finance |

| Development Team | Often anonymous or minimal | Professional, usually doxxed |

| Community Role | Central to success | Supportive but secondary |

| Utility | Rare, sometimes added post-launch | Core to project design |

| Price Stability | Extremely volatile | Variable, but less erratic |

This comparison shows how meme coin occupy a unique space. They’re not replacements for Bitcoin or Ethereum—but they do attract a different kind of investor.

How to Buy Meme Coins Safely

If you’re still interested in exploring meme coins, proceed cautiously. Here are general steps to do it safely:

- Research first. Look for a whitepaper, team transparency, and token audits. Check if the liquidity is locked or if holders are anonymous whales.

- Choose your exchange wisely. Centralized exchanges like Binance or Coinbase list only select meme coins. Others may be available only on DEXs like Uniswap, requiring a wallet like MetaMask or Phantom.

- Use a small amount. Don’t risk money you can’t afford to lose. Treat it like entertainment, not a savings plan.

- Watch for exit signals. If influencers start talking about a coin after it pumps, it may be a sign that it’s too late.

Above all, understand that meme coins are not long-term investments unless the project evolves significantly. They are speculative, community-based assets.

What’s Trending: Meme Coin Themes in 2025

This year, several trends are influencing the meme coin space:

- AI-powered memes generation: Some coins are now integrating AI tools for automatic memes creation and viral campaigns.

- Crossover branding: Partnerships with influencers or NFT artists have become more common, especially on Solana-based projects.

- Charity and social use cases: A few meme coins now support donations, crowdfunding, or social causes to add legitimacy.

- Deflation-focused tokens: Coins like SHIB and PEPE are incorporating burn mechanisms to manage supply.

Despite these developments, most meme coins remain short-lived. For each success story, there are dozens of coins that fade within weeks.

Final Thoughts: Should New Investors Buy Meme Coin?

So, what are meme coins, really? In many ways, they reflect the chaotic, community-driven nature of the crypto market. They are unpredictable, often unserious, and heavily reliant on online culture. But they are also a reminder that people value emotion, fun, and participation—not just spreadsheets and code.

For new investors, meme coin can serve as a learning experience. They offer a low-stakes entry point into blockchain basics, trading platforms, and crypto communities. But they are not a shortcut to wealth. And without caution, they can become expensive lessons.

If you choose to dive in, do so with your eyes open. Meme coin may come and go—but the decisions you make with your money will stay with you far longer.