USDT vs Cash: 9 Key Differences You Should Know Before Choosing

Why the USDT vs Cash Debate Matters More Than Ever

We’re living in a time when even money is evolving. Paper bills are no longer the only option — enter USDT, a stablecoin pegged to the U.S. dollar, offering a digital alternative to physical cash. But how do they really stack up? Let’s walk through 9 major areas where USDT vs cash goes head-to-head. Whether you’re new to crypto or just tired of carrying a bulky wallet, this breakdown will help you decide which option fits your life better.

1. USDT vs Cash: Physical vs Digital

- Cash: Tangible money in the form of coins and bills. No internet required.

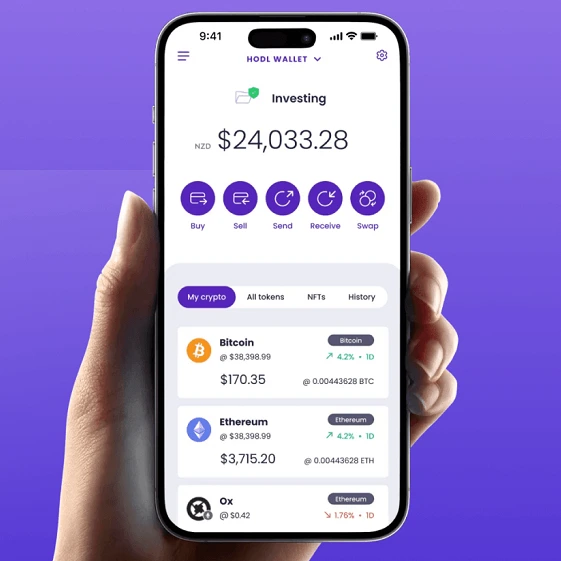

- USDT: 100% digital. Stored in a crypto wallet or exchange platform. You’ll need a smartphone or computer and internet access.

Winner: Tie — depends on whether you prefer physical simplicity or digital convenience.

2. USDT vs Cash: Speed of Transactions

- Cash: Instant in-person payments. But sending it remotely? Mail or in-person delivery — both slow.

- USDT: Transfers happen in minutes or seconds, even internationally. Perfect for global payments.

Winner: USDT, hands down, for speed.

3. USDT vs Cash: Accessibility and Acceptance

- Cash: Accepted nearly everywhere. From barbershops to food trucks, cash is king.

- USDT: Growing in popularity but still limited acceptance. Great for online use, less so for local stores (unless you’re in crypto-savvy zones).

Winner: Cash — it’s still the universal default.

4. Cost of Use

- Cash: No tech required, but beware of ATM fees, cash handling charges, and currency conversion costs.

- USDT: Cheap to send across borders, especially on efficient networks (like Tron). But Ethereum can rack up network (gas) fees.

Winner: USDT, especially for cross-border or large digital transfers.

5. Privacy & Anonymity

- Cash: Totally anonymous. Once it’s exchanged, there’s no record.

- USDT: Blockchain records every transaction — wallet addresses are visible, even if user identities aren’t always linked.

Winner: Cash, if privacy is your top concern.

6. Trust & Stability

- Cash: Backed by government central banks. Regulated, stable (outside of inflation).

- USDT: Pegged to the dollar, but backed by Tether Ltd. They’ve faced questions over reserve transparency.

Winner: Cash, thanks to regulatory backing and decades of trust.

7. Security Risks

- Cash: Can be lost, stolen, or damaged. Once it’s gone, it’s usually gone for good.

- USDT: Protected by digital wallets and encryption — but vulnerable to hacks, phishing, or forgotten passwords.

Winner: Tie — both have different risks, and both require careful handling.

8. Global Use & Relevance

- Cash: Still dominant in developing regions, where internet access is limited.

- USDT: A growing lifeline in countries with unstable currencies (like Venezuela and Nigeria), offering more stability than local money.

Winner: USDT — for anyone navigating financial instability or cross-border living.

9. Ease of Use

- Cash: Simple and intuitive. No apps, no passwords.

- USDT: Easier than ever with user-friendly apps, but still requires some digital literacy and device access.

Winner: Cash, for tech-free simplicity.

Conclusion: Which One’s Right for You?

When it comes to USDT vs cash, there’s no universal winner — only the better fit for your needs:

| Use Case | Better Choice |

|---|---|

| Daily purchases, small vendors | Cash |

| Fast global transfers | USDT |

| Total privacy | Cash |

| Inflation protection | USDT |

| Low-tech environment | Cash |

| Long-distance remittances | USDT |

So, should you ditch your bills for stablecoins? Not necessarily. But it might be smart to get comfortable with both — the world is moving fast, and financial flexibility is key.

Relevent news: Here