Top 10 Staking & Yield Platforms in 2025: Comparing Rewards, Risks, and Opportunities

In 2025, staking and yield farming have matured into central pillars of the crypto economy. Once seen as experimental or risky, these strategies are now regarded as practical tools for building long-term income streams. The top 10 staking & yield platforms highlight the growing variety of ways investors can participate—from user-friendly centralized exchanges (CEX) to highly decentralized protocols that prioritize transparency and flexibility.

At the core, staking allows token holders to contribute to blockchain security while earning consistent rewards. Yield farming, on the other hand, leverages liquidity provision and lending strategies to generate annual percentage yields (APYs) that often surpass traditional finance returns. But what really makes 2025 unique is the increasing sophistication of platforms: investors are no longer choosing between safety and yield; many services now offer a blend of both.

Top 10 Staking & Yield Platforms in 2025

1. Binance Staking

Source: 99Bitcoin

Binance continues to hold its place as the entry point for millions of retail investors looking to earn through staking. The platform offers one of the widest selections of coins—Ethereum, Solana, BNB, Cardano, and Polkadot, among many others. Its staking services are divided into flexible options, which allow withdrawal at any time, and locked staking, which often provides higher returns for those willing to commit for weeks or months.

Typical yields range from 1% on major coins like ETH to double-digit percentages on niche tokens. The user experience is straightforward, designed to accommodate both new and experienced traders. However, Binance’s custodial nature means investors give up direct control over their funds. For many, the convenience outweighs the risk, but it remains an important factor in decision-making.

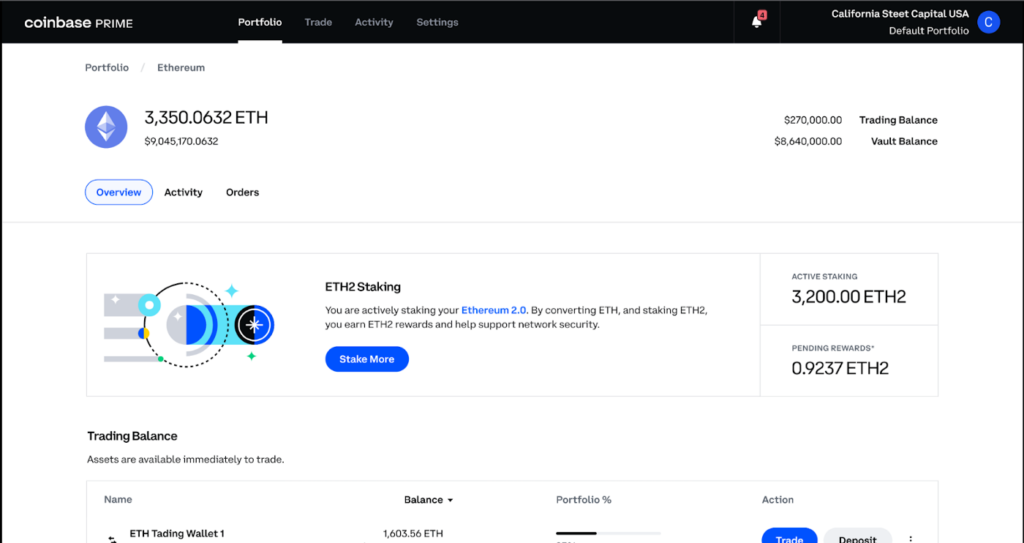

2. Coinbase Staking

Source: Coinbase

Coinbase has built its reputation as a regulated and beginner-friendly platform, particularly for U.S.-based investors. Its staking service emphasizes simplicity and compliance, making it one of the safest entry points for those new to the crypto world. Assets supported include Ethereum, Cardano, Cosmos, and Solana, with APYs usually ranging between 2% and 6%.

What differentiates Coinbase is its emphasis on clarity. Rewards are calculated transparently, and users receive detailed breakdowns of fees, which are admittedly higher than on some competitors. Still, for those who prioritize regulatory backing and a sense of security in uncertain markets, Coinbase offers peace of mind—even if it means lower returns.

3. Kraken Earn

Kraken has cultivated an image of trust and security since its early days, and its staking service reflects this commitment. Kraken Earn allows users to stake coins like ETH, DOT, KSM, and ADA, with yields ranging from 2% to 12%. While the platform does not boast as many supported assets as Binance, it compensates with a strong reputation for transparency and reliability.

Many investors appreciate Kraken’s cautious approach, which prioritizes security and regulatory compliance over aggressive expansion. This makes it particularly appealing to those who view staking as a steady, low-maintenance income strategy rather than a high-risk, high-reward play.

4. Lido Finance (Decentralized Liquid Staking)

Source : ZEPHYRNET

In the decentralized world, Lido Finance has become nearly synonymous with liquid staking. Its most popular product, stETH, represents staked Ethereum while still being tradable across DeFi platforms. Lido also supports Solana, Polygon, and other major chains, with yields averaging between 4% and 8%.

The main advantage is flexibility—users can participate in staking without locking up their assets. By issuing liquid tokens like stETH and stSOL, Lido enables investors to continue trading or using their tokens in DeFi protocols while still earning rewards. Yet, critics point to centralization concerns and reliance on smart contracts as potential risks. For many, the trade-off is worth it, especially given how liquid staking has become a vital part of DeFi in 2025.

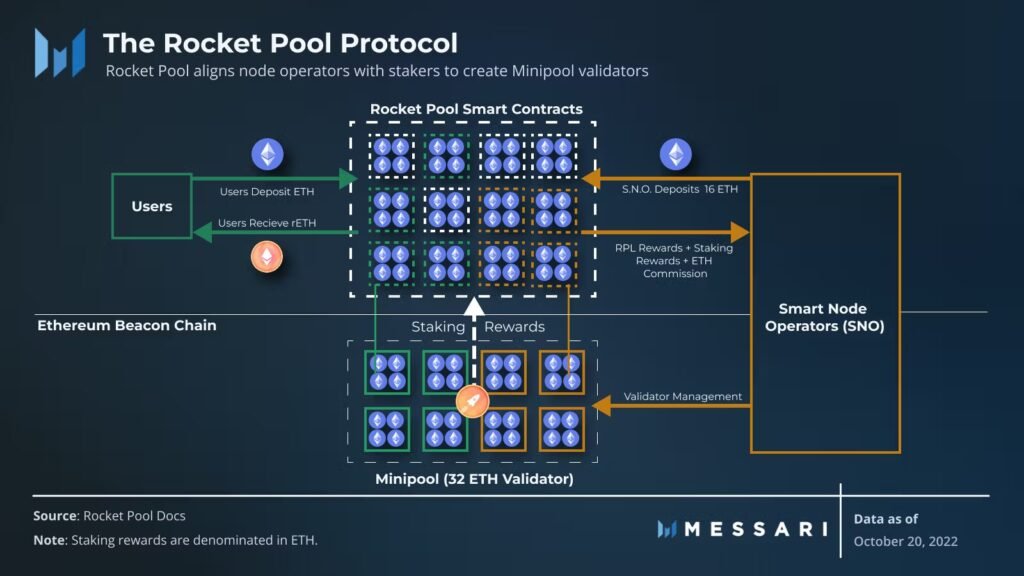

5. Rocket Pool

Source: Messari

Rocket Pool has carved out a loyal following as a decentralized alternative for Ethereum staking. Unlike centralized services, Rocket Pool allows users to stake as little as 0.01 ETH, making it accessible to smaller investors. It also supports node operators, ensuring a distributed network rather than one dominated by a few large players.

Yields typically fall between 3% and 6%, but the real draw is its alignment with Ethereum’s ethos of decentralization. Investors who value sovereignty over their assets and want to avoid centralized custodians see Rocket Pool as a long-term solution. The use of rETH tokens also introduces liquidity, though the ecosystem is still narrower than that of Lido.

6. Figment

Source: Figment

Figment is widely recognized as an institutional-grade validator, catering to professional investors and large-scale staking operations. It supports a broad range of blockchains, including Ethereum, Solana, Cosmos, Near, and Polkadot. Its transparent reporting, slashing protection, and consistent rewards have made it a trusted partner for funds and institutions entering staking as a financial product.

Yields are generally competitive, ranging from 4% to 12% depending on the network. For retail investors, access is often indirect—via platforms that partner with Figment—but its reputation and reliability make it one of the backbones of staking infrastructure in 2025.

7. Stakefish

Source: X

Stakefish has built itself into one of the most recognized global validator services, supporting a wide array of assets including Ethereum, Solana, Cosmos, and Cardano. The platform is favored by advanced stakers who value its strong validator performance and extensive network presence.

Yields average between 4% and 10%, and the platform offers detailed information about its validator nodes and fees. While not as beginner-friendly as exchanges, Stakefish has become a respected choice for those who prefer non-custodial staking but still want professional-grade infrastructure.

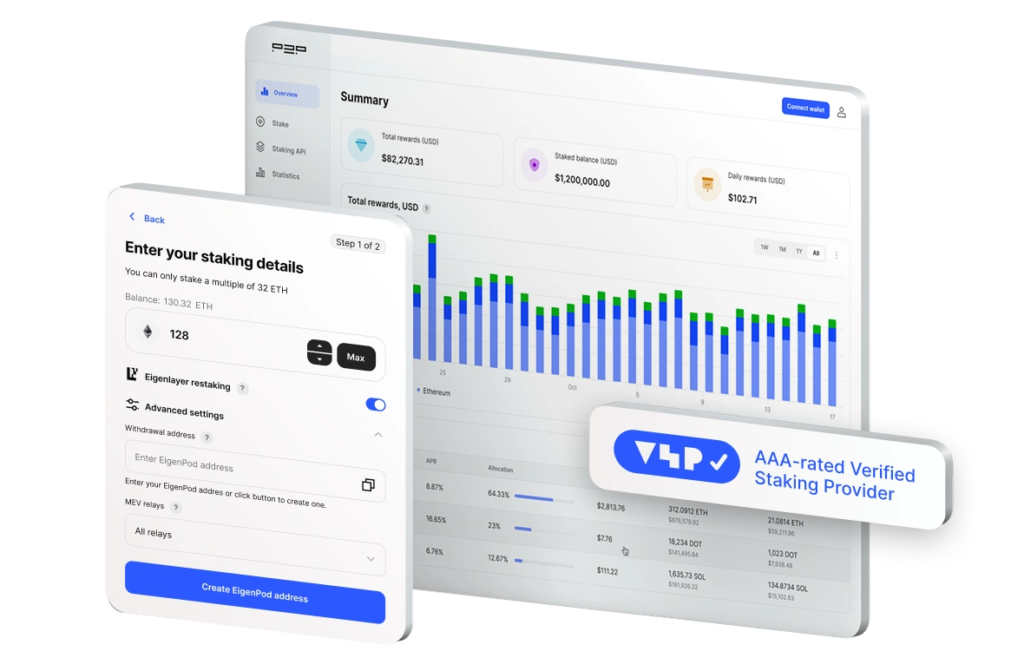

8. Top 10 Staking & Yield : P2P.org

Source: P2P

P2P.org positions itself as a premium validator service, known for advanced security measures such as slashing protection and detailed analytics dashboards. It supports major ecosystems like Ethereum, Solana, Polkadot, and Cosmos, making it appealing to institutions and serious individual investors alike.

Rewards are competitive, often in the 4%–12% range, but the added value comes from its transparency and professional services. In a year where institutions increasingly view staking as part of portfolio diversification, P2P.org’s role as a high-trust validator continues to grow.

9. Top 10 Staking & Yield : Marinade Finance (Solana Focused)

For those focused on the Solana ecosystem, Marinade Finance remains the dominant liquid staking solution. By issuing mSOL, it enables investors to stake SOL while retaining liquidity to participate in Solana-based DeFi projects. Yields typically range from 6% to 8%.

What sets Marinade apart is its integration with the wider Solana ecosystem, where mSOL is widely accepted across lending, trading, and farming platforms. This gives users flexibility that goes beyond simple staking. Of course, the platform’s exposure is limited to Solana, which may concern investors who prefer diversification across multiple blockchains.

10. Top 10 Staking & Yield : Ankr Staking

Ankr has positioned itself as one of the most versatile staking platforms, offering multi-chain liquid staking options across Ethereum, Binance Smart Chain, Avalanche, Polygon, and more. It provides staking tokens such as aETH and aBNB, allowing investors to maintain liquidity while earning yields of around 3%–9%.

Beyond staking, Ankr’s ecosystem also supports Web3 developers, making it more than just a yield platform. Its developer-friendly infrastructure has made it a favorite for users who want staking to integrate with broader blockchain services. For investors seeking flexibility and cross-chain exposure, Ankr offers one of the most well-rounded experiences.

Conclusion – Top 10 Staking & Yield

The top 10 staking & yield platforms in 2025 showcase the diverse paths available for investors seeking passive crypto income. Some, like Binance and Coinbase, emphasize simplicity and accessibility, while others—like Lido and Rocket Pool—embody the decentralized ideals of Web3. Institutional services like Figment and P2P.org point to the increasing role of staking as a professional financial product, while Marinade and Ankr highlight the importance of liquidity and multi-chain participation.

For investors, the choice ultimately depends on priorities: convenience, decentralization, or institutional-grade security. What’s clear is that staking and yield farming have moved beyond experimental territory. They are now essential components of a maturing crypto economy, offering rewards that balance risk, flexibility, and long-term growth potential.