Top 10 Real-World Asset (RWA) Tokenization Projects in 2025 Transforming Global Finance

Top 10 RWA : Real-World Asset (RWA) tokenization has become one of the most closely watched trends in crypto this year. The concept is straightforward but powerful: take traditional assets such as U.S. Treasuries, corporate bonds, or even luxury real estate, and issue them as tokens on the blockchain. The appeal is enormous because it opens access to investments once limited to large institutions, enabling anyone with a digital wallet to own a fraction of assets worth millions.

Why does this matter in 2025? Because the landscape has matured. Tokenization is no longer an experimental idea tossed around in conferences — it is now backed by major financial institutions, supported by clearer regulatory frameworks, and deeply integrated into decentralized finance (DeFi). According to data from CoinGecko, billions of dollars in RWAs are already represented on-chain, with U.S. Treasuries alone forming a significant portion of the market. This article highlights the Top 10 RWA tokenization projects in 2025 that are not only driving adoption but also reshaping the future of finance.

1. Chainlink (LINK)

Chainlink is often described as the invisible glue holding together the world of tokenized assets. Its oracle technology ensures that smart contracts can access reliable, real-world data — a necessity for any RWA project. In 2025, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) has become a backbone for RWA ecosystems, allowing tokenized treasuries, commodities, and real estate tokens to move seamlessly across multiple blockchains. Without oracles like Chainlink, RWA markets would be fragmented and prone to inaccuracies. Its dominance in the oracle space makes it not just a project to watch, but a fundamental infrastructure piece in the RWA puzzle.

2. Ondo Finance (ONDO)

If one project has captured the spotlight in tokenized treasuries, it is Ondo Finance. Launched with the vision of bridging traditional financial yields with crypto, Ondo introduced products like Ondo USD Yield (OUSG), which packages U.S. Treasuries into tokenized instruments accessible on-chain. In 2025, institutions and DeFi platforms alike are adopting Ondo’s offerings as safe, yield-generating assets in an otherwise volatile crypto landscape. By partnering with custodians and regulated financial entities, Ondo provides assurance to both retail and institutional investors, positioning itself as a leader in the rapidly growing RWA sector.

3. Algorand (ALGO)

Source: IQ.wiki

Algorand is not just another blockchain; it has quietly built a reputation as one of the most reliable platforms for enterprise-grade tokenization. Its low fees, fast transactions, and eco-friendly design make it attractive to governments and corporations experimenting with blockchain-based finance. In 2025, Algorand continues to power initiatives such as real estate tokenization and even central bank digital currency (CBDC) pilots. Its emphasis on scalability and security ensures that large-scale RWA projects can operate smoothly, reinforcing its role as a foundational infrastructure provider in the tokenization movement.

4. XDC Network (XDC)

Source: IQ.Wiki

XDC Network has carved out a niche in trade finance and tokenized debt instruments. With its hybrid blockchain design, XDC caters to enterprises that need both the transparency of public chains and the privacy of private ones. In 2025, XDC’s adoption is particularly strong in Asia and the Middle East, where trade finance tokenization is becoming a priority for governments and financial institutions. By focusing on real-world applications like supply chain finance and tokenized bonds, XDC demonstrates how blockchain can solve longstanding inefficiencies in global commerce.

5. Quant (QNT)

Source: Cryptonary

One of the recurring challenges in RWA tokenization is interoperability — how do you ensure that tokenized assets can flow between different blockchains and legacy financial systems? Quant addresses this with its Overledger technology, which acts as a connective layer across networks. In 2025, Quant’s partnerships with financial institutions have given it a unique position as a bridge between traditional banks and the decentralized world. Its focus on compliance and enterprise readiness makes it a project with strong institutional appeal, vital for scaling RWA adoption globally.

6. MakerDAO (MKR)

Source: Venga

As one of the earliest DeFi protocols, MakerDAO has long experimented with incorporating RWAs into its ecosystem. The protocol’s stablecoin, DAI, is partly backed by tokenized assets such as U.S. Treasuries and real estate. In 2025, MakerDAO’s RWA strategy has expanded significantly, making it one of the largest decentralized players in this space. By diversifying collateral and bringing stability to DeFi lending markets, MakerDAO shows how RWAs can serve as a bridge between crypto-native assets and real-world financial products.

7. Top 10 RWA : Pendle (PENDLE)

Source: Big Whale

Pendle is innovating in a different direction: yield tokenization. It allows users to split yield-bearing assets into two components — principal and yield — enabling new strategies for managing fixed and variable returns. In 2025, this model is particularly powerful when applied to RWA-backed tokens like treasury yields. By creating a secondary market for yield trading, Pendle expands the possibilities of how investors interact with tokenized assets, turning yield itself into a tradable commodity.

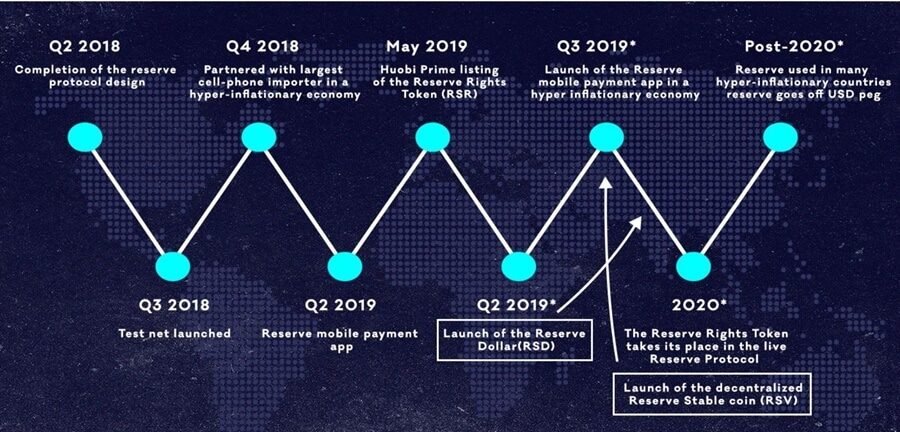

8.Top 10 RWA : Reserve Rights (RSR)

Source: Coinbureau

Reserve has positioned itself as a project with both financial and social impact. Its ecosystem creates stablecoins backed by real-world assets, which are particularly useful in emerging economies plagued by inflation and unstable currencies. By enabling individuals in Latin America and beyond to access inflation-resistant savings through blockchain, Reserve demonstrates the humanitarian side of tokenization. In 2025, its continued growth highlights how RWAs can serve not only institutional investors but also everyday people who need stable, reliable financial tools.

9. Top 10 RWA : Plume Network (PLUME)

Source: App.layer3

Plume Network is one of the newest entrants in the RWA landscape, but its focus is highly specialized. As a Layer-1 blockchain built specifically for asset tokenization, Plume addresses compliance, custodianship, and institutional requirements from the ground up. While still early in adoption, its tailored approach has caught the attention of startups and financial service providers looking for a blockchain optimized for RWAs. 2025 may be the year it transitions from promising newcomer to recognized player in the ecosystem.

10. Top 10 RWA: Tokeny Solutions

Source: Tokeny.com

While most RWA projects are blockchain-native protocols, Tokeny Solutions takes a different angle. It provides infrastructure for enterprises to tokenize assets, from real estate funds to private equity offerings. Its tools ensure that tokenization happens within the bounds of regulation, making it an essential partner for traditional financial institutions. By empowering companies to issue compliant digital securities, Tokeny fills a critical gap in the ecosystem. In 2025, its role as a service provider ensures that tokenization extends beyond DeFi into mainstream finance.

Top 10 RWA : Conclusion

The rise of real-world asset tokenization represents one of the most important shifts in crypto to date. These Top 10 RWA tokenization projects in 2025 illustrate just how diverse the field has become — from infrastructure providers like Chainlink and Algorand, to innovators like Pendle and Reserve, and service enablers like Tokeny Solutions. Together, they form the backbone of an emerging financial system where traditional assets flow seamlessly into blockchain-based markets. As adoption widens and regulations evolve, RWAs may soon transform from a niche experiment into the foundation of global finance.