TOP 10 Risks and Threats to Crypto in 2025: The Hidden Dangers Ahead

TOP 10 Risks and Threats: By 2025, cryptocurrencies have moved further into the mainstream, attracting not only investors but also regulators, hackers, and global scrutiny. While innovation in blockchain continues, the risks have multiplied. These TOP 10 Risks and Threats highlight the challenges that could define the industry’s future — spanning legal, financial, and technological dangers.

1. Regulatory Crackdowns and Legal Ambiguity

Governments worldwide are tightening their grip on digital assets. From new tax frameworks to licensing requirements, crypto businesses face a shifting legal landscape. In the U.S., enforcement actions are growing, while Europe pushes forward with MiCA.

This patchwork of laws creates uncertainty. Investors may face restrictions on cross-border transfers, while exchanges risk heavy penalties for non-compliance. Until global standards align, regulation will remain one of crypto’s biggest risks.

2. AML and KYC Compliance Gaps

Source: Covery

Even in 2025, some platforms cut corners when it comes to Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. Regulators are responding with audits, fines, and in some cases, shutdowns.

Exchanges operating without proper checks are prime targets for money laundering probes. This undermines trust, driving institutional investors away and pushing users to safer, regulated alternatives.

3. Cyberattacks and Exchange Security Breaches

Source: Bloxbytes

Cybersecurity threats remain relentless. Hackers now use AI-driven techniques to breach defenses, while phishing and ransomware continue to evolve.

The biggest concerns are smart contract exploits on DeFi platforms, where billions remain locked in vulnerable protocols. In 2025 alone, several high-profile breaches have shaken investor confidence, proving that digital assets remain a magnet for cybercrime.

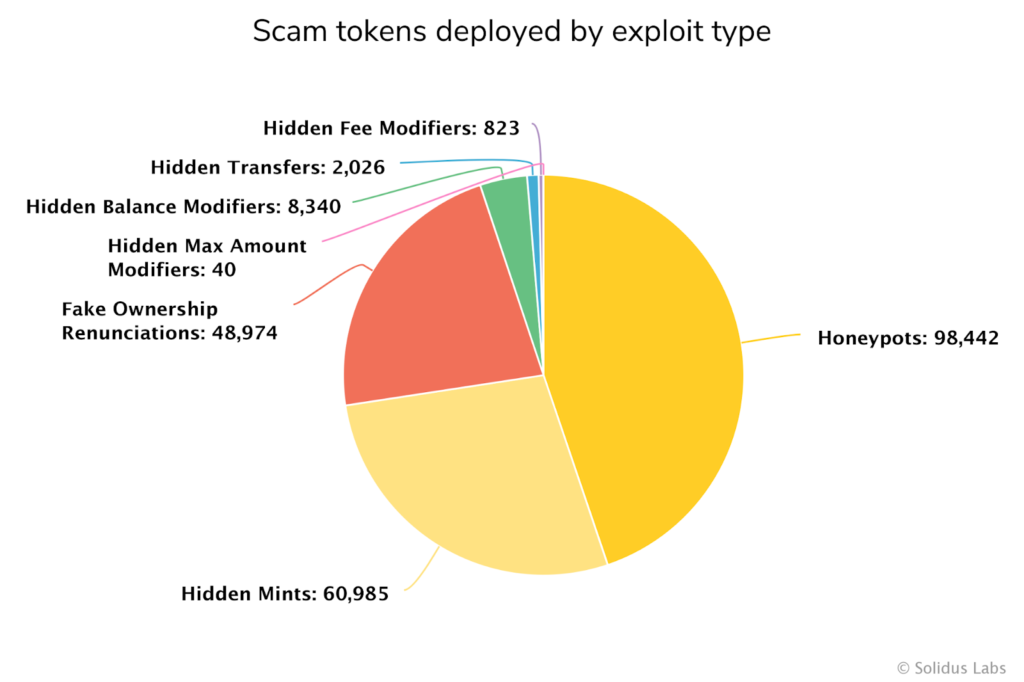

4. Scams, Fraud, and Rug Pulls

Source: Soliduslabs

The darker side of crypto persists in the form of scams and rug pulls. DeFi projects promising high yields often collapse overnight, leaving investors with worthless tokens.

Meme coins and NFT scams are still rampant. Many investors skip proper due diligence, and opportunistic developers exploit that gap. Education and stricter project vetting are crucial — but not yet widespread.

5. Stablecoin Crashes and Liquidity Pressures

Source: boldergroup

Stablecoins play a central role in crypto markets, yet they remain fragile. Algorithmic stablecoins continue to struggle with price stability, while questions over reserve transparency plague fiat-backed tokens like USDT and USDC.

If one of the major stablecoins loses its peg in 2025, the ripple effects across DeFi lending markets and centralized exchanges could be catastrophic. Liquidity crises remain a looming threat.

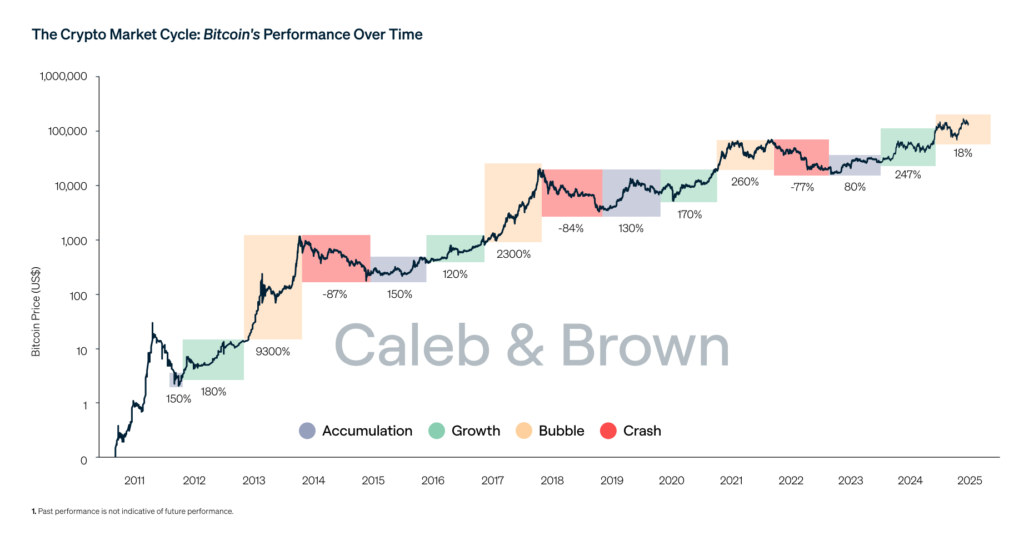

6. TOP 10 Risks and Threats : Market Volatility and Sudden Sell-Offs

Source: Caleb and Brown

Extreme volatility has long defined crypto, and in 2025 it shows no signs of slowing. Macro trends like inflation data, central bank decisions, and whale activity continue to spark sudden market moves.

Leveraged trading adds more fuel. A single downturn can trigger cascading liquidations across major exchanges, intensifying price swings and causing widespread panic.

7. Smart Contract Exploits

DeFi runs on smart contracts, but code vulnerabilities continue to cause havoc. Audits are improving, yet many projects rush to launch without thorough testing.

In 2025, attackers have exploited even audited contracts, demonstrating that no protocol is entirely safe. Balancing innovation with security remains one of the sector’s toughest dilemmas.

8. TOP 10 Risks and Threats : Cross-Border Legal Challenges

Source: Linkedin

Operating globally is harder than ever. Countries have conflicting crypto regulations, and businesses are forced to adapt or risk penalties.

Some jurisdictions welcome crypto innovation, while others impose outright bans. For companies and investors, navigating this fragmented environment is costly and risky — particularly when laws change overnight.

9. TOP 10 Risks and Threats : Environmental and ESG Pressures

Crypto mining’s environmental impact is under sharper focus. Proof-of-Work coins, especially Bitcoin, face criticism for energy usage, while Proof-of-Stake chains market themselves as greener.

Institutional investors increasingly demand ESG compliance. Without improvements in sustainability, some projects risk losing access to major funding sources and adoption opportunities.

10. TOP 10 Risks and Threats : Reputational Damage and Loss of Public Trust

Source: Kanga

Crypto’s image problem persists. Exchange collapses, scams, and fraud cases make headlines and erode confidence among the public.

For mainstream adoption to grow, the industry must overcome its reputation for instability. Projects that prioritize transparency, governance, and investor protection stand the best chance of rebuilding trust in 2025 and beyond.

Conclusion – TOP 10 Risks and Threats

The TOP 10 Risks and Threats facing crypto in 2025 show that the industry is both maturing and becoming more complex. Regulatory pressure, cybersecurity challenges, and reputational risks are no longer isolated issues — they are deeply interconnected.

For crypto to thrive, collaboration between regulators, businesses, and communities will be essential. The challenge for 2025 and beyond lies in finding a balance between innovation and responsibility, ensuring that digital assets can evolve without being undermined by their own vulnerabilities.