Top 10 Crypto Trends Poised to Transform 2025’s Digital Economy

The cryptocurrency market in 2025 is moving into a more mature phase, where speculation takes a backseat to innovation and practical use. Institutional players are deepening their involvement, regulators are setting clearer rules, and blockchain technology is quietly weaving itself into the fabric of traditional finance. These top 10 crypto trends capture the major forces shaping the industry this year — from AI integration to real-world asset tokenization.

1. Regulatory Evolution and Global Compliance Standards

Source: linkedin

Clearer regulations are replacing the patchwork of laws that once left crypto in legal limbo. The EU’s MiCA rules are influencing markets worldwide, while major economies like the U.S., Japan, and Singapore are tightening compliance protocols. Uniform KYC and AML requirements are creating a safer environment for investors but also raising entry barriers for smaller startups. The net effect: a market that feels less like the Wild West and more like a regulated financial ecosystem.

2. Institutional Adoption Reaches New Heights

Source: Name coin news

Crypto is no longer a fringe asset for hedge funds alone. In 2025, pension funds, insurers, and corporate treasuries are expanding their holdings, helped by the availability of Bitcoin and Ethereum ETFs. Major Wall Street firms are offering crypto investment products alongside stocks and bonds. This influx of institutional capital boosts liquidity but also introduces new market dynamics tied to traditional finance.

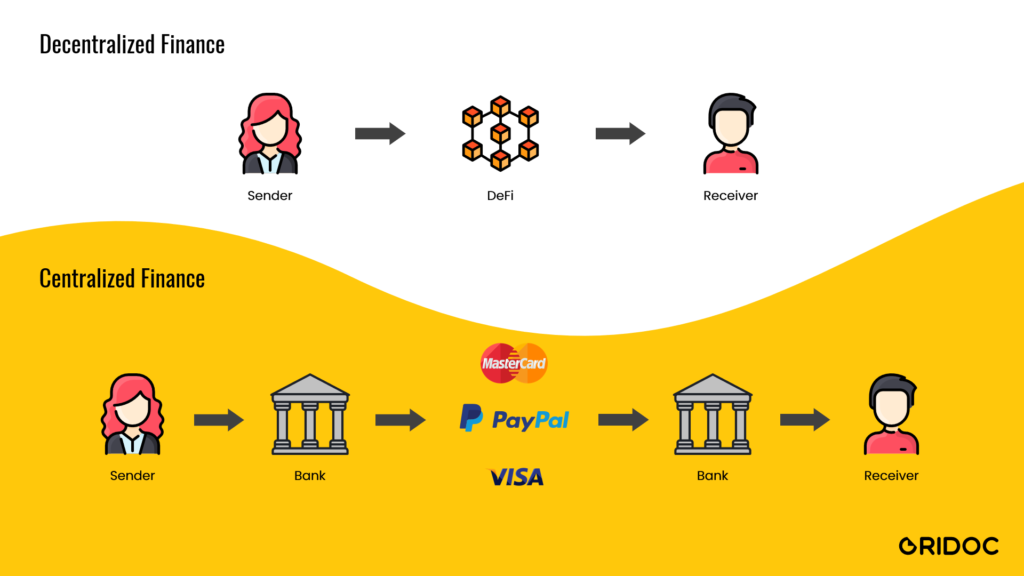

3.

Source: Oridoc

The convergence of DeFi and TradFi is creating hybrid financial products that appeal to both sides of the aisle. Tokenized bonds, equity instruments, and real-world assets are drawing institutional interest, while retail investors benefit from higher transparency and lower settlement times. Cross-chain compatibility is making it possible to tap into multiple ecosystems without switching platforms, paving the way for a seamless multi-chain finance experience.

4. Real-World Asset Tokenization Surges

Tokenization is turning illiquid markets into tradable ecosystems. Real estate, luxury collectibles, commodities, and even carbon credits are moving on-chain. Fractional ownership models let investors buy a small share of high-value assets, while 24/7 blockchain markets improve liquidity. Corporations are starting to use tokenization not just as a novelty but as a strategic financing tool.

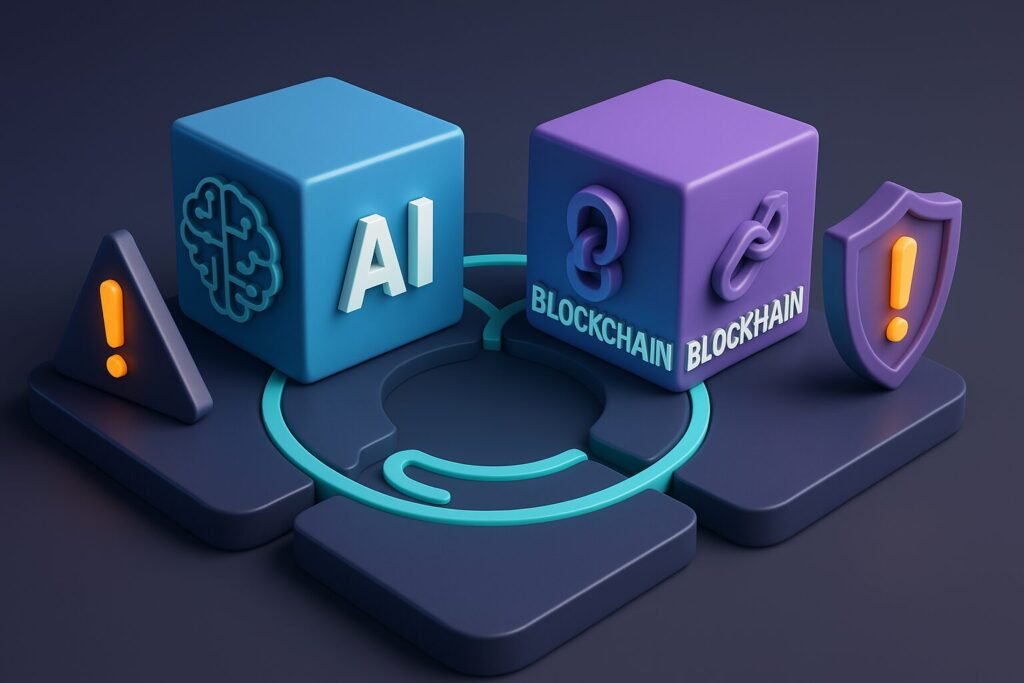

5. AI–Blockchain Synergy

Source: Tutorial Dojo

AI is finding a natural ally in blockchain. Decentralized AI marketplaces allow secure sharing of models and datasets, while AI-driven analytics enhance crypto trading, risk management, and fraud detection. Tokenized AI models are emerging as a new asset class, raising questions around intellectual property rights and ethical use. The blend of AI’s predictive power with blockchain’s transparency is opening up entirely new economic models.

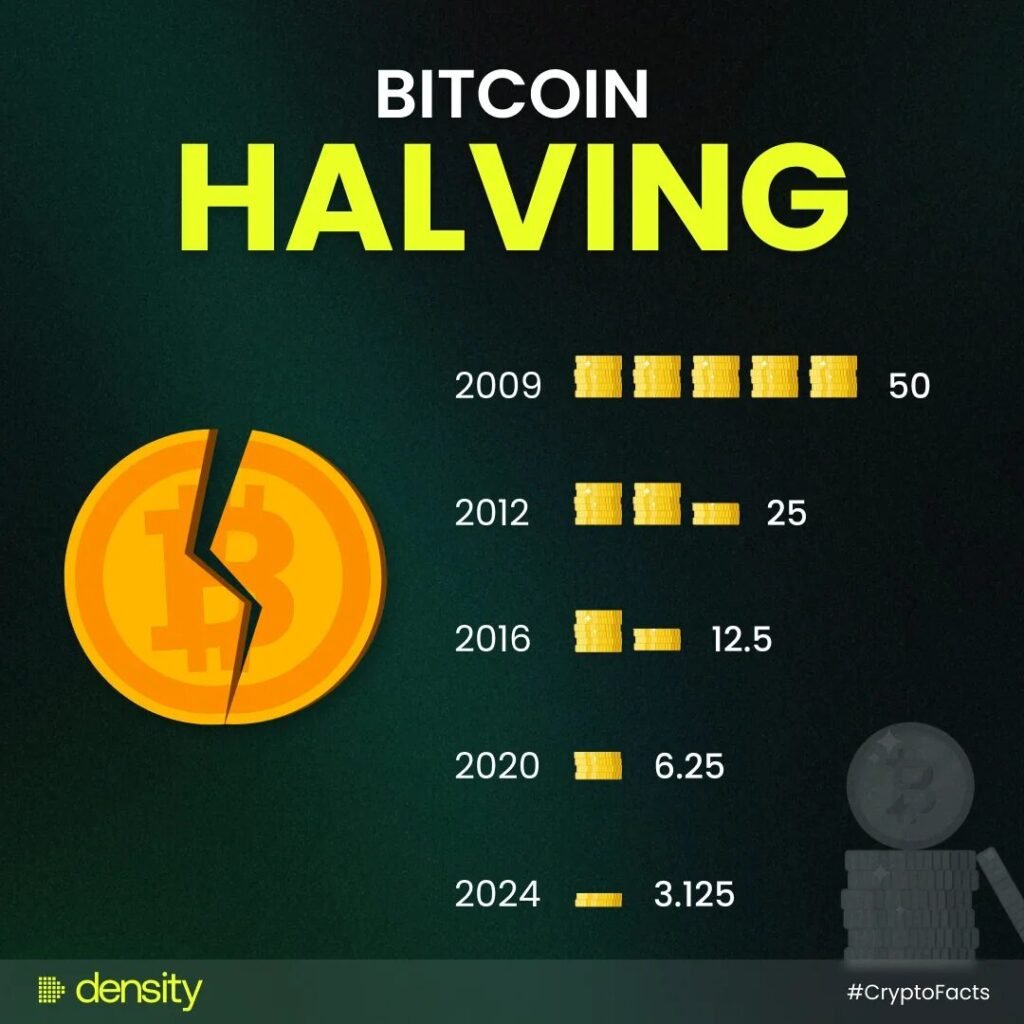

6. Bitcoin’s Post-Halving Institutional Era

Source: Reddit

Following the 2024 halving, Bitcoin’s reduced supply has become more attractive to long-term investors. Corporations are holding BTC as a reserve asset, while Lightning Network upgrades are making it more usable for payments. Bitcoin’s role is expanding — it’s not just a store of value anymore, but a foundation for new Layer 2 solutions and decentralized applications.

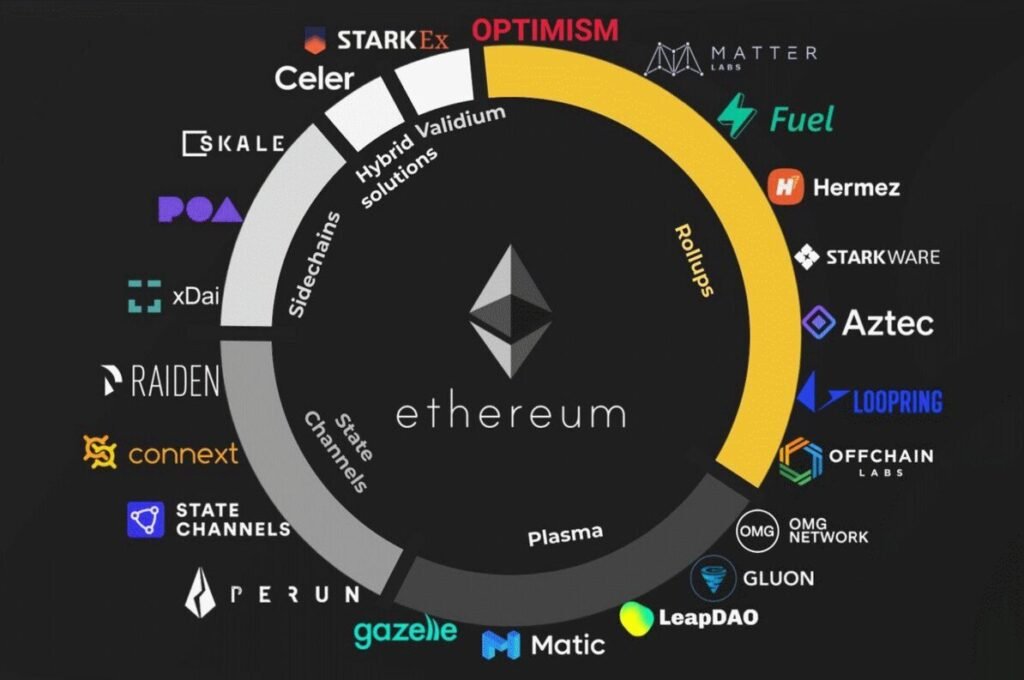

7. Ethereum Ecosystem Scales Up

Source: Finyear

Ethereum remains the go-to platform for DeFi and NFTs, but its 2025 momentum comes from Layer 2 networks like Arbitrum, Optimism, and Base. Staking participation has grown significantly, and yield strategies tied to Ethereum’s activity are becoming more sophisticated. Despite competition from faster chains, Ethereum’s network effects keep it ahead in developer activity and liquidity depth.

8. Top 10 Crypto Trends : NFTs Shift Toward Utility and Integration

Source: Medium

NFTs are stepping into more practical roles — as tickets, loyalty program assets, gaming items, and even digital IDs. Big brands are experimenting with NFT-based engagement strategies, blending physical and digital experiences. By linking NFTs to tokenized real-world assets, creators are unlocking new business models and revenue streams.

9. Top 10 Crypto Trends : Memecoins Get a Functional Makeover

Source: Crypto Daily

The memecoin craze hasn’t died — it’s evolved. Communities are building memecoins with real-world applications, from charity funding to gaming integration. Social media hype still fuels price swings, but the new wave is experimenting with utility-driven roadmaps to extend lifespan and investor interest.

10. Cross-Chain Interoperability Becomes the Norm

Gone are the days of being locked into a single blockchain. Interoperability protocols like LayerZero, Wormhole, and Cosmos are making multi-chain swaps as simple as single-chain transactions. This trend is dissolving blockchain silos, increasing liquidity, and giving users more freedom to move assets wherever opportunities arise.

Top 10 Crypto Trends: Security and Self-Custody Innovations

As crypto integrates deeper into mainstream finance, the need for robust security is growing. Hardware wallets, MPC custody solutions, and decentralized identity systems are gaining traction. At the same time, improved smart contract auditing tools are making it harder for bad actors to exploit vulnerabilities — a necessary evolution in a space that’s still prone to high-stakes hacks.

Conclusion – Top 10 Crypto Trends

The top 10 crypto trends defining 2025 point toward a more interconnected, regulated, and utility-driven industry. With institutional capital flowing in, blockchain and AI working hand in hand, and tokenization breaking down barriers between digital and physical assets, crypto’s role in the global economy is becoming more entrenched. The coming years will be about refining these foundations and ensuring the innovation wave benefits a wider audience — without losing the decentralized ethos that started it all.