TOP 10 Crypto Regulations 2025: Key Global Shifts Every Investor Should Know

The TOP 10 Crypto Regulations 2025 mark a critical moment for the digital asset industry. In just a few years, cryptocurrency has moved from being a niche innovation to a trillion-dollar asset class influencing global finance. This growth has attracted more than just investor attention — it’s put crypto firmly on the radar of governments, central banks, and regulatory bodies.

In 2025, regulation is no longer a question of if but how far it will go. From Washington to Brussels, Tokyo to Singapore, the world is witnessing a wave of new rules targeting everything from stablecoin reserves and DeFi protocols to taxation and cross-border compliance. While some regions are opening the door to innovation under strict supervision, others are tightening controls or maintaining outright bans.

Before we explore the ten key developments, here’s a snapshot of how the world’s major economies are positioned on crypto regulation this year.

Global Crypto Regulation Snapshot 2025

| Region / Country | Legal Status | Main Regulator(s) | Licensing Requirements | Tax Treatment | Notable Restrictions |

|---|---|---|---|---|---|

| United States | Legal, regulated | SEC, CFTC, FinCEN, OFAC, IRS | Federal & state licenses | Property classification | AML/KYC, Travel Rule, SEC enforcement |

| European Union | Legal | ESMA & national regulators | MiCA license | Varies by state | Consumer protection, AMLD compliance |

| China | Banned | N/A | N/A | N/A | Total ban on trading and mining |

| Japan | Legal | FSA, JVCEA | FSA registration | Misc. income tax | Remittance limits, strict AML rules |

| Singapore | Legal | MAS | MAS licensing | Varies | Retail marketing restrictions, stablecoin rules |

| South Korea | Legal, regulated | FSC | 2023 Act licensing | Tax deferred | Ban on privacy coins |

| UK | Legal | FCA | FCA registration | CGT applies | Ban on retail crypto derivatives |

| Australia | Legal | AUSTRAC | AUSTRAC registration | CGT applies | Privacy coin ban |

| Canada | Legal | FINTRAC, securities regulators | Platform registration | Commodity treatment | Custody rules, insurance requirements |

| India | Legal but restrictive | RBI, Finance Ministry | None formal | 30% capital gains tax | High taxation, loss offset ban |

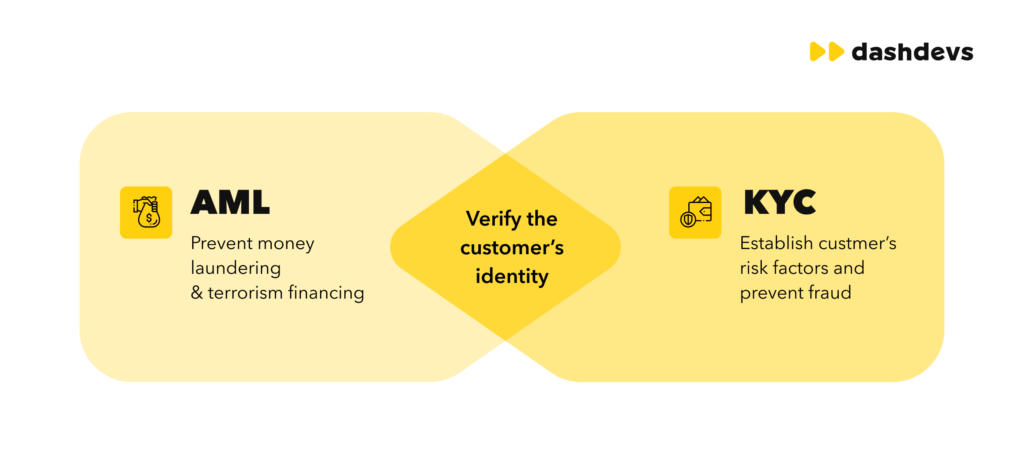

1. Stricter AML & KYC Standards Worldwide – TOP 10 Crypto Regulations

Source: dashdevs

The tightening of Anti-Money Laundering (AML) and Know Your Customer (KYC) rules is a defining trend in 2025. The FATF is pushing countries to expand the “Travel Rule” to include all virtual asset transfers, forcing exchanges and wallet providers to verify senders and recipients. These steps aim to combat fraud and illicit activity, but they also raise compliance costs for smaller operators.

2. Stablecoin Licensing and Reserve Audits – TOP 10 Crypto Regulations

Source: Ledger Insights

Stablecoins are under the microscope as regulators demand proof of full reserves and transparent audits. Jurisdictions like Singapore, Japan, and the EU are requiring issuers to be licensed, with penalties for failing to maintain backing. These rules could push unregulated stablecoins out of the market, reshaping liquidity in crypto trading.

3. DeFi and DAO Regulation Takes Shape

Source: The Cryptonomist

Decentralized Finance (DeFi) is moving toward regulated territory. The SEC, ESMA, and other agencies are examining whether DeFi front-end operators, DAO governance tokens, or liquidity providers should be treated as financial intermediaries. Licensing requirements may soon apply to even non-custodial protocols.

4. U.S. Shifts in Policy Direction -TOP 10 Crypto Regulations

Source: Blockonomi

In 2025, the United States is at a crossroads. The Trump administration has hinted at loosening some crypto restrictions, potentially resolving the SEC vs. CFTC jurisdiction battle. But enforcement actions remain aggressive against projects seen as evading securities laws.

5. MiCA Rollout in the European Union – TOP 10 Crypto Regulations

The EU’s Markets in Crypto-Assets Regulation (MiCA) is one of the most comprehensive frameworks in the world. By 2025, it requires all crypto firms to secure a single EU-wide license, comply with strict AML rules, and offer clear risk disclosures to consumers.

6. Asia’s Mixed Model: Japan, Singapore, South Korea

Source: Digwatch

Japan’s FSA continues its rigorous oversight, Singapore tightens retail crypto marketing, and South Korea enforces a privacy coin ban alongside its 2023 Act on Virtual Asset Users. These countries demonstrate that Asia’s regulatory strategy balances innovation with risk management.

7. Jurisdictions Maintaining Bans

China’s total ban on crypto remains in place, effectively blocking domestic participation. India stops short of a ban but uses high taxation and lack of licensing clarity to discourage widespread adoption. These policies continue to push talent and capital abroad.

8. Cross-Border Enforcement Gains Momentum

Regulators are sharing intelligence more than ever before. Agencies from different jurisdictions coordinate on sanctions, AML investigations, and fraud cases, making it harder for bad actors to exploit jurisdictional gaps.

9. CBDC Rollouts and Crypto’s Role

Source: FINEKSUS

Central Bank Digital Currencies (CBDCs) are going mainstream in several economies in 2025. Their launch often comes with tighter restrictions on private crypto for payments, raising questions about whether CBDCs will compete with or complement decentralized assets.

10. New Global Tax Compliance Rules

From the IRS in the U.S. to the Australian Tax Office, tax agencies are broadening their definitions of taxable crypto events. In 2025, expect more stringent reporting obligations, including possible real-time transaction reporting in some countries.

Conclusion

The TOP 10 Crypto Regulations 2025 reflect a global push toward maturing the digital asset industry. With some jurisdictions embracing structured oversight and others enforcing strict controls or outright bans, the year ahead will demand adaptability from both investors and companies. For those willing to stay compliant and informed, the evolving landscape offers both challenges and opportunities.