Top 10 Crypto Derivatives Platforms in 2025: Where Futures Trading is Heading

Top 10 Crypto Derivatives: Crypto derivatives have become a defining part of digital asset trading. In 2025, daily volumes in futures and perpetual contracts rival spot markets, with traders using these tools for hedging, speculation, and arbitrage. Institutions have also entered the mix, demanding higher compliance and more advanced structures.

The top 10 crypto derivatives platforms reflect these shifts, blending scale, accessibility, and new trading innovations. Whether it’s liquidity dominance, copy trading growth, or regulatory trust, each exchange takes a different approach to serving traders.

1. Binance Futures: Scale Above All

Source: Binance

Binance Futures continues to set the standard in derivatives. It consistently records the largest daily trading volume and open interest, giving traders confidence in execution and pricing. Its broad selection of perpetual swaps and futures markets also makes it versatile for different strategies.

Features such as isolated and cross-margin options, combined with the SAFU insurance fund, underline its appeal. Yet, access restrictions in some jurisdictions remain a sticking point, and compliance questions may shape its future growth.

2. Bybit: User-Friendly Yet Professional

Source: Forkast

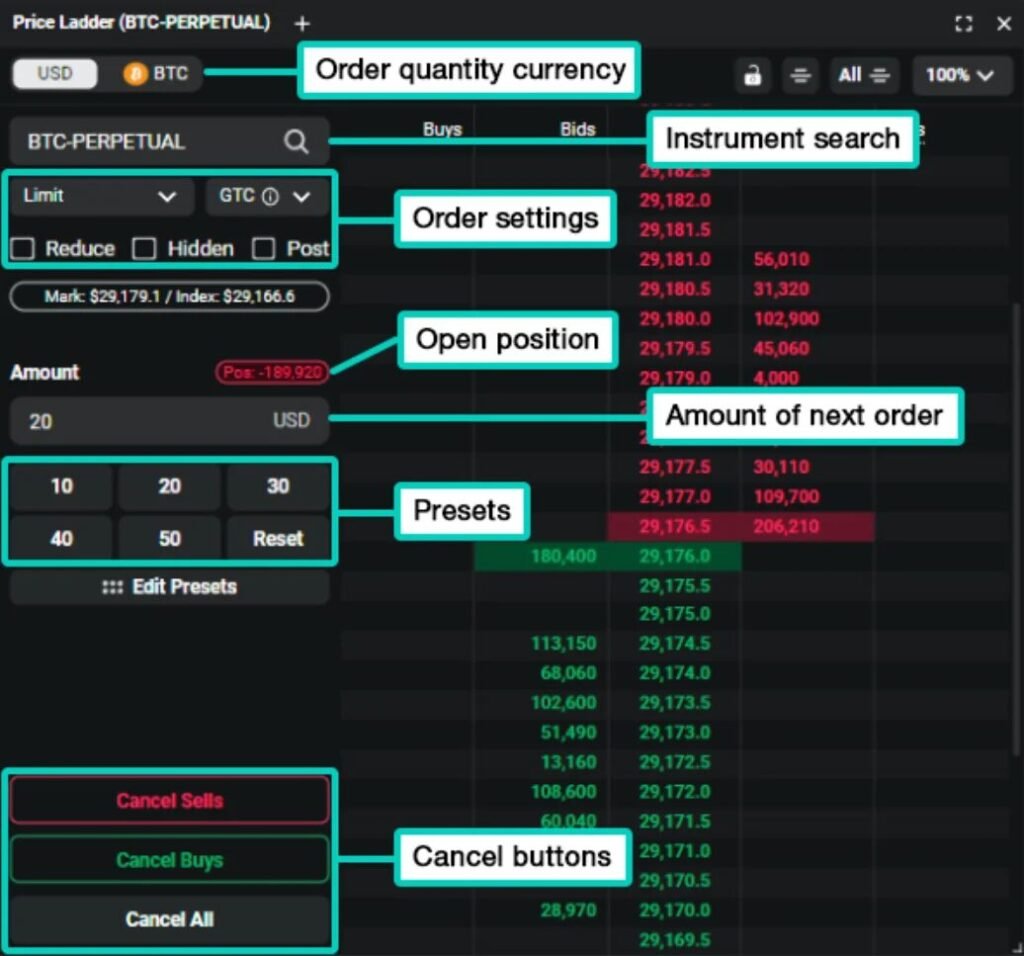

Bybit has built its identity as a derivatives-first exchange with strong emphasis on UI design and execution tools. Its fast-growing user base values both its liquidity and the balance it strikes between professional-grade features and retail-friendly dashboards.

Bybit’s USDC-settled contracts have set a trend for stable collateral usage. Its copy trading ecosystem is also one of the most developed in the sector. That said, some regional regulatory barriers continue to limit its reach.

3. OKX: The Hybrid Ecosystem

OKX has made its mark by merging centralized exchange reliability with DeFi access. Its derivatives suite includes futures, perpetual swaps, and options, backed by risk management tools for advanced traders.

One of its strengths is the integration with DeFi yield products, giving traders more flexibility. While it supports fewer total markets compared to Gate.io or MEXC, its combination of tools makes it a balanced choice for both retail and institutional clients.

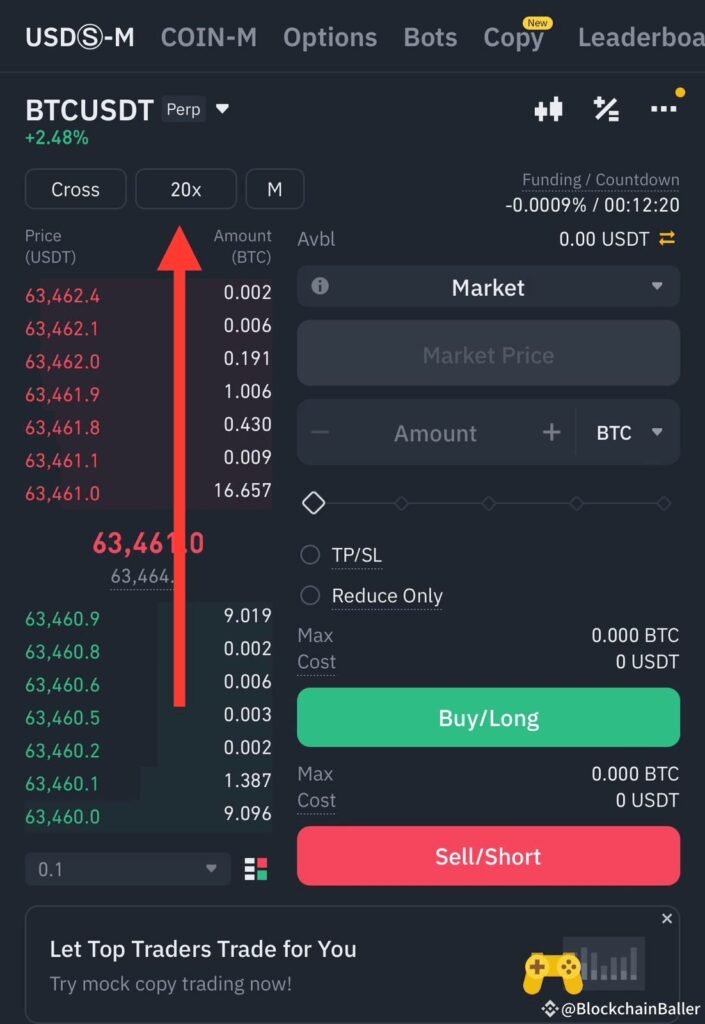

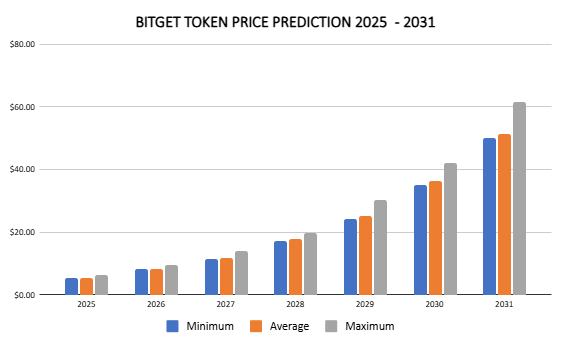

4. Bitget: Rising With Copy Trading – Top 10 Crypto Derivatives

Source: Cryptopolitan

Bitget has quickly positioned itself as one of the fastest-growing futures platforms in 2025. The exchange leans heavily into copy trading, enabling retail users to follow experienced traders’ strategies in real time.

Its insurance funds and risk management practices add an extra layer of security for those navigating high-leverage trading. However, as Bitget expands globally, it faces compliance challenges similar to those that larger platforms like Binance have already encountered.

5. Gate.io: The Market Coverage Giant

Source: Cointelegraph

Gate.io has been part of the derivatives scene for years, and in 2025 it maintains its edge through sheer variety. With 600+ markets available, it offers one of the most comprehensive sets of futures and perpetual contracts.

Its strong presence in Asia fuels high liquidity across altcoin markets. The downside is that for new traders, the platform’s complexity can be intimidating. Still, for those who want depth of choice, Gate.io remains a reliable destination.

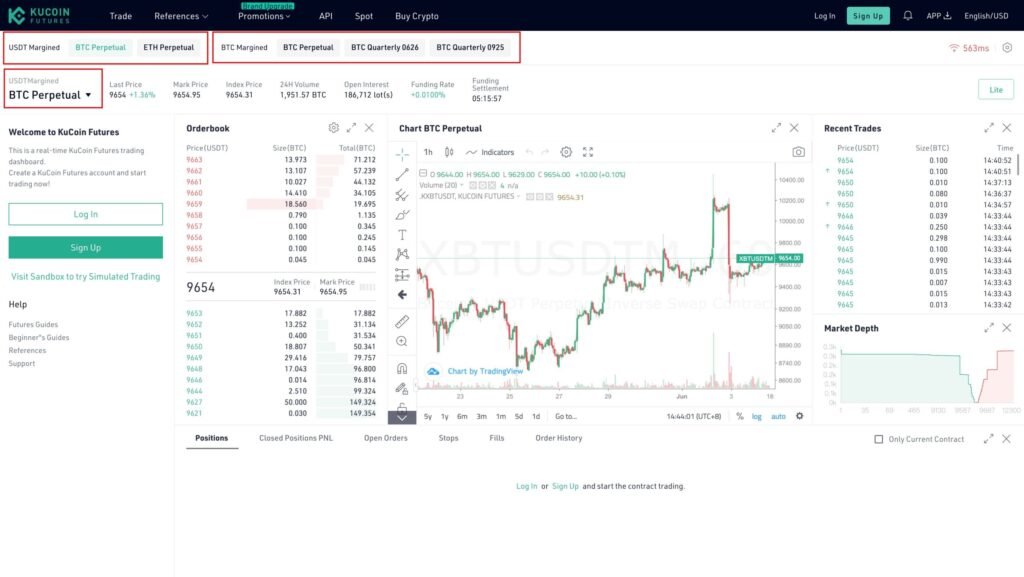

6. KuCoin Futures: Altcoin Opportunities

Source: Kucoin

KuCoin has embraced its reputation as the “People’s Exchange,” particularly for altcoin trading. Its derivatives products span a wide range of smaller market futures that often aren’t listed elsewhere.

Unique features like Futures Brawl, a gamified trading tool, reflect its appeal to younger, retail-driven audiences. Fee benefits tied to KuCoin Token (KCS) usage also make it cost-effective. Ongoing regulatory risks, however, remain a concern for long-term expansion.

7. Kraken Futures: Institutional Trust

Kraken Futures offers a more conservative but highly trusted entry into the world of derivatives. Unlike Asian competitors, it emphasizes regulation, compliance, and security-first policies.

Its futures lineup is smaller, primarily focusing on Bitcoin, Ethereum, and a few majors, but this has not stopped it from being a preferred venue for institutional traders seeking transparency and safety. Its focus is not breadth but reliability.

8. BingX: Accessible and Growing

Source: CoinBureau

BingX has established itself as a rapidly growing exchange in Southeast Asia and beyond. Its demo trading and copy trading features make it particularly appealing to new traders, while also providing pro-level tools for experienced users.

By balancing retail appeal with serious trading infrastructure, BingX has carved out space as an emerging competitor. Still, it is in the process of scaling liquidity and volumes compared to the largest names.

9. Deribit: Dominating Options

Source: DInsights

Deribit continues to be the undisputed leader in crypto options trading, particularly for Bitcoin and Ethereum contracts. Its focus on volatility products makes it the go-to platform for institutions seeking complex hedging instruments.

Unlike rivals, Deribit’s weakness lies in its narrow market coverage — it doesn’t offer the same broad futures selection. But for traders who want a serious options platform, it remains unmatched.

10. MEXC Futures: Fee-Cutting Challenger

MEXC Futures has surged in popularity by undercutting rivals with zero or ultra-low trading fees. Combined with an extensive list of 700+ markets, it offers strong incentives for both high-frequency traders and retail participants.

Though relatively new to the global futures spotlight, MEXC’s aggressive strategy has made it one of the most discussed competitors in 2025. Its sustainability will depend on whether it can maintain stability while growing fast.

Quick Comparison: Top 10 Crypto Derivatives – Fees and Market Depth

| Exchange | 24h Volume | Maker Fee | Taker Fee | Open Interest | Markets | Strengths | Weaknesses |

|---|---|---|---|---|---|---|---|

| Binance | $52.2B | 0.02% | 0.04% | $40.1B | 576 | Liquidity, scale | Regulatory barriers |

| Bybit | $17.6B | 0.02% | 0.055% | $25.2B | 609 | Copy trading, UI | Regional limits |

| OKX | $18.6B | 0.02% | 0.05% | $11.6B | 279 | Hybrid ecosystem | Fewer markets |

| Bitget | $16.7B | 0.02% | 0.06% | $26.2B | 538 | Social trading | Compliance hurdles |

| Gate.io | $14.4B | 0.015% | 0.05% | $19.1B | 633 | Market breadth | Steep learning curve |

| KuCoin | $5.6B | 0.02% | 0.06% | $2.8B | 468 | Altcoin access | Regulatory risks |

| Kraken | $516M | 0.02% | 0.05% | $757M | 338 | Security, trust | Limited contracts |

| BingX | $7.1B | 0.02% | 0.05% | $3.8B | 511 | Copy & demo trading | Scaling stage |

| Deribit | $414M | 0% | 0.05% | $3.4B | 33 | Options expertise | Few pairs |

| MEXC | $16.1B | 0% | 0.02% | $8.3B | 779 | Low fees, variety | Still new in futures |

Shaping Trends in 2025 – Top 10 Crypto Derivatives

Looking across these best crypto derivatives platforms 2025, a few themes stand out:

- Institutions are driving stricter compliance standards.

- Asian platforms are pulling ahead in product diversity and retail activity.

- Zero-fee models are becoming a competitive lever.

- Copy trading and social tools are reshaping retail adoption.

Conclusion: Different Needs, Different Platforms – Top 10 Crypto Derivatives

The top 10 crypto derivatives platforms of 2025 each serve different niches. Binance still leads on scale, Bybit and Bitget shine in retail engagement, while Deribit dominates options. Kraken offers the trust institutions want, and MEXC experiments with aggressive fees.

For traders, the decision is less about which platform is “best” and more about which one fits their risk appetite, product needs, and trading style. Futures and derivatives carry high risks — making research and risk management essential parts of the journey.