Top 10 Cross-Chain Bridges and Interoperability Protocols in 2025 for Seamless Blockchain Transfers, DeFi, NFTs, and Multi-Chain Web3 Adoption

The blockchain world has shifted from single-chain silos to a multi-chain Web3 ecosystem. In this environment, top 10 cross-chain bridges are not just utilities but foundations for growth. They enable tokens, NFTs, and data to move seamlessly between different blockchains, making decentralized finance (DeFi), gaming, and digital identity interoperable.

Why does this matter? Without interoperability, blockchains remain fragmented — liquidity pools are isolated, NFTs lose utility across ecosystems, and institutional adoption is slowed by inefficiencies. Cross-chain bridges address these gaps by acting as connective rails, bringing scalability and accessibility to Web3.

In 2025, multiple protocols are competing to provide this interoperability. Let’s explore the top 10 cross-chain bridges and interoperability protocols shaping the landscape this year.

1. Portal Bridge (Powered by Wormhole)

Source: wormhole

Portal Bridge leverages Wormhole’s underlying technology to connect blockchains such as Ethereum, Solana, BNB Chain, and Avalanche. By 2025, it has become a central tool for NFT transfers and token swaps.

Its network of integrations and audits shows resilience, though security remains a watchpoint after past exploits. Developers increasingly build multi-chain apps around Wormhole’s messaging layer, while NFT communities rely on Portal to move collections across ecosystems.

2. Binance Bridge

Source: Across

Binance Bridge ties together BNB Smart Chain and major blockchains, offering users cost-efficient transfers with deep liquidity. By integrating directly with Binance Exchange, it makes bridging simple even for non-technical users.

The trade-off lies in centralization, as validation depends on Binance’s infrastructure. Still, with millions of retail users and strong liquidity pools, Binance Bridge remains one of the most widely used solutions in 2025.

3. Avalanche Bridge (AB)

Avalanche Bridge focuses on Ethereum–Avalanche transfers, offering high speed and low fees. This specialization has made it attractive for gaming, NFT minting, and institutions experimenting with tokenized assets.

By 2025, AB is considered among the most secure and reliable dedicated bridges, playing an important role in Avalanche’s growing ecosystem of DeFi protocols.

4. Synapse Protocol

Synapse is more than just a bridge — it’s a DeFi interoperability network with its own liquidity pools. It supports stablecoin transfers, AMM swaps, and cross-chain messaging, making it versatile for developers.

Layer-2 adoption has strengthened Synapse’s position. Its integrations with Arbitrum, Optimism, and Base highlight its role in scaling Ethereum’s ecosystem efficiently in 2025.

5. Symbiosis Finance

Source: P0x

Symbiosis Finance simplifies the user journey with one-click multi-chain swaps. Its governance and tokenomics model reflects a decentralized approach, while partnerships across multiple ecosystems in 2025 expand its reach.

For traders who want broad coverage without managing complex routes, Symbiosis has become a practical gateway into the multi-chain world.

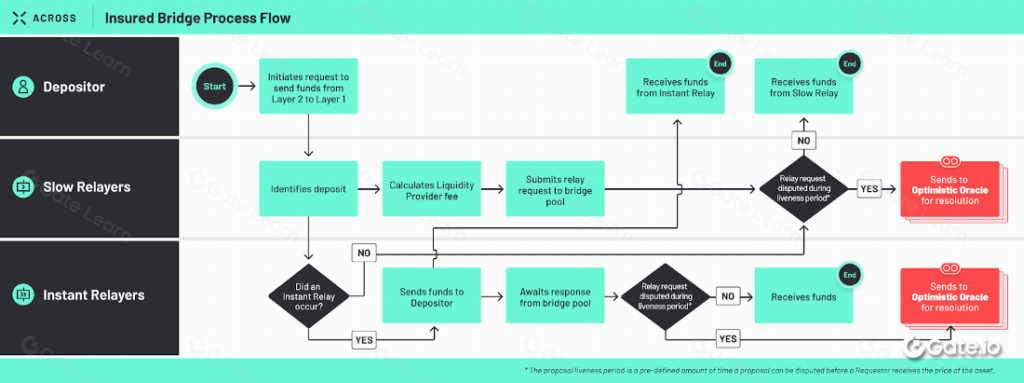

6. Across Protocol

Source: Gate Learn

Across is optimized for Ethereum Layer-2 transfers, using liquidity providers to make transactions instant. Users enjoy low fees and fast settlement, while providers are compensated through protocol incentives.

Its design has made it a backbone for L2-to-L2 transactions, often powering DeFi aggregators in the background. Across continues to attract developers looking for efficiency.

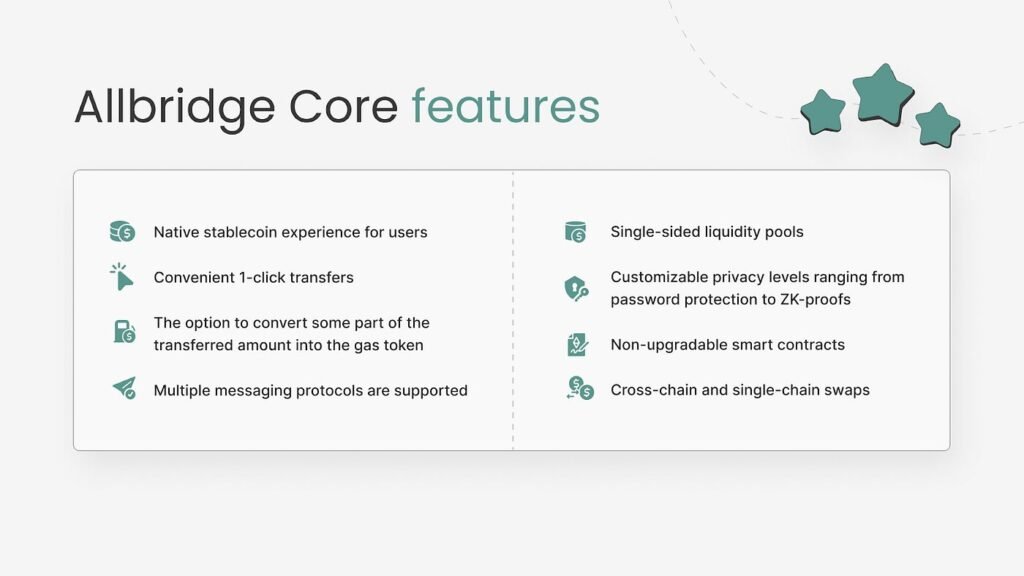

7. Allbridge

Source : Medium

Allbridge connects EVM and non-EVM blockchains, giving access to ecosystems like Solana, Tron, and Polygon. Its inclusive chain coverage fills gaps left by more specialized solutions.

In 2025, Allbridge continues to focus on stablecoin transfers and broad interoperability. While performance and liquidity risks are ongoing, it remains valuable for users exploring diverse blockchains.

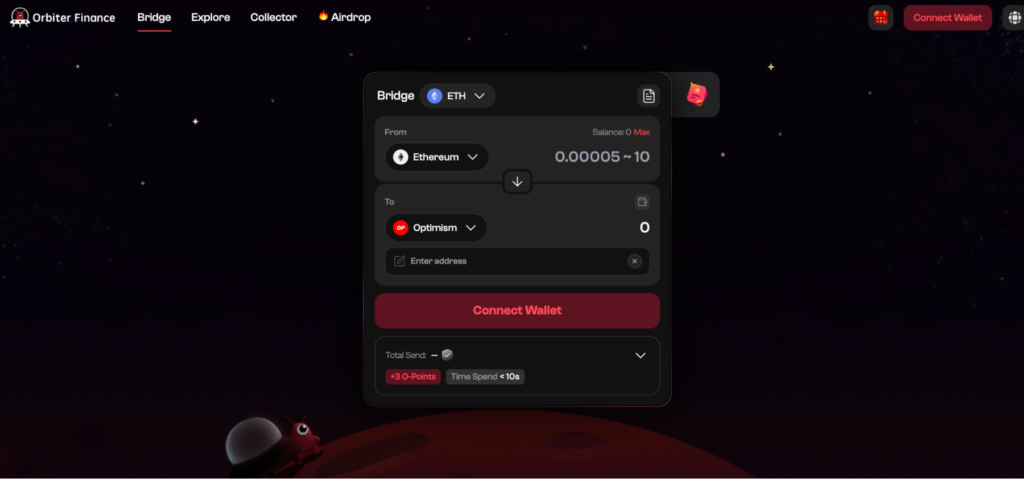

8. Orbiter Finance

Source: Gatelearn

Built for Ethereum’s L2s, Orbiter Finance enables fast transfers across zkSync, StarkNet, Arbitrum, and Optimism. It has developed a reputation for low-cost, high-speed bridging tailored to scaling solutions.

Developers benefit from Orbiter’s open tools and APIs, making it a popular choice for projects that want to integrate L2 interoperability directly into their dApps.

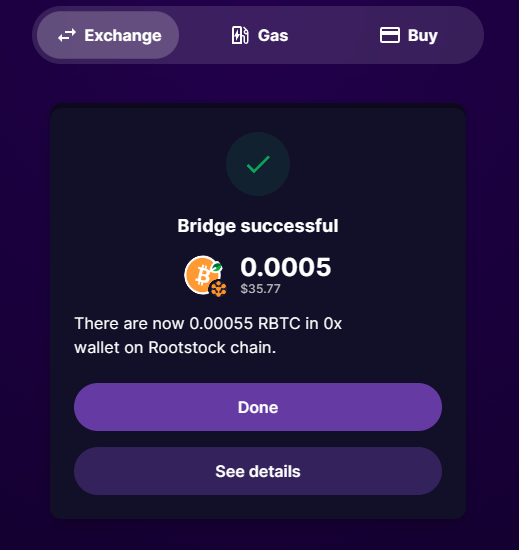

9. Jumper Exchange (by LI.FI)

Source: Rootstock

Jumper takes an aggregator approach, connecting users to the best bridge options automatically. Instead of committing to one protocol, users can access routing that balances cost, speed, and liquidity.

By 2025, Jumper has become essential for traders and dApps, acting as a meta-bridge that streamlines multi-chain swaps without the need for manual decisions.

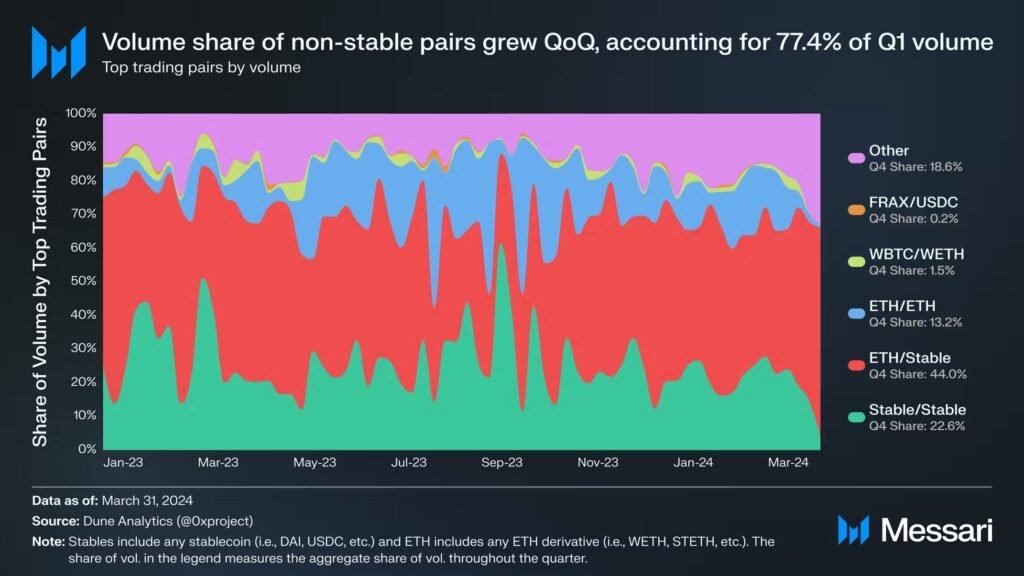

10. Top 10 Cross-Chain : Retro Bridge (Matcha Cross-Chain)

Source: Messari

Retro Bridge, linked with Matcha’s DeFi aggregator background, emphasizes cross-chain swaps backed by liquidity depth. While newer, it leverages competitive advantages in efficient routing.

It is especially attractive to DeFi power users who prioritize liquidity access and trade execution, even if its coverage is narrower than other bridges.

Comparative Overview – Top 10 Cross-Chain

- Security: Wormhole and Synapse stand out for audit frequency, while Binance Bridge relies more on centralized trust.

- Speed vs. Cost: Avalanche Bridge and Orbiter Finance provide fast, low-cost transactions, whereas Symbiosis simplifies multi-chain routes.

- Adoption: Binance Bridge dominates in retail, while Synapse and Across are more DeFi-native.

- Innovation: Aggregators like Jumper Exchange reflect the trend toward meta-bridging.

Future Outlook for Interoperability – Top 10 Cross-Chain

Cross-chain technology is moving beyond asset transfers toward cross-chain messaging and modular blockchain interoperability. In 2025, institutional adoption is rising, demanding secure and compliant solutions.

At the same time, risks remain. Exploits, scams, and regulatory questions continue to shape the industry. The next wave of development will likely see interoperability embedded more invisibly into dApps, reducing friction for users.

Conclusion – Top 10 Cross-Chain

The top 10 cross-chain bridges and interoperability protocols of 2025 reveal a fast-maturing landscape. From Wormhole’s wide reach to Orbiter’s L2 focus, these tools are transforming how liquidity, NFTs, and data move across ecosystems.

As Web3 grows more interconnected, bridges are evolving into full interoperability protocols. Their role is no longer just about moving tokens but about enabling seamless interaction across fragmented blockchains. Interoperability, more than ever, remains the backbone of Web3.