What Is Tokenomics? A Beginner’s Guide to Crypto Economics

Tokenomics for beginners starts with a simple idea: every cryptocurrency has an economic system that governs how it works. Tokenomics—short for “token economics”—explains how a crypto token is created, how it’s used, how many exist, who holds it, and how its value might change over time.

If you’re investing in or developing crypto projects, understanding tokenomics isn’t optional. It’s the framework that can make or break a project, influence its value, and determine whether users and investors will trust it.

Tokenomics for Beginners: Why Tokenomics Matters in Crypto

The entire value proposition of a cryptocurrency can rest on its tokenomics. Without a sound economic design, even a technically brilliant blockchain project can fail. Consider this: a poorly distributed token can fall into the hands of a few players who manipulate the market. On the flip side, clear supply caps and transparent reward systems can foster trust and long-term adoption.

For crypto investors, tokenomics offers clues about sustainability, scarcity, and incentive models. For developers, it’s a toolkit to balance supply and demand while maintaining network activity and value flow.

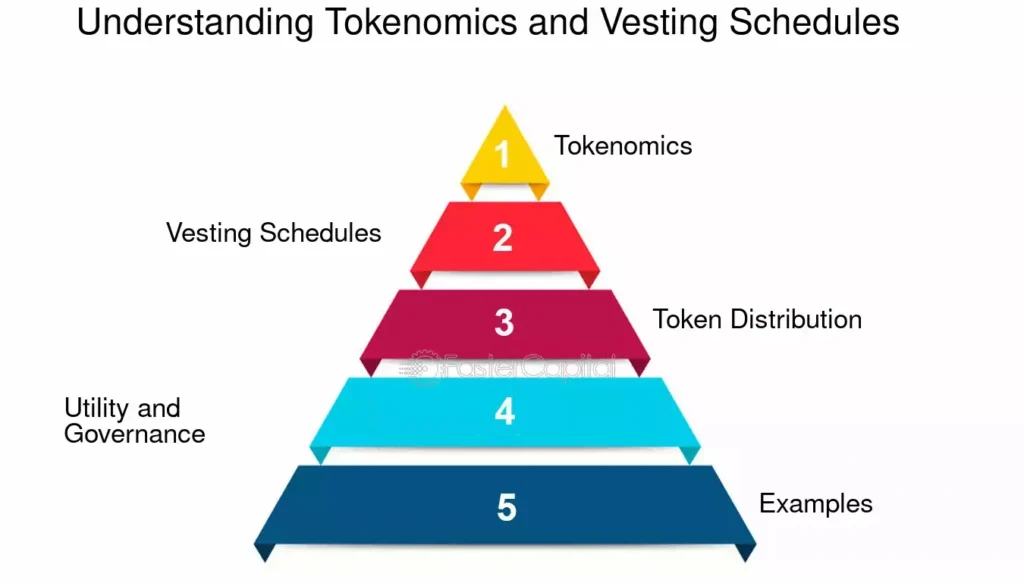

Key Components of Tokenomics for Beginners

Credit from FasterCapital

1. Total Supply vs. Circulating Supply

These two figures provide a snapshot of scarcity and potential inflation.

| Metric | Definition | Example |

|---|---|---|

| Total Supply | The maximum number of tokens that can ever exist. | Bitcoin: 21 million |

| Circulating Supply | The number of tokens currently available in the market. | Ethereum: ~120 million (as of 2025) |

While Bitcoin’s supply is capped, Ethereum’s supply is dynamic and affected by network usage and fee burning. Investors watch these numbers closely to predict future scarcity or inflation risk.

2. Distribution and Vesting

How tokens are distributed among founders, teams, early investors, and communities speaks volumes about a project’s fairness. A skewed distribution can lead to centralized power and price manipulation.

Vesting schedules are common mechanisms to slowly release tokens over time. For instance, team tokens might unlock monthly over four years, preventing sudden dumps in the market and ensuring long-term commitment.

3. Token Utility and Use Cases

Tokens without a purpose often fail. Strong projects define clear utility for their tokens:

- Governance: Token holders vote on protocol changes (e.g., Uniswap, Aave)

- Payments: Used as currency within a platform (e.g., Binance Coin on Binance exchange)

- Access: Required to use services or participate in special features (e.g., Filecoin for storage)

- Staking: Locked to help validate transactions or secure the network

If a token has multiple use cases, especially tied to real demand, it is more likely to sustain value.

4. Incentive Mechanisms

Tokenomics designs often include reward structures that encourage participation or long-term holding. These include:

- Staking rewards: Users earn interest by locking tokens (e.g., Cardano, Solana)

- Liquidity mining: Rewards for providing token pairs to decentralized exchanges

- Airdrops: Free tokens distributed to generate awareness and adoption

The key is sustainability—overly generous incentives may cause inflation or short-term hype without lasting value.

5. Token Burning: Controlling Supply

Token burning permanently removes tokens from circulation. Projects like Binance burn BNB regularly based on revenue, reducing total supply and increasing scarcity.

Ethereum’s EIP-1559 upgrade introduced a fee-burning mechanism in 2021. Since then, over 4 million ETH have been burned (as of mid-2025), creating periodic deflationary pressure that can help balance supply.

6. Security and Governance Structures

While often overlooked in beginner discussions, governance and consensus models are critical to tokenomics. Proof-of-stake (PoS), proof-of-work (PoW), and delegated proof-of-stake (DPoS) each affect how tokens are earned and used.

Governance models—whether on-chain or off-chain—also impact token value. Active participation, transparent voting systems, and the ability to propose or veto changes can add depth to a token’s ecosystem.

Real-World Examples of Tokenomics in Action

Bitcoin (BTC)

- Tokenomics model: Fixed capped supply (21 million), mined through PoW.

- Outcome: High scarcity, strong store-of-value narrative, low inflation.

Ethereum (ETH)

- Tokenomics model: Transitioned to PoS; now burns a portion of fees; no fixed cap.

- Outcome: Dynamic supply; possible long-term deflation, utility-driven.

Axie Infinity (AXS & SLP)

- Tokenomics model: Dual-token system for governance and rewards.

- Outcome: Massive growth during NFT boom, but poor supply controls led to inflation and value crash in 2022–2023.

Tokenomics for Beginners: How to Evaluate a Token’s Economics

Evaluating tokenomics requires more than reading a whitepaper. Here’s a simplified process:

- Start with supply metrics: What’s the total supply? How much is circulating? Any burning mechanisms?

- Review distribution: How many tokens are held by the team, investors, or whales?

- Check utility: Is the token essential to the platform’s function?

- Study incentives: Are rewards sustainable, or do they promote short-term speculation?

- Gauge market maturity: Is the token actively traded, staked, or governed?

All these factors interact with market conditions, hype cycles, and regulation. No single metric guarantees success.

Tokenomics for Beginners: Common Pitfalls in Tokenomics Design

- Over-supply with weak demand: Projects mint billions of tokens with no real use.

- Poor distribution: Centralized control by insiders erodes trust.

- Over-reliance on incentives: Rewards without organic growth can collapse once funding dries up.

- Lack of burn or lockup strategies: Leads to inflation and price dilution.

Smart investors avoid tokens where economic models rely too heavily on speculation or artificially inflated rewards.

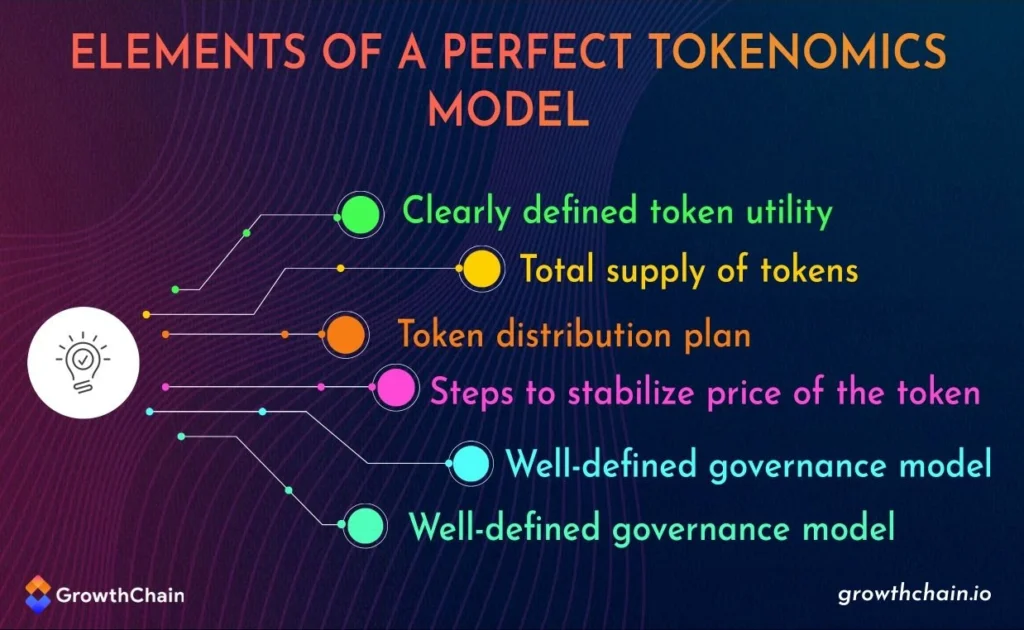

How Tokenomics Affects Price and Adoption

Credit from GrowthChain

Token price is not only a product of market sentiment but also of its supply dynamics, utility, and trust in the ecosystem. A well-structured tokenomics plan can:

- Boost investor confidence

- Encourage active participation (e.g., staking or voting)

- Sustain developer engagement

- Drive adoption through real utility

On the flip side, flawed tokenomics is one of the top reasons early-stage crypto projects fail. Without balancing supply, incentives, and governance, projects quickly lose relevance.

Conclusion: Tokenomics for Beginners Is More Than Just Numbers

Tokenomics for beginners is not about mastering technical jargon. It’s about understanding how a crypto token behaves economically—what drives its value, how it’s distributed, and why people would want to use or hold it. This knowledge is crucial whether you’re buying, building, or analyzing blockchain projects.

As crypto continues evolving, the projects that survive won’t just have flashy interfaces or social media hype. They’ll have solid tokenomics—backed by real demand, sustainable incentives, and transparent governance.