Margex Exchange Review 2025: What It’s Really Like to Trade Here

If you’ve been searching for a Margex Exchange Review 2025, chances are you’ve already seen the usual polished write-ups. But let’s keep it real: Margex started as a niche margin trading platform, and while it’s improved over the years, it’s not without flaws.

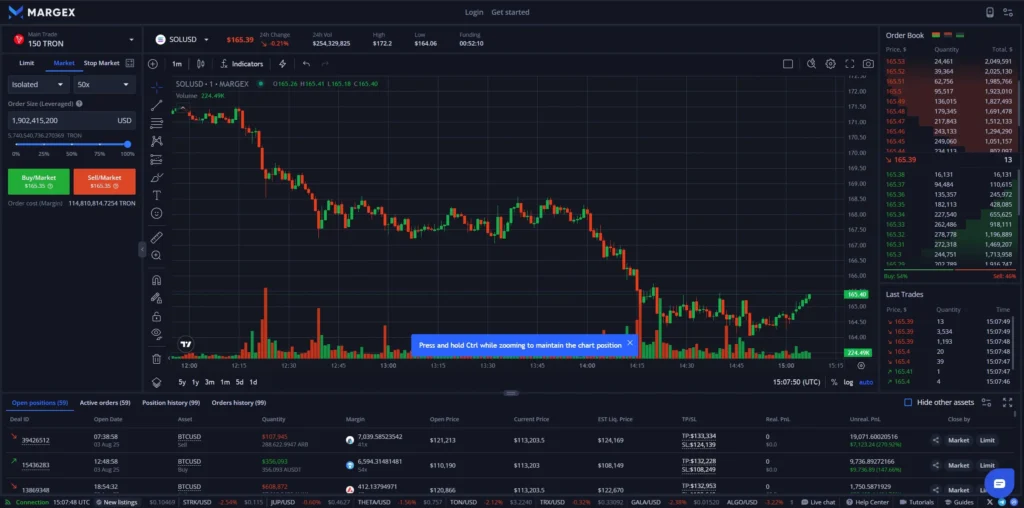

When I first tested Margex, it felt bare-bones. Fewer pairs, some liquidity gaps, and support that could take forever to reply. Fast-forward to today, and the vibe is noticeably better. Execution feels quicker, the interface is less clunky, and you don’t need a manual to figure out how to place a trade. It’s still not as big as Binance or Bybit, but many traders, including myself, like that it’s not overloaded with unnecessary features.

Security: More Reassuring Than Before, but Not Perfect

The number one question every trader has is, “Is my money safe here?” Margex now stores most funds in cold wallets, meaning they’re not constantly online waiting for hackers to find a hole. Withdrawals take extra steps—emails, codes, confirmations—which can be slightly annoying if you’re in a rush, but you’d rather be annoyed than compromised.

Regulation is where things get murky. Margex is pushing for more licenses in stricter markets like Singapore, which is a good sign. But globally, crypto rules are still a patchwork. Some users report unexpected KYC requests, while others trade without much friction. That uncertainty is just part of the crypto landscape right now, and Margex isn’t immune to it.

Fees and Leverage: Competitive Enough for Most

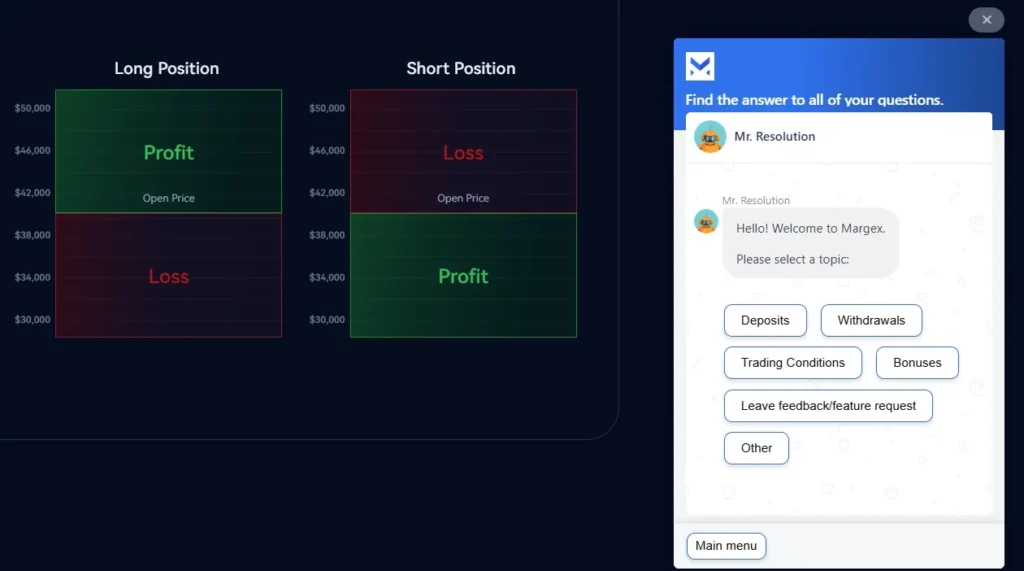

Let’s talk money. Fees are roughly 0.1% on spot trades and a bit lower for derivatives. Not the cheapest on the planet, but far from the worst. Leverage goes up to 100x, which is both exciting and terrifying. If you’re new, don’t touch 100x—it’s a fast way to burn your account. Veterans sometimes use it for quick, high-conviction trades, but everyone knows the risk.

Here’s a quick comparison against other platforms:

| Exchange | Spot Fees | Derivatives Fees | Max Leverage |

|---|---|---|---|

| Margex | 0.1% / 0.1% | 0.02% / 0.06% | 100x |

| Bybit | 0.1% / 0.1% | 0.01% / 0.06% | 100x |

| Binance | 0.1% / 0.1% | 0.02% / 0.07% | 125x |

Margex Exchange Review: Simple, but Not Lacking

One of the best parts about Margex is its straightforward design. You can use BTC, ETH, or stablecoins as collateral without swapping everything first. It saves time and makes jumping into trades smoother. Tools like isolated margin and stop-loss help keep trades from spiraling out of control during sudden price swings.

Support has improved since the early days. It’s not 24/7 instant help like you’d expect from top-tier exchanges, but it’s faster than it used to be. During fast markets, that response speed makes a difference.

Margex Exchange Review: Weak Spots You Should Know

Margex still feels like a mid-sized exchange. The trading volume isn’t on the same level as Binance, meaning huge orders can move the price more than you’d like. Advanced tools—copy trading, deeper analytics—aren’t fully fleshed out. And depending on where you live, KYC rules can feel inconsistent, leaving some new users frustrated before they even start trading.

Margex Exchange Review: Who Is Margex Best For?

After spending time on Margex in 2025, I’d say it’s a solid platform for traders who like simplicity, fair fees, and decent leverage options. It’s not trying to be everything for everyone, and maybe that’s a good thing. If you need huge liquidity pools or advanced bells and whistles, other platforms have more to offer.

For regular margin trading, Margex feels safe enough to keep funds you actively use. But like many traders say: store your long-term bags in a private wallet. Exchanges, no matter how well-built, can change overnight in the crypto world.