Why Malaysia Stock Account Opening Might Be the Smartest (or Most Overlooked) Move You’ll Make This Year

Introduction: Why We’re Not Talking Enough About Stock Accounts

Look, if you’ve been on the fence about investing, I get it. Stocks feel risky, headlines are dramatic, and the last thing you want is to make a money move you regret. But here’s the thing most people won’t tell you: Malaysia stock account opening is one of the simplest, smartest, and most ignored financial steps you can take. And no — you don’t need to be rich, savvy, or even particularly brave to do it.

Let’s talk about why this matters more than you think.

Why Opening a Stock Account Isn’t Just for “Finance People”

Here’s a spicy take: If you’ve ever left your money sitting in a savings account “just in case,” you’re losing more to inflation than you realize.

Banks reward you with interest that barely scratches 2%. Meanwhile, companies on Bursa Malaysia are out there generating real growth — and giving investors a slice of the pie.

When you open a stock account, you’re not just gambling. You’re stepping into ownership. You’re saying, I believe this company is going places — and I want in.

Malaysia Stock Account Opening: A Small Step That Changes Your Money Game

This is where people freeze up. “Is it complicated?” “Will I mess it up?” “What if I lose money?”

Here’s my answer: yes, maybe, and probably — but that’s true of everything worth doing.

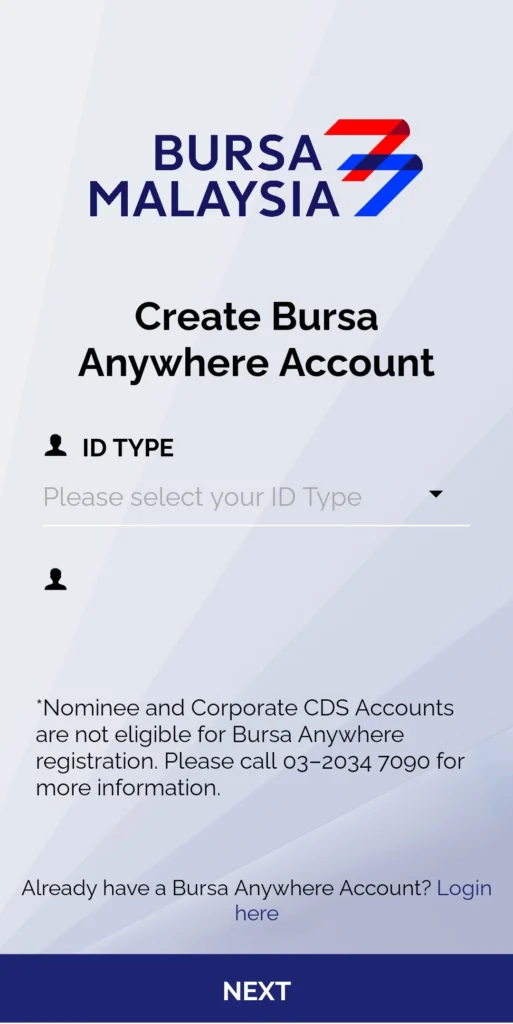

Opening a stock account in Malaysia is actually way less painful than you’d expect. All you need is:

- Your NRIC (or passport + visa if you’re not Malaysian)

- A proof of address (hello, utility bills!)

- Your bank details

- And maybe income documents — but only if you’re going into fancy margin territory (which most newbies aren’t)

Apply online or in-person through brokers like Rakuten Trade, Maybank, or CIMB. Some platforms let you start in under 48 hours. That’s faster than your last Shopee delivery.

Choosing a Broker Is Like Choosing a Gym — Find What Feels Right

You don’t need the fanciest broker, just the one you’ll actually use. Here’s how I think of it:

| Broker Feature | Real-Life Vibe |

|---|---|

| Low fees | Like a gym that doesn’t charge for a towel |

| User-friendly app | So you don’t get lost trying to “buy” |

| Good customer support | Someone picks up when you panic-click a button |

| Learning tools | They want you to succeed, not just take your money |

Don’t get analysis paralysis. Just pick one and move forward. You can always switch later if it’s not working out.

What Happens After You’re In? Honestly… Not That Much (At First)

Once you’ve completed your Malaysia stock account opening, the real game begins. But here’s a dose of honesty: it’s a bit boring at the start.

- You fund your account.

- You browse a few stocks.

- You place a trade.

- You refresh the app like a maniac for two days.

And then… life goes on. Stocks don’t moon overnight. The trick is to stay in the game long enough to see them work for you.

Malaysia Stock Account Opening Fees: The Price of Admission

Yes, there are fees. But they’re not outrageous — and if they scare you off, investing might not be your thing (yet).

| Fee | What to Expect |

|---|---|

| CDS setup | One-time, RM10–RM20 |

| Brokerage fees | Around RM7–RM30 per trade |

| Stamp duty & clearing | Standard, set by regulators |

Read the fine print. No surprises = no regrets.

Final Word: Do It Scared, But Do It Anyway

Too many people wait for the “right time” to start investing. Newsflash: there’s never a perfect time.

Malaysia stock account opening is one of those small, practical steps that signals something bigger — you’re taking your money seriously. You’re playing offense, not just defense. You’re finally making moves.

Will you stumble? Probably. Will you learn? Definitely. Will you thank yourself in 10 years? Absolutely.

Start. You’ll be glad you did.

Relevent news: Here