How to Store Cryptocurrency Securely: A Beginner’s Guide to Protecting Your Digital Assets

Introduction: Getting Started with Crypto Security

Before you make your first crypto purchase, one of the most important things to understand is how to store cryptocurrency securely. Digital assets like Bitcoin and Ethereum offer new opportunities—but they also come with serious responsibilities.

Unlike money in a traditional bank, cryptocurrency doesn’t come with built-in protections. If you misplace your wallet credentials or fall for a scam, there is no one to call for a refund. For beginners, getting storage right from the start can help prevent costly mistakes down the road.

Understanding What a Crypto Wallet Is

A cryptocurrency wallet doesn’t hold actual coins—it stores the credentials you need to access your crypto. These credentials include your private keys, which authorize transactions and confirm your ownership on the blockchain.

Every wallet also comes with a public address, which functions like a digital account number that others can use to send you funds. But it’s the private key that gives you full control. If someone else has it, they can move your funds without your permission.

Wallets generally fall into two categories: hot wallets and cold wallets. The main difference is whether or not they’re connected to the internet.

Hot vs. Cold Wallets: What’s the Difference?

Hot wallets are software-based tools connected to the internet. They’re easy to set up and use for trading, sending, or receiving crypto. However, their constant internet connection makes them more vulnerable to hacking and phishing attacks.

Cold wallets, in contrast, store private keys offline. This significantly reduces the risk of cyberattacks. Although cold wallets are less convenient for frequent transactions, they are the preferred option for long-term storage or large balances.

Here’s a side-by-side comparison:

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Internet Access | Always connected | Completely offline |

| Security Risk | Higher risk of online attacks | Low risk if physically secure |

| Usability | More convenient for frequent use | Better suited for storage and backups |

| Ideal Use Case | Trading and daily transactions | Long-term holding of crypto |

| Examples | MetaMask, Exodus, Coinbase Wallet | Ledger Nano, Trezor, Paper wallets |

How to Store Cryptocurrency: Getting Started with a Wallet

If you’re new to crypto, it’s best to start with a hot wallet. These are typically apps or browser extensions that can be installed within minutes. They support a wide range of cryptocurrencies and allow you to test the waters before committing large funds.

MetaMask is a top choice for Ethereum users, while Exodus offers a visually intuitive experience across both desktop and mobile. Coinbase Wallet, separate from the Coinbase exchange, is also beginner-friendly with strong security options.

As your holdings grow, consider transitioning to a cold wallet. Devices like the Ledger Nano S Plus or the Trezor One provide offline storage for thousands of tokens and protect your keys from online exposure.

Paper wallets—where private keys are printed or handwritten—were once popular but are now rarely recommended due to the high risk of physical damage or loss.

How to Store Cryptocurrency: The Importance of Private Keys

In crypto, private keys are everything. If you lose access to your wallet but still have the private key (or its recovery phrase), you can restore your funds. But if someone else obtains your key, they can transfer your assets without your consent.

That’s why owning your keys means owning your crypto. Wallets provided by exchanges are sometimes custodial—meaning they control the private keys, not you. While convenient, this limits your control and increases risk if the provider is hacked or shuts down.

Backing Up Your Wallet to Store Cryptocurrency Securely

Every crypto wallet generates a recovery phrase—usually 12 or 24 words—that acts as a backup. This phrase must be kept safe, because it’s the only way to recover your funds if you lose your wallet or device.

The best practice is to write the phrase on paper and store it in a secure, private location such as a safe. Some long-term holders also use metal backup plates that are fireproof and waterproof. Avoid saving your phrase on cloud services, phones, or computers, as these can be compromised.

It’s wise to make at least two physical copies and keep them in separate secure places. For those managing large holdings, splitting the phrase across multiple locations or with trusted individuals may add an extra layer of safety—though this adds complexity.

Protecting Your Assets Beyond the Wallet

Security doesn’t end with choosing a wallet. Good habits are just as important.

Always download wallet software from official sources. Double-check URLs and don’t click on links in suspicious emails or messages. Keep your wallet app and device updated to ensure you’re protected from known vulnerabilities. And if your wallet offers two-factor authentication (2FA), enable it immediately.

Public Wi-Fi should be avoided when making wallet transactions, as it increases the risk of man-in-the-middle attacks. Similarly, never share your seed phrase or private keys with anyone—not even support agents. Scammers often pretend to be helpful services to steal access.

Long-Term Storage and Custodial Options

Credit from Token Metrics

If you’re planning to hold crypto for the long term, it’s worth investing in more secure storage.

Hardware wallets like Ledger and Trezor are ideal for this purpose. They store your keys in an isolated chip that only signs transactions when connected to a verified computer. Many investors use a combination: keeping a small balance in a hot wallet for convenience and storing the rest in a cold wallet.

For larger portfolios or business applications, multi-signature wallets add another layer of protection. These require multiple parties to sign off before any transaction can be executed, reducing the risk of theft or accidental loss.

Some institutional investors also use custodial services from firms like Coinbase Custody, Anchorage, or BitGo, which provide regulated cold storage and insurance coverage for crypto assets. These are more expensive, but may be appropriate for those holding significant amounts.

What Happens If You Lose Your Wallet?

Losing your device doesn’t mean losing your crypto—as long as you’ve backed up your seed phrase properly. You can restore your wallet on a new device by entering the recovery phrase. But if both your wallet and backup are lost, the assets are unrecoverable.

This is why it’s critical to test your recovery process. Practice restoring your wallet on a second device (without moving your funds) to make sure your backups work as intended.

Conclusion: Your Keys, Your Responsibility

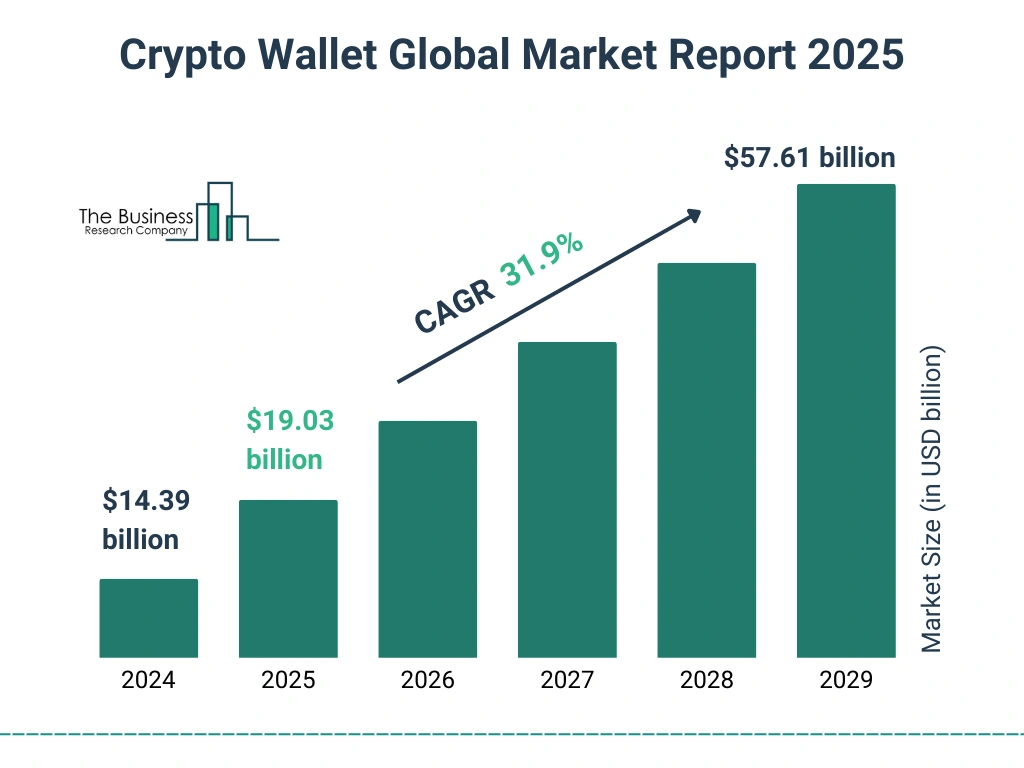

Credit from The Business Research Company

Learning how to store cryptocurrency securely isn’t just for experts—it’s essential for anyone entering the space. A well-chosen wallet and safe handling of your private keys can protect your investment from both digital and physical threats.

Start simple, stay cautious, and keep control. With just a few smart choices, you can secure your digital assets and build confidence in your crypto journey.