Gold price forecast Indonesia 2025: What Investors Should Know About the Trends This Year

Gold price forecast Indonesia: Gold continues to attract attention in Indonesia as 2025 presents a mix of economic caution and shifting global indicators. With price levels holding strong and the rupiah under pressure, gold remains a preferred hedge for many Indonesians looking for security over speculation.

This trend analysis dives into what’s currently happening in the gold market and what investors should watch for in the months ahead.

1. Gold price forecast Indonesia: Where do things stand in mid-2025?

Gold prices in Indonesia are maintaining strength as mid-2025 progresses. While the market isn’t booming, it’s showing solid support above Rp 1,100,000 per gram in many regions, reflecting persistent demand amid economic uncertainty.

This steady performance has encouraged more long-term investors to enter the market, while short-term traders remain cautious due to limited price swings.

2. What’s influencing price movement this year?

source: What do analysts expect from the gold market in Indonesia this year?

The Indonesian gold market is being shaped by several intersecting forces:

- Rupiah fluctuations — A weaker currency inflates local gold prices.

- Global inflation — Though easing, it still prompts demand for protective assets.

- Interest rate changes — Especially in the U.S., affecting global investor behavior.

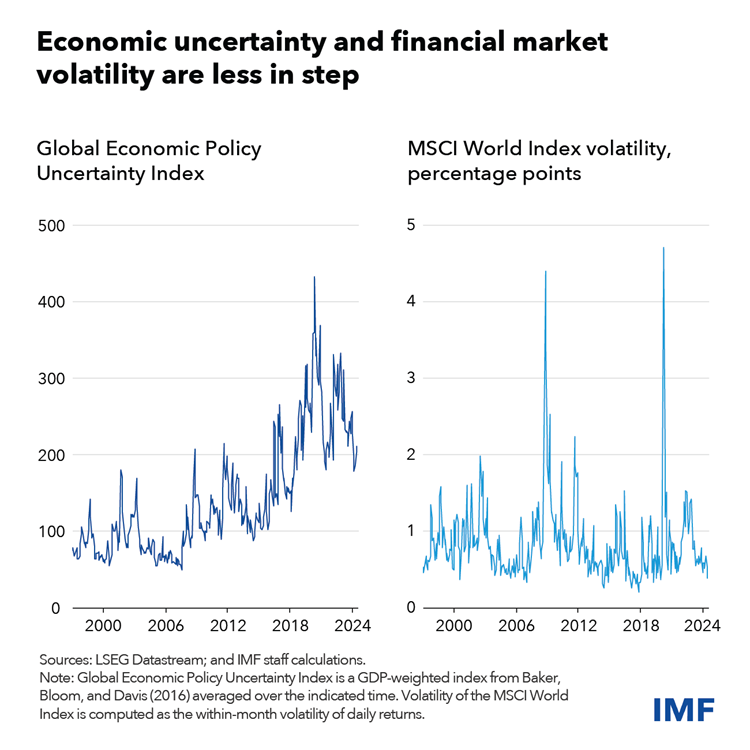

- Uncertainty in major economies — From elections to conflicts, global risk perception matters.

These variables continue to drive cautious optimism in the gold space.

3. Gold price forecast Indonesia: What do analysts expect through 2025?

While outlooks vary slightly, most forecasts predict stability with slight upside:

- Bullish analysts expect gold to approach Rp 1,400,000 per gram if inflation returns or global uncertainty deepens.

- Moderate forecasts put a likely range between Rp 1,150,000 and Rp 1,250,000 per gram.

- Bearish views are rare, as there’s little indication of a sharp price decline unless interest rates rise aggressively.

Overall, analysts foresee gold holding its value rather than showing explosive gains.

4. Gold price forecast Indonesia: Is now the right time to invest?

For long-term wealth preservation, many financial planners still recommend allocating a portion to gold. It continues to serve as:

- A hedge against weakening currencies

- A store of value during inflationary periods

- A portfolio stabilizer amid market volatility

If you’re investing with a 3–5 year horizon, current levels remain attractive. But don’t expect quick profits — gold performs best with patience.

5. Gold price forecast Indonesia: How do global trends affect local pricing?

Indonesia doesn’t operate in a vacuum — these global events play a major role:

- Federal Reserve policies shift global gold dynamics almost immediately.

- Geopolitical instability often pushes gold demand higher.

- China and India’s consumption patterns significantly influence pricing.

- Commodities markets (like oil) indirectly impact inflation and gold prices.

Monitoring global financial news is key to anticipating local shifts in gold pricing.

6. Gold price forecast Indonesia: Where should investors track reliable prices?

Accurate pricing is essential, especially in a market that changes daily. Recommended sources include:

- Antam (Logam Mulia) – The most trusted benchmark for physical gold pricing in Indonesia.

- Pegadaian Digital – For daily rates and accessible investment options.

- Bareksa, Pluang, IndoGold – Ideal for digital investing and real-time price data.

- Marketplaces – Like Tokopedia Emas and Shopee Emas, useful for small-scale buyers.

- News platforms – CNBC Indonesia, Kontan, and Bisnis.com for analysis and macro context.

Stay informed and avoid outdated or unreliable sources.

7. Gold price forecast Indonesia: What’s the outlook for the second half of 2025?

Most projections indicate a steady-to-slightly-positive trend for the rest of the year. No major downturn is expected, but neither is an aggressive rally.

As long as inflationary pressure and geopolitical risk persist, gold is expected to retain its role as a protective asset. Prices may trend upward modestly, especially if the rupiah weakens further or global tensions rise.

Conclusion

Gold price forecast Indonesia 2025 suggests a cautious but optimistic outlook. While not a fast-moving market, gold continues to serve its core purpose — stability, value protection, and long-term peace of mind for investors.

For those building a balanced investment portfolio in uncertain times, gold deserves a serious look this year.