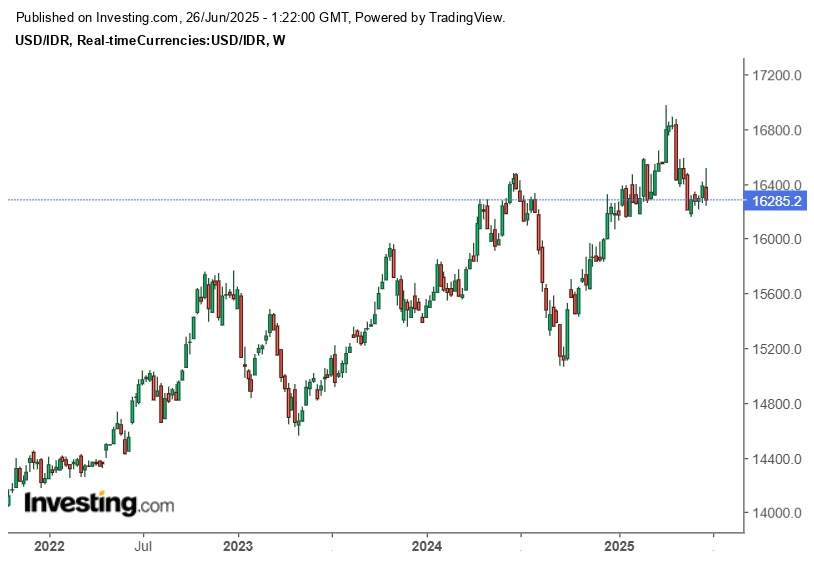

Gold Hedge Rupiah: A Crucial Move as IDR Volatility Puts Savings at Risk

Gold Hedge Rupiah: The Indonesian rupiah has had better years. Between global market shocks, rising interest rates abroad, and ongoing inflation, the currency continues to face pressure.

While the headlines haven’t all screamed crisis — not yet — the signs are clear: value is slipping. And if your savings are sitting in IDR without any protection, you could be exposed.

That’s why a growing number of Indonesians are now taking action — using a gold hedge rupiah strategy to shield themselves from what may come next.

Risk 1: Gold Hedge Rupiah- Currency Drift Erodes Buying Power Slowly, Then Suddenly

Source: Investing.com

It starts subtly. Maybe imported items go up in price. Travel becomes more expensive. Even local goods feel slightly pricier. That’s not just inflation — that’s your currency buying less.

When the rupiah weakens, your savings buy fewer goods and services. It doesn’t take a crash for this to hurt — just steady, quiet slippage. And historically, that’s when gold performs its job best.

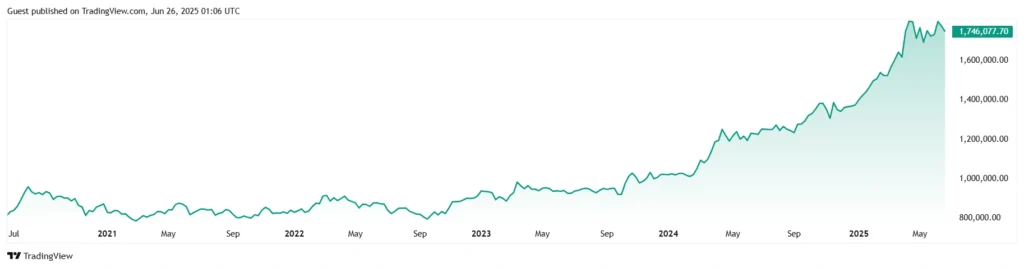

Risk 2: Gold Hedge Rupiah- Gold Gets More Expensive in IDR as Soon as the Pressure Hits

Source: TradingView

Here’s the problem: once IDR begins to slip, people rush into gold — and prices rise fast. By the time you decide to buy, the cost in rupiah may already be out of reach.

That’s the danger of waiting too long to build a hedge. You’re no longer protecting your money — you’re reacting, often too late.

Risk 3: Gold Hedge Rupiah- Traditional Savings Can’t Keep Up

Bank accounts and time deposits are secure, yes — but are they protecting your money from losing value? In many cases, interest rates are simply not keeping up with inflation or currency depreciation.

This is why even small hedges — just 5 to 10 percent of your cash — into gold can offer balance and insulation. A gold hedge rupiah position doesn’t require a fortune, just forethought.

Why Gold Still Holds Its Ground in 2025

Despite market ups and downs, gold continues to be a trusted store of value during unstable periods. It isn’t tied to one economy, it doesn’t rely on a central bank, and it’s accepted worldwide.

For Indonesians, gold priced in rupiah tends to climb when the local currency weakens — giving it a natural role as a buffer asset.

How to Start Hedging — Without Overcomplicating It

If you’re ready to take action, you’ve got options:

- Digital gold platforms like Pluang, Tokopedia Emas, and Lakuemas allow small, easy purchases

- Physical gold from certified sellers such as Antam or Pegadaian remains a popular long-term choice

- Gold funds or ETFs work well for those already using investment apps or brokers

You don’t need to go big from day one. Even buying 1 gram of gold can begin the shift.

Final Risk: Believing There’s Still Time

“I’ll do it later” has cost many people dearly — especially in times of financial uncertainty. The longer you wait, the narrower your options become.

Gold hedging isn’t a trend. It’s a defensive move. One that quietly works while everything else feels unpredictable.

Final Thought

You’ve worked hard to save. Don’t let a slow currency slide undo that effort. A gold hedge rupiah plan doesn’t have to be complex or costly — just consistent and intentional.

Because when the next economic wave hits, those who prepared will already be one step ahead.