Gold Forecast 2025: How Vietnam’s Market Trends Reflect Global Shifts

Tracking the 2025 Gold Forecast: Where Is Vietnam’s Market Heading?

In the face of continued global uncertainty, Vietnam’s gold market remains a key indicator of investor sentiment and consumer confidence. As we enter the second half of 2025, attention is turning toward whether the gold forecast points toward growth or a looming correction — and what role inflation may still play.

Gold has always had a cultural and financial presence in Vietnam. But recent volatility in the global economy is amplifying local concerns, especially as inflation, currency fluctuations, and asset diversification strategies intersect.

Global Context: Gold vs Inflation Dynamics

Credit from www.sinchew.com.my

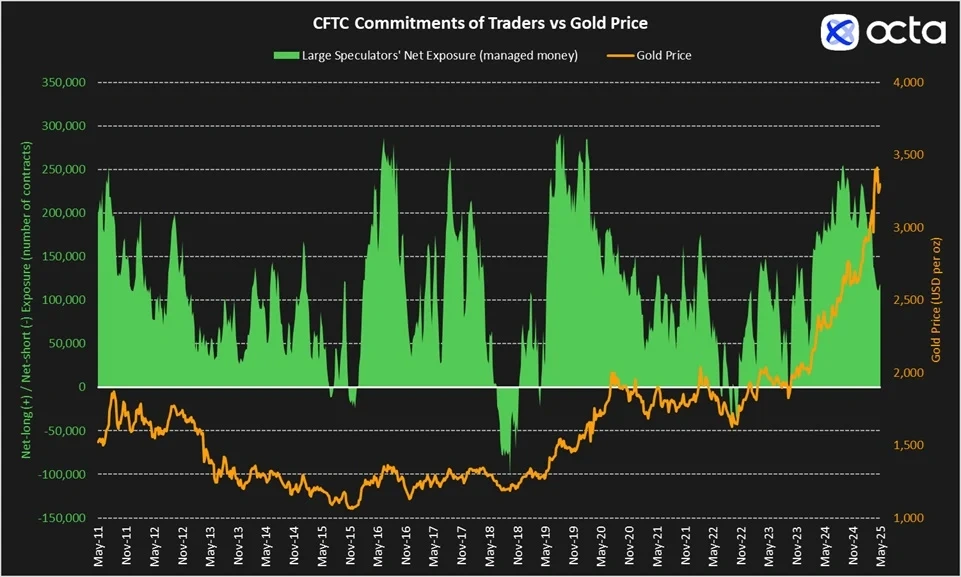

One of the core forces shaping the gold forecast this year is the ongoing tension between inflation and central bank policy. Globally, inflation has cooled compared to the 2022–2023 peak, but not evenly. In Southeast Asia, especially in countries like Vietnam, local inflation continues to affect purchasing power, housing costs, and consumer behavior.

Gold, in this environment, retains its reputation as a hedge — especially when fiat currency trust wavers. Analysts have long pointed to this relationship: when inflation rises, so does gold demand, particularly in emerging markets.

But there’s a twist. If global central banks shift away from rate hikes and adopt looser policies, it may make riskier assets more attractive — potentially softening gold’s momentum in late 2025.

Vietnam Gold Price 2025: Cultural Demand and Policy Impact

Credit from Vietnam.vn

Within Vietnam, several internal trends affect the Vietnam gold price 2025 outlook beyond inflation. Cultural factors — such as gifting gold during Tet and weddings — sustain physical gold demand at a household level, independent of global investor movements.

According to data from the World Gold Council, Vietnam consistently ranks among the top countries for consumer gold purchases per capita in Asia. This steady baseline demand helps buffer against price volatility.

However, government policy also plays a role. Restrictions on gold imports, state management of bullion distribution, and local currency valuation can all distort local prices. While international prices might drop, Vietnam’s domestic gold prices don’t always follow — creating a unique divergence in trend perception.

Will Gold Crash in 2025 — Or Normalize?

The question on many investors’ minds is: Will gold crash in 2025? While some analysts warn of a correction following multi-year highs, the term “crash” may be too strong in Vietnam’s context.

Unlike speculative assets, gold in Vietnam is typically viewed as a long-term store of value, passed down through generations. The majority of Vietnamese buyers aren’t day-traders or speculators — they’re families preserving value, which provides natural stability.

What is more likely, say economists, is a gradual price normalization if global economic sentiment improves and inflationary fears subside. A boom may be off the table, but a crash doesn’t appear imminent either.

Key Trend Drivers to Watch in Vietnam

Credit from The Star

Several signals will shape the 2025 gold price prediction for Vietnamese investors:

- Inflation Stability: If Vietnam’s inflation rate levels off, speculative demand could ease.

- Monetary Policy Abroad: Moves by the U.S. Federal Reserve and China’s central bank can ripple into Vietnam’s market.

- Import Control Policies: Gold access in Vietnam is state-regulated — any policy shifts here can drastically impact local prices.

- Real Estate & Crypto Recovery: If confidence in other assets returns, gold’s safe-haven appeal could diminish.

Conclusion: Navigating the Gold Forecast in 2025

Based on current patterns, Vietnam’s gold forecast for 2025 is likely to reflect broader regional sentiment: cautious, not panicked. Inflation still matters, but it’s no longer the only factor shaping demand.

For investors and households alike, gold remains a conservative choice — more of a stabilizer than a gamble. Whether you’re holding gold bars or tracking international indices, the trends in Vietnam suggest a soft landing, not a freefall.