Gemini Exchange Review 2025: A Practical Look at Security, Costs, and Trading

When people talk about regulated crypto exchanges in the U.S., Gemini is almost always part of the conversation. This gemini exchange review explores what makes it different in 2025. Unlike many platforms that chase massive coin listings, Gemini doubles down on compliance, safety, and transparency. That doesn’t mean it lacks variety – the supported assets on Gemini now include a healthy mix of top cryptos and carefully selected altcoins.

For me, the appeal was straightforward: solid gemini security features, a reliable gemini mobile app, and the ability to connect to institutional-grade services like the gemini custody service.

Gemini Exchange Review: Registration and KYC

Opening an account is simple, but not instant. You’ll need to complete the gemini KYC process, which involves ID uploads and proof of residence. It took me less than 24 hours to get verified.

For those who want to explore before funding, the gemini demo account helps new traders test the trading instruments on Gemini without any financial risk.

Gemini Exchange Review: Trading Options and Market Coverage

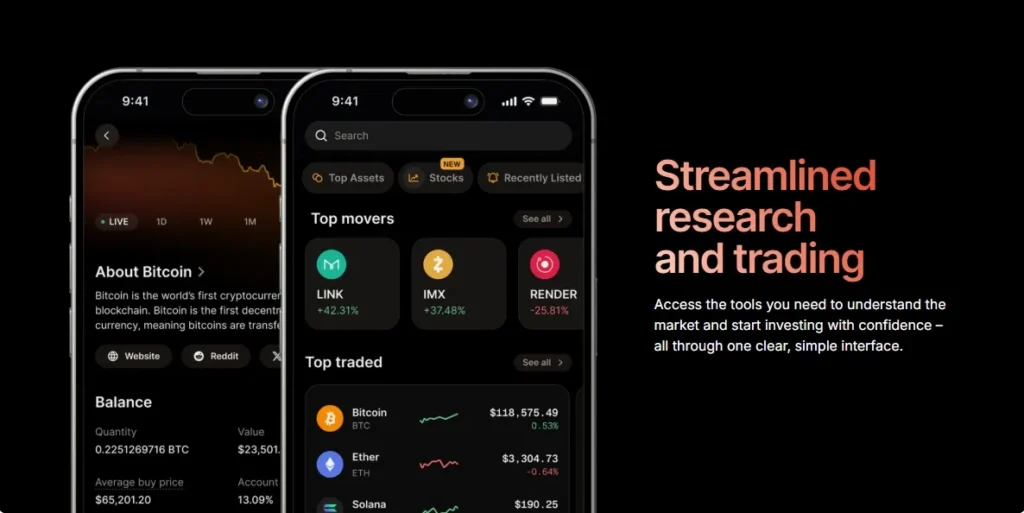

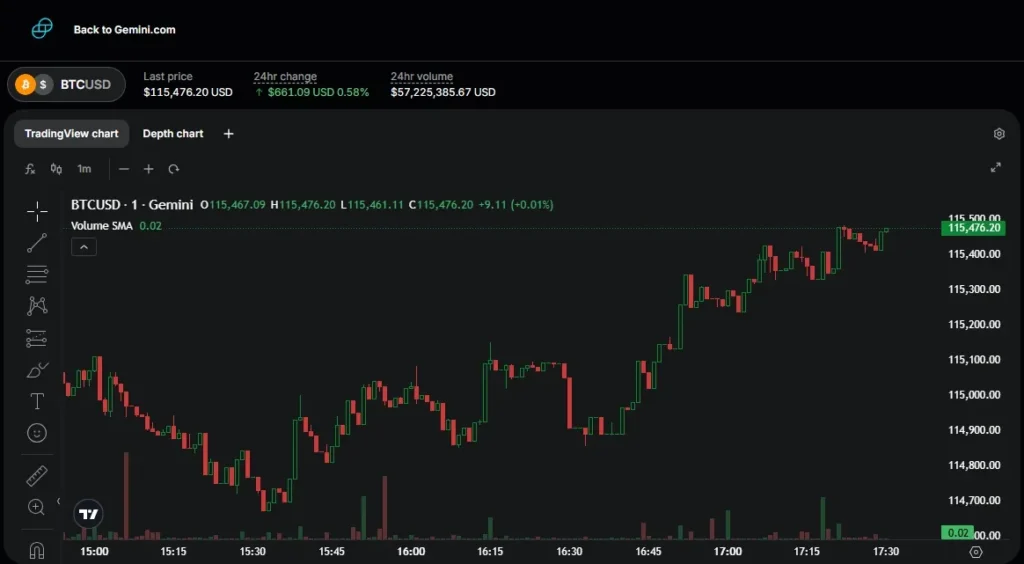

Gemini offers straightforward gemini spot trading, with deep liquidity in BTC, ETH, and several stablecoins. While gemini futures trading is not as developed as on other exchanges, Gemini’s gemini active trader platform provides pro-level tools for those who need more advanced features.

The platform focuses on quality rather than quantity, which means you won’t find every meme coin listed, but you will have access to reliable investment tools on Gemini and solid market depth in major pairs.

Fees – Not the Lowest, But Transparent

When it comes to cost, Gemini is often called pricey, but fees depend heavily on how you trade. Retail users pay higher gemini trading fees on the standard interface, while the ActiveTrader option slashes costs significantly.

Here’s the 2025 fee outline:

| Service | Fee | Details |

|---|---|---|

| Standard Spot | ~1.49% | Applies on web and app trades |

| Active Trader | 0.25% maker / 0.35% taker | Lower for pros |

| Futures | Contract-based | Still limited availability |

| Withdrawal | Free up to 10/month | Network fee afterward |

| Earn Program | 0% fee | Interest on lending/staking |

In gemini vs coinbase, both exchanges are regulated and beginner-friendly. Coinbase wins in marketing reach, but Gemini’s low fee trading platform via ActiveTrader gives serious traders better value.

Gemini Exchange Review: Security and Regulation

The highlight of this review is security. The gemini security features include two-factor authentication, device approval, anti-phishing codes, and cold storage for the majority of assets.

The regulatory status Gemini is also robust: it’s a New York trust company under NYDFS oversight. For institutions, the gemini custody service provides insured cold storage – something few competitors can match.

Daily Trading Experience

On desktop, the platform is intuitive and uncluttered. For advanced users, the gemini active trader platform has professional-grade charts and quick order execution.

The gemini mobile app mirrors this simplicity, making it easy to buy, sell, or check your portfolio on the go. During my test, liquidity and execution speed were smooth for BTC/USD and ETH/USD pairs, though smaller altcoins were less liquid compared to Binance.

Passive Income and Tools

The Gemini Earn Program offers interest on crypto holdings, letting you earn passive returns. While rates depend on the coin and regulatory environment, it’s a good option for long-term holders.

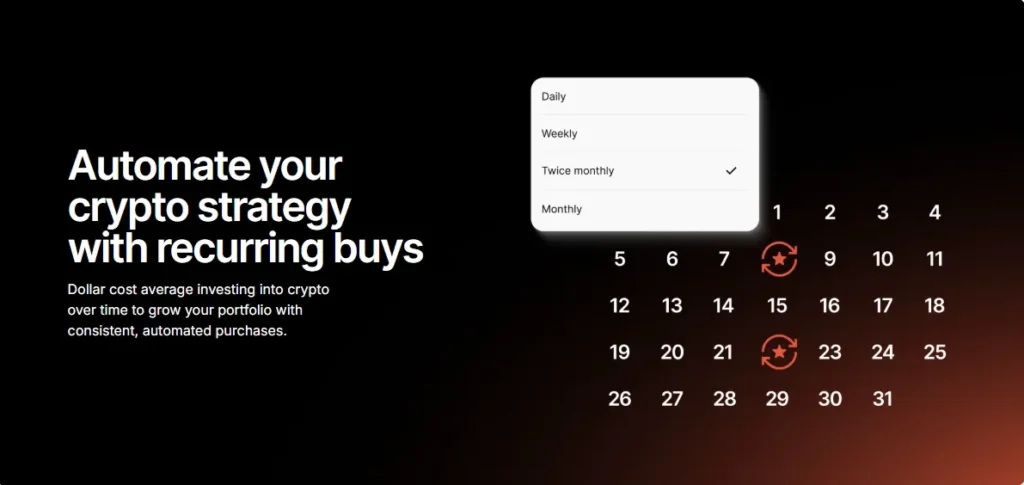

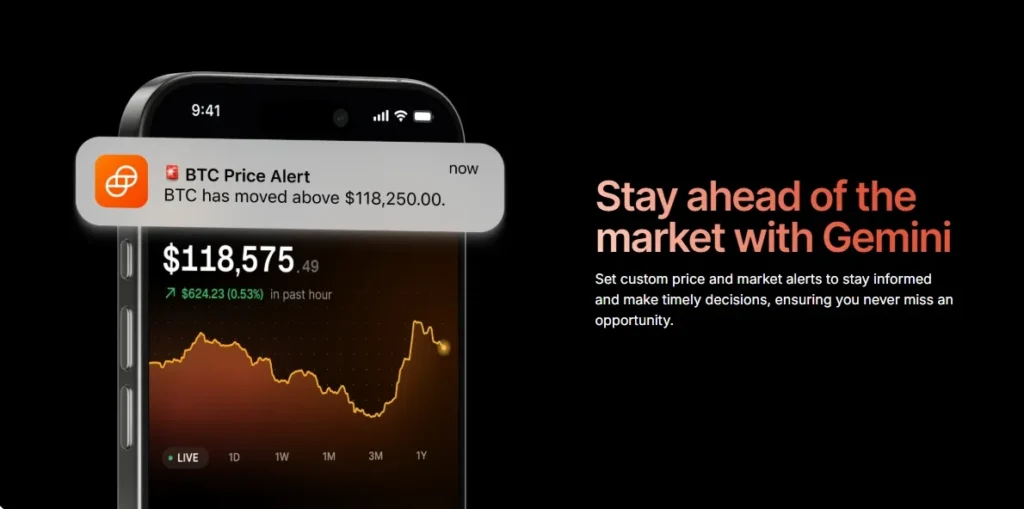

Meanwhile, investment tools on Gemini include alerts, analytics, and tracking that make portfolio management easier, especially for retail traders who need guidance.

Deposits and Withdrawals

The deposit and withdrawal process is straightforward. Fiat deposit options Gemini include ACH and wire transfers in the U.S., plus debit card purchases. International users can rely on SWIFT transfers. Withdrawals are smooth, with up to 10 free per month – a clear advantage over many rivals.

Final Thoughts – Is Gemini Worth Using in 2025?

This gemini exchange review highlights Gemini as a safe, regulated, and transparent platform. Its gemini trading fees may not be the lowest, but the combination of gemini security features, Gemini Earn Program, and strong regulatory status Gemini make it a trusted choice.

If you’re chasing meme coins or ultra-low spreads, it may not be your only exchange. But for investors and institutions that put compliance and security first, Gemini remains one of the most reliable options in 2025.