Mastering Forex Time Zones: A 7-Step Guide to the Best Trading Hours for Asian Traders

Tutorial 1: Understanding Forex Time Zones — The First Step to Smarter Trading

The forex market operates 24 hours a day, five days a week, which often gives the impression that any time is a good time to trade. But experienced traders know that’s far from true. Not all hours are equal in terms of market activity, liquidity, or volatility. That’s where the idea of forex time zones becomes critical.

The trading day is divided into four major global sessions — Sydney, Tokyo, London, and New York — each influenced by the economic activity of their respective regions. For traders in Asia, understanding when these sessions open and close is essential for identifying the best trading hours. It’s not just about being awake; it’s about being active when the market is.

Tutorial 2: Mapping the Sessions — Sydney to New York, and Everything In Between

Credit from FXOpen UK

Each forex session has its own rhythm. The Sydney session, though quieter, marks the start of the trading week. Tokyo follows, bringing in Asian market momentum. The London session opens next, accounting for the largest share of daily forex volume. Finally, New York brings in U.S. economic data and institutional movement.

Asian traders — especially those in countries like Vietnam, the Philippines, and Malaysia — often begin during the Tokyo session. But the real action usually happens during overlap periods, when two major sessions are open at once. These moments often provide increased liquidity and sharper price movements, offering more opportunities for timely trades.

Tutorial 3: How Vietnam Fits In — Time Zones and Trading Realities

Credit from FasterCapital

Vietnam is seven hours ahead of GMT, which means its trading window aligns naturally with the Tokyo session and partially with London. The Vietnam forex session usually begins around 6:00 AM and remains active until late evening.

What makes Vietnam interesting is how it straddles time zones. Traders here can catch the full Tokyo session in the morning, then move into the London overlap in the late afternoon. By 7:00 PM Vietnam time, the New York session opens — offering an evening opportunity for those who can stay alert. Understanding the Vietnam time zone forex market overlap allows local traders to build smart schedules without losing sleep.

Tutorial 4: What Is the Best Forex Time in Vietnam? It Depends on Your Style

Credit from Oanda

There’s no single best time that suits everyone. Instead, the right window often depends on your trading strategy. Short-term traders who thrive on volatility may prefer the London–New York overlap, which falls in the evening in Vietnam — typically between 7:00 PM and 11:00 PM. This is when the market sees the most volume and the tightest spreads.

Those with longer-term positions or who prefer steadier moves may trade during the Tokyo–London transition, roughly 2:00 PM to 5:00 PM local time. These hours are less frantic but still active enough to find meaningful setups. For beginners or part-time traders with day jobs, evening hours offer the most flexibility, without sacrificing market quality.

Tutorial 5: Why Overlap Sessions Offer the Best of Both Worlds

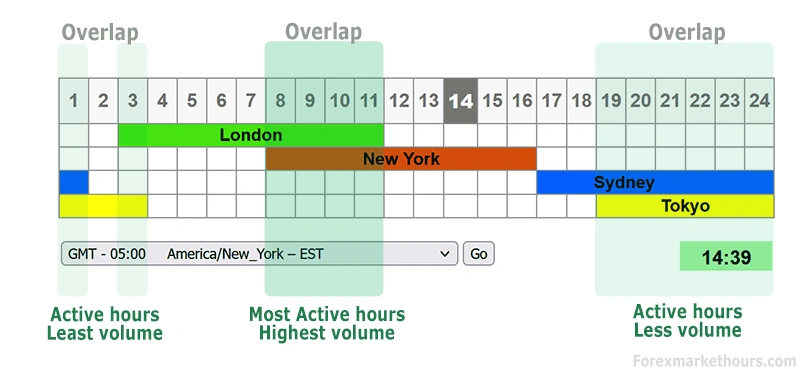

Credit from www.forexmarkethours.com

The forex market may be open continuously, but price action thrives when major financial centers are active together. Overlap periods — when two major sessions cross — typically offer the best mix of liquidity and volatility.

The Tokyo–London overlap is relatively calm, yet ideal for pairs like EUR/JPY or GBP/JPY, which reflect both European and Asian market sentiment. In contrast, the London–New York overlap sees a global tug-of-war, especially on pairs like EUR/USD and GBP/USD. For traders in Vietnam and across Asia, knowing when these overlaps occur can be the difference between a slow day and a profitable one.

Tutorial 6: Building a Daily Trading Routine That Works in Vietnam

Many traders fall into the trap of thinking they need to be at their screens all day. The truth is, building a solid daily routine around your country’s trading hours can lead to better results with less fatigue.

In Vietnam, mornings (6:00 AM to 10:00 AM) are typically used for analysis and early trades during the Tokyo session. Afternoons are perfect for catching the Tokyo–London crossover, while evenings allow traders to jump into the high-energy London–New York overlap. By splitting the day into focused trading blocks, it becomes easier to balance forex with work, study, or family life — making trading more sustainable long-term.

Tutorial 7: Final Thoughts — When Should Asians Trade Forex?

For Asian traders, finding the best trading hours isn’t just about global clocks. It’s about personal routine, strategy, and understanding forex time zones in the context of your own lifestyle. In countries like Vietnam, where access to the Tokyo and London sessions is relatively smooth, there’s room to explore multiple trading strategies across different parts of the day.

Whether you’re a night owl seeking market momentum or a morning person analyzing trends, the key is to align your personal rhythm with global market flows. In the end, forex is less about being online all the time, and more about knowing when to show up.