A Closer Look at the Shifting Roles of Traders and Money Changers

Once a niche concern for travelers and exporters, forex activity in Indonesia has transformed into a multifaceted sector. These days, Forex Indonesia is no longer confined to money changers or airports — it extends into digital apps, trading dashboards, and speculative investments. What’s fascinating is not just the expansion, but the way the ecosystem is splitting in two: one path leads toward high-speed, online forex trading, while the other remains rooted in traditional money exchange services.

This dual-track system doesn’t signal conflict — it reflects choice. And that choice says a lot about where the country is headed, both economically and behaviorally.

Digital Forex Trading: A Rising Lifestyle Among Young Professionals

In major Indonesian cities, the rise of forex trading platforms is hard to ignore. Driven by smartphone access and greater financial awareness, online forex trading is becoming a lifestyle choice, especially for young urban dwellers. These platforms — licensed by BAPPEBTI — give users the ability to trade global currency pairs in real time, reacting to economic news, political events, and market sentiment from around the world.

Users aren’t just trying to make a quick profit. Many see trading as a skill, a form of digital entrepreneurship that blends strategy, psychology, and risk management. The barrier to entry is low: demo accounts, mobile apps, and flexible funding options make it accessible to a wide demographic. And while not without risk, the transparency of these platforms — paired with regulatory oversight — is making digital forex a more trusted part of the Forex Indonesia financial landscape.

Money Changers: Still Trusted, Still Essential

Source: Midpoint

In parallel, money changers remain a pillar of real-world financial transactions. Found across shopping malls, travel hubs, and business centers, these licensed outlets provide immediate currency conversion for travelers, students, and workers heading abroad. Regulated by Bank Indonesia, they offer set daily rates and issue receipts — ensuring transparency and consumer protection.

For many Indonesians, especially in smaller towns or older age groups, money changers are not just a service — they’re part of a routine. They offer reliability, personal service, and peace of mind. While the process may seem simple, it fulfills a very specific function: turning money into usable, tangible resources for immediate needs. That physical exchange — cash for cash — remains highly valued in parts of Indonesia where digital financial tools still face trust barriers.

Forex Indonesia: Two Systems, Two Goals

Source: forexopher

The functional divide between forex trading and money exchange is becoming sharper. Forex trading is about opportunity, projection, and the future — trading based on what might happen. It requires interpretation, timing, and, often, emotional control.

Money changers are about certainty. They exist for immediate needs — converting currency based on a known rate for a known purpose. There’s no guesswork, no volatility, and no speculation. It’s a transaction grounded in the now.

Rather than compete, these services fulfill different ends of the spectrum. And as more Indonesians define their financial identities, they’re picking sides based not on which is “better,” but which aligns with their intent.

Forex Indonesia: What Influences the Shift Toward Digital?

Source: Forbes

Several factors are accelerating the rise of forex trading apps. One is financial education. More Indonesians — especially among Gen Z and millennials — are actively seeking ways to build wealth outside traditional savings accounts. Influencers, webinars, and social media content about trading have made once-intimidating concepts more approachable.

Another is convenience. Unlike money changers, forex platforms are 24/5, mobile-accessible, and fully self-service. You can monitor charts during your commute, execute trades from a café, or automate strategies from home. For users who value control, speed, and flexibility, forex trading fits easily into a tech-first lifestyle.

Still, this growth depends heavily on regulation and user awareness. Without the oversight of BAPPEBTI, the sector could easily fall prey to scams or unlicensed operators. Fortunately, efforts to strengthen regulation have grown in tandem with user adoption — keeping the digital side of Forex Indonesia on a relatively steady course.

Forex Indonesia: Why Money Changers Still Matter

Source: The Conversation

Despite digital enthusiasm, physical money exchange hasn’t faded. It simply operates on different assumptions: that people want face-to-face service, that cash is still king in many parts of Indonesia, and that not everyone is comfortable taking financial risks.

Moreover, not all needs can be met digitally. A student leaving for Japan next week still needs actual yen. A business settling a cross-border invoice still wants the certainty of today’s rate. These are not investment decisions — they are logistics. And for those cases, money changers remain irreplaceable.

In fact, some changers have begun modernizing: offering online rate previews, integrating with travel services, or expanding into regional areas underserved by banks. In this way, the offline branch of Forex Indonesia is adapting — just at its own pace.

Pricing Tells the Story

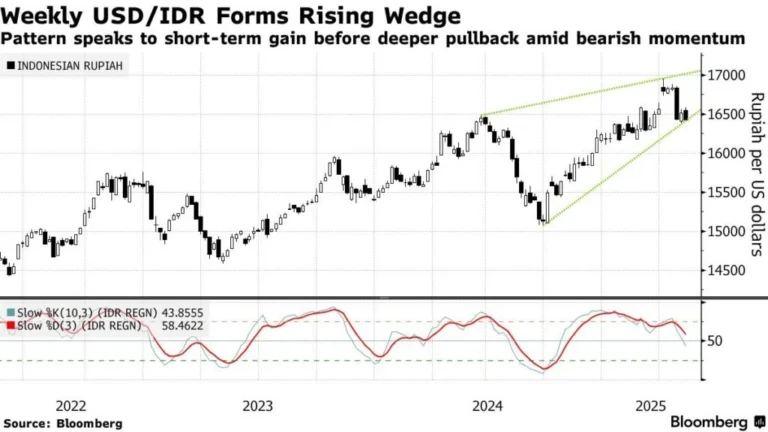

Source: Bloomberg

One of the most tangible differences lies in how each service handles pricing. Forex traders operate in a live pricing environment, with spreads often measured in points. It’s real-time, but also unpredictable — requiring users to accept the possibility of slippage or overnight swap fees.

Money changers, on the other hand, post fixed daily rates. These include the operator’s margin and are usually rounded for clarity. There are no hidden fees, and customers know what they’ll get before the transaction. For those exchanging large amounts or working within a travel budget, this predictability is reassuring.

Each model reflects its user’s relationship to risk. And that’s perhaps the clearest way to understand the structure of Forex Indonesia today.

Conclusion: Coexistence, Not Convergence

The evolution of Forex Indonesia is not a story of one model overtaking the other. Instead, it’s a story of parallel progress. As long as financial needs are diverse, both forex trading and traditional money exchange will have roles to play.

What’s more important is that Indonesians now have options — and the freedom to choose based on goals, comfort levels, and context. Whether you’re chasing currency trends on a screen or counting cash at a counter, the growth of this dual system reflects a larger shift: one where financial empowerment is becoming more personalized, and more possible, than ever.