Decentralized Finance for Beginners: How DeFi Is Changing Access to Money

What Is Decentralized Finance (DeFi)?

Decentralized Finance for Beginners is a gateway into a financial system that operates without banks, brokers, or traditional oversight. For decades, global finance has relied on trusted institutions, but DeFi reimagines that structure through blockchain technology. In this new model, services like lending, borrowing, trading, and earning interest are powered by smart contracts instead of intermediaries.

These smart contracts—self-executing code stored on public blockchains like Ethereum—let users interact directly, without approval processes or paperwork. With just a digital wallet and an internet connection, anyone can access DeFi platforms, regardless of location or financial background.

While DeFi lowers barriers and increases autonomy, it also introduces complexity and risk. For those starting out, understanding how it works is essential before engaging with decentralized tools.

How DeFi Differs from Traditional Finance

Traditional finance relies on central authorities to approve, clear, and settle financial transactions. Whether you’re applying for a loan or sending funds abroad, a bank or payment processor plays gatekeeper. In contrast, DeFi lets users interact with protocols directly through wallets and code.

Here’s how the two systems compare:

| Feature | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Control | Managed by banks, governments | Controlled by users and smart contracts |

| Access | Often limited by region or credit score | Global and permissionless |

| Speed | Can take hours or days | Typically seconds to minutes |

| Transparency | Opaque and closed | Open-source, publicly auditable |

| Identity Verification | Required (KYC/AML) | Rarely needed |

| Regulation and Insurance | Regulated and sometimes insured | Mostly unregulated and uninsured |

While DeFi provides faster, borderless access to money, it also places responsibility squarely on the user.

How DeFi Works

At the core of every DeFi application is a smart contract. These contracts define rules and automate actions. For instance, a lending platform like Aave lets users deposit cryptocurrencies into a smart contract. The code automatically calculates how much interest they can earn, or how much they can borrow using their deposit as collateral.

Unlike centralized finance apps that hold your money, DeFi protocols only operate when you give permission from your wallet. There are no usernames, and no one can access your funds without your approval. Everything you do—depositing tokens, earning yield, or making trades—runs on public blockchains.

What You Can Do With DeFi

Credit from Rapid Innovation

For beginners, DeFi offers a number of useful financial functions that mirror those of the traditional system—but with a decentralized twist.

You can swap tokens directly from your wallet using decentralized exchanges (DEXs) like Uniswap, without relying on an exchange to hold your assets. You can lend your crypto to others and earn interest through protocols like Compound. Or, you might borrow stablecoins by locking up digital assets like ETH as collateral.

You can also take part in staking, where holding certain tokens helps support blockchain networks while earning rewards. Liquidity provision is another feature: users contribute pairs of tokens to decentralized trading pools and earn a share of the transaction fees. While this can be rewarding, it also introduces exposure to price fluctuations.

Using DeFi: Wallets and Connections

Accessing DeFi starts with setting up a crypto wallet. Unlike a bank account or a custodial wallet on an exchange, DeFi wallets give users full control over their assets. Wallets such as MetaMask, Rabby, and Trust Wallet allow you to connect directly to decentralized apps.

Once your wallet is funded—usually by transferring assets from a centralized exchange—you can explore DeFi platforms. Connecting your wallet is simple: most dApps have a “Connect Wallet” button that brings up a prompt asking for confirmation.

Each transaction—whether it’s lending, borrowing, or swapping—requires wallet approval. Since you hold your own private keys, no one else can access your funds unless you give permission.

Decentralized Finance for Beginners: Risks to Be Aware Of

Despite its promise, DeFi is not without real dangers. Because it operates outside traditional regulations, users take on both control and liability.

Smart contracts, for instance, can be flawed. Even platforms that are audited may be vulnerable to exploitation. In 2022 alone, DeFi protocols lost over $3 billion to hacks and coding errors. These events often result in permanent losses, since there’s no legal recourse or insurance.

Some developers have launched “rug pull” schemes, where they attract users to invest in a protocol or token, then drain all liquidity and disappear. These scams often occur in newer or unaudited projects.

Another concept worth knowing is impermanent loss—a risk specific to liquidity providers. If the value of your deposited tokens changes too much during market activity, your final holdings might be worth less than if you had just held them.

In addition, cryptocurrency markets are volatile. Token values can fluctuate widely in short periods, making collateral-based borrowing and leveraged positions especially risky for newcomers.

How Beginners Can Start Using DeFi

You don’t need to be a blockchain expert to try DeFi. But starting slow and staying cautious is key.

First, install a wallet such as MetaMask. Set up a secure password and write down your seed phrase (offline, never shared). This phrase is the only way to recover your wallet if you lose access.

Next, purchase some cryptocurrency from a regulated exchange like Coinbase or Binance. Common starter tokens include ETH or USDC. Transfer them to your wallet address.

Once your wallet is funded, you can visit DeFi apps like Aave, Compound, or Uniswap. Connect your wallet and explore basic functions like swapping tokens or depositing stablecoins for interest.

If you’re new, test with small amounts. Many platforms display your balance, interest earned, and transaction history clearly. Stick to audited, transparent projects with active communities and documentation.

Examples of Beginner-Friendly Platforms

Credit from CoinDCX

A few platforms stand out as stable entry points into DeFi. For trading, Uniswap offers one of the most intuitive interfaces for swapping tokens. Lending protocols like Aave and Compound make it easy to earn interest or borrow against your assets. Curve is useful for stablecoin trading with minimal slippage.

If you want a visual overview of your portfolio, tools like Zapper or DeBank show your assets, yield positions, and exposure across multiple dApps.

These platforms support major networks such as Ethereum and Arbitrum, and most are compatible with popular wallets.

DeFi Trends in 2025: What’s Next?

DeFi is evolving fast. In 2025, one of the biggest changes is the rise of Layer 2 networks. These platforms, including Arbitrum, Optimism, and Base, are built on top of Ethereum and offer lower fees and faster transaction speeds.

Another major development is real-world asset tokenization. Projects are beginning to bring government bonds, real estate, and invoices onto the blockchain, making them tradable within DeFi systems. This blurs the line between traditional finance and the decentralized world.

We’re also seeing growth in decentralized identity systems, which allow users to build on-chain reputations and access certain features without revealing personal data. And as compliance tools improve, institutions are slowly entering the space through regulated DeFi experiments.

These shifts could make DeFi more stable and accessible over time.

Conclusion on Decentralized Finance for Beginners

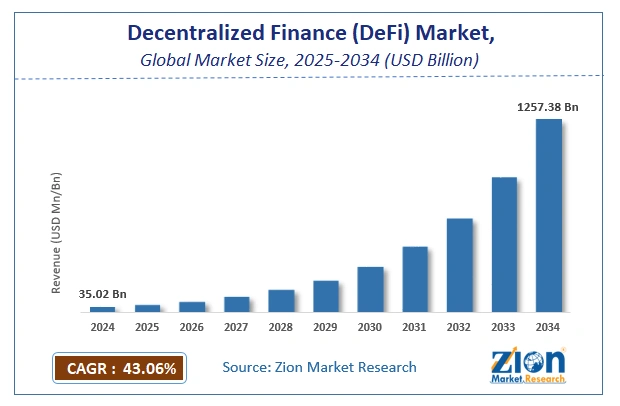

Credit from Zion Market Research

Decentralized finance for beginners is no longer just an idea for coders or crypto veterans. It’s becoming a real alternative to traditional banking for millions of people. Whether you want to trade tokens, earn yield, or borrow crypto, DeFi offers you the tools — along with full responsibility for how you use them.

As with any financial system, risks exist. But by starting small, learning from trusted sources, and using tested platforms, you can explore this ecosystem safely and confidently.

DeFi’s strength lies in giving users control. With knowledge and care, that control becomes a powerful financial advantage.