Crypto Staking for Beginners: A Safer Way to Grow Your Digital Assets in 2025

For newcomers entering the cryptocurrency space, understanding how to earn passive income without actively trading can be a turning point. Crypto staking for beginners offers a way to do exactly that—put your digital assets to work, support blockchain networks, and potentially earn consistent returns.

In this guide, you’ll learn how staking works, which coins are suitable for beginners, what risks to watch out for, and how to choose the right platform for staking safely in 2025.

What Is Crypto Staking?

Credit from Bake Blog

Staking is a process that allows holders of certain cryptocurrencies to earn rewards by locking their tokens into a blockchain protocol. This is common in networks that operate on Proof-of-Stake (PoS) or similar consensus mechanisms. Unlike mining, which relies on powerful computers, staking allows anyone holding coins to help validate transactions and maintain network security.

In return for staking, you earn additional tokens over time. These rewards are often distributed in the same cryptocurrency you’ve staked. The idea is similar to earning interest in a traditional savings account, except the interest is paid in digital currency.

Why People Are Turning to Staking in 2025

The appeal of staking lies in its balance of simplicity and reward potential. You don’t need technical skills or expensive equipment. Even with a modest amount of crypto, you can get started. More importantly, staking aligns with the goals of long-term holders who believe in the value of a project and want to contribute to its health while earning a return.

Networks like Ethereum, Solana, and Cardano have made staking accessible to a global audience. With more tools and platforms than ever, new users can now start staking in just a few steps.

The Key Benefits of Crypto Staking

Credit from Medium

Staking is often seen as one of the most beginner-friendly ways to participate in crypto. Here’s why:

- Passive Earnings: By simply holding and staking eligible tokens, you generate additional income over time. Unlike trading, it doesn’t require constant monitoring.

- Energy Efficient: Staking does not rely on power-hungry mining hardware, making it an environmentally friendlier choice.

- Supports Network Security: When you stake, you’re directly contributing to the integrity of the network.

- No Technical Setup Required (for Most Methods): Platforms like Coinbase or Ledger Live provide guided tools that eliminate complex node management.

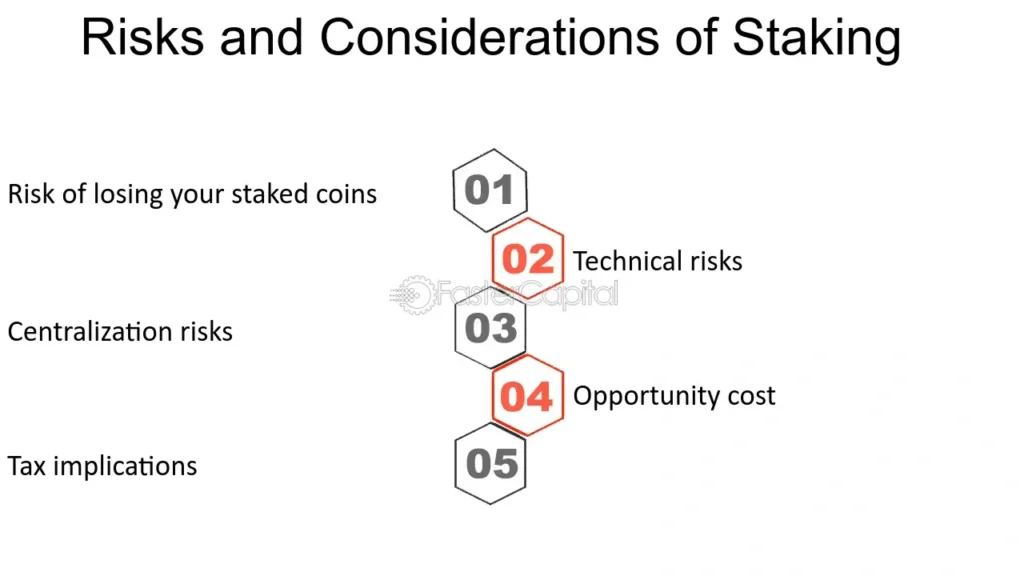

Understanding the Risks

Credit from FasterCapital

While staking offers many upsides, it also comes with risks—some of which may not be obvious at first glance.

One major risk is market volatility. Even if you earn a 6% yield, the value of the asset you’re staking could fall sharply. For instance, if a coin drops 30% in value, your rewards may not make up for the loss.

Another concern is lock-up periods. Some networks or platforms require you to commit your coins for a fixed time—anywhere from a few days to several weeks. During that time, you can’t sell or move your assets.

There’s also the issue of validator reliability. In delegated staking models, if the validator behaves dishonestly or performs poorly, your rewards may decrease—or you might face “slashing,” where a portion of your staked assets is forfeited.

And finally, platform risk must be considered. Using exchanges or DeFi protocols that lack security measures or transparency could expose your assets to theft or loss.

How to Start Crypto Staking for Beginners

Getting started doesn’t have to be complicated. Here’s how most newcomers enter the world of staking:

1. Select a Staking-Compatible Coin

Not every cryptocurrency allows staking. You’ll need to choose one that uses PoS or a similar consensus model. Well-known options include Ethereum (ETH), Solana (SOL), Cardano (ADA), and Polkadot (DOT).

2. Buy or Transfer the Coins

You can acquire staking-compatible tokens from exchanges like Binance, Kraken, or Coinbase. Be sure to check if the exchange offers staking features or if you’ll need to transfer your crypto to an external wallet.

3. Pick Your Staking Method

There are a few main ways to stake:

- Through a Centralized Exchange: This is the easiest method. Platforms like Coinbase automatically handle technical details for you.

- Using a Wallet: Tools like Ledger Live, Trust Wallet, or Keplr allow users to stake directly while maintaining control of their private keys.

- Delegated Staking: On networks like Solana or Cardano, you can delegate your tokens to a validator who stakes on your behalf.

- Liquid Staking: This option lets you stake while keeping access to a tradable version of your tokens (such as stETH for Ethereum).

4. Monitor and Manage Your Stake

Once your tokens are staked, it’s important to regularly check your rewards, validator performance, and any changes to staking conditions. Most platforms offer a dashboard with these details.

Real Comparison of Beginner-Friendly Staking Options (2025)

To help you make an informed decision, here’s a table comparing some of the most popular staking coins and their average annual yields as of mid-2025:

| Coin | Network Type | Average APY | Lock-Up Period | Beginner Friendly |

|---|---|---|---|---|

| Ethereum | Proof-of-Stake | 3%–5% | Variable (up to 7d) | Yes (via Lido, CEX) |

| Solana | Delegated PoS | 5%–7% | Optional | Yes |

| Cardano | Ouroboros PoS | 4%–6% | No lock required | Yes |

| Polkadot | Nominated PoS | 8%–10% | Yes (28 days) | Moderate |

These figures are averages and subject to change. Always check with your platform for current rates and lock-up terms.

Security Tips for Crypto Staking for Beginners

If you’re just beginning, focus on simplicity and security. The following practices will help reduce risk:

- Use reputable platforms — whether it’s an exchange or a wallet-based tool, look for services with a history of reliability and transparency.

- Enable two-factor authentication on all accounts linked to your staking.

- Never share your private keys or recovery phrases. Keep them offline in a secure location.

- Stay informed about validator performance if you’re using delegated staking. A poorly performing validator can reduce your returns.

- Understand unstaking periods — some coins require a delay between unstaking and withdrawal. Plan accordingly.

- Diversify your assets — staking multiple coins or using different platforms can protect your portfolio against localized failures or slashing events.

Platforms That Help Beginners Stake Easily

In 2025, beginners have more options than ever for safe and simple staking:

- Centralized Exchanges:

Coinbase and Binance offer built-in staking services with low entry barriers. - Wallet Platforms:

Ledger Live allows hardware wallet users to stake from the safety of cold storage. Trust Wallet provides mobile access with multi-coin staking features. - Liquid Staking Providers:

Lido Finance and Rocket Pool let you stake Ethereum and receive liquid tokens like stETH or rETH, which can still be used in DeFi or traded. - Aggregators & Comparison Tools:

StakingRewards.com is a valuable resource to track reward rates, find validators, and compare platforms.

Final Word: Is Staking Right for You?

For anyone exploring long-term crypto strategies, crypto staking for beginners is a practical and accessible entry point. It allows holders to grow their portfolios steadily while contributing to blockchain security and decentralization.

That said, the most successful stakers are those who stay informed. Don’t chase the highest yields blindly. Start small, understand the platforms you’re using, and always put security first. In 2025, staking is no longer reserved for tech-savvy users—it’s a mainstream option for smart, cautious investors who want their crypto to work for them.