Crypto Forks for Beginners: Navigating Hard and Soft Forks

Summary

Introduction: Understanding Crypto Forks for Beginners

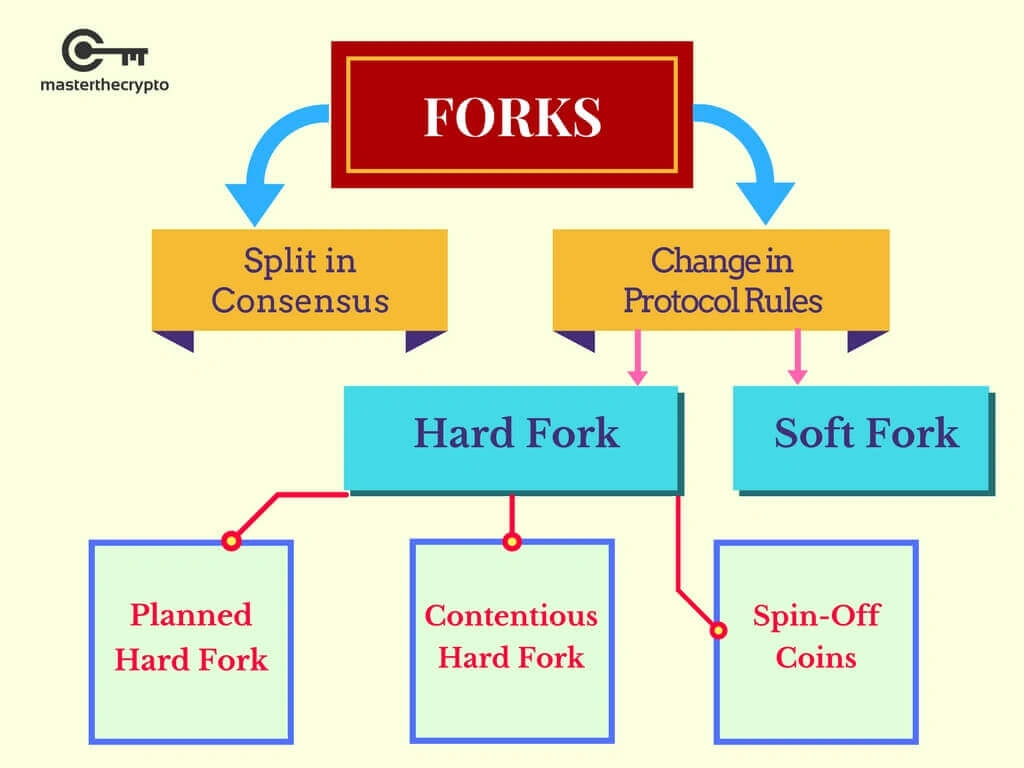

Crypto forks for beginners may seem complicated at first, but they are essential events in the lifecycle of blockchain networks. Forks occur when a blockchain updates or changes its protocol rules, leading to either minor or major adjustments. Some forks result in new cryptocurrencies, while others improve network efficiency without splitting the chain. Knowing the differences between hard forks and soft forks helps users make informed decisions, protect their assets, and understand blockchain evolution.

What Triggers a Crypto Fork?

Credit from Master The Crypto

Blockchain networks are decentralized, meaning updates require consensus among developers and participants. Forks happen when:

- Developers implement protocol upgrades for performance, scalability, or security.

- Vulnerabilities or bugs are discovered that need immediate fixes.

- Communities disagree on network rules, sometimes creating new coins.

- External factors like regulations or market pressures influence protocol changes.

In essence, forks reflect both technological advancement and community governance in blockchain ecosystems.

Hard Forks: Permanent Network Splits

Credit from DailyCoin

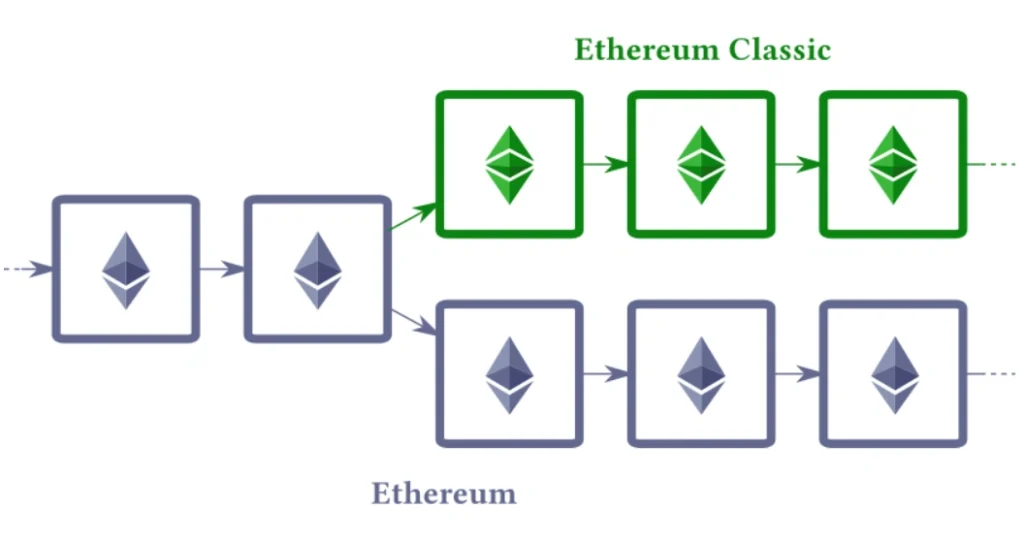

A hard fork is a protocol change that is not backward-compatible. Nodes running the old software cannot accept new blocks created under the updated rules. Hard forks can create a permanent split in the blockchain, often resulting in a new cryptocurrency.

Notable Hard Fork Examples:

| Blockchain | Fork Type | Reason | Outcome |

|---|---|---|---|

| Bitcoin Cash (BCH) | Hard Fork | Disagreement over block size | Split from Bitcoin |

| Ethereum Classic (ETC) | Hard Fork | Response to The DAO hack | Ethereum and Ethereum Classic |

| Litecoin (LTC) | Hard Fork | Network upgrade for SegWit | Improved scalability without chain split |

Hard forks often involve debate and may divide the community. Users holding coins on the original chain may receive equivalent tokens on the new chain, but they must pay attention to wallet and exchange policies to claim them safely.

Soft Forks: Compatible Updates

Soft forks are backward-compatible upgrades, meaning older nodes still recognize new blocks as valid. These updates enhance features or security without creating a new cryptocurrency or splitting the chain. Soft forks tend to be smoother and less disruptive than hard forks.

Prominent Soft Forks:

- SegWit (Bitcoin, 2017): Reduced transaction size and fixed transaction malleability.

- Taproot (Bitcoin, 2021): Enhanced privacy and smart contract flexibility while remaining compatible with older nodes.

Soft forks require users to update their wallets or nodes for optimal compatibility, but the network continues as a single chain.

Key Differences Between Hard and Soft Forks

| Feature | Hard Fork | Soft Fork |

|---|---|---|

| Compatibility | Not backward-compatible | Backward-compatible |

| Network Outcome | Creates a new chain | Single chain |

| User Impact | May require claiming new tokens | Usually automatic |

| Risk Level | Higher, can confuse users | Lower, smoother upgrade |

| Examples | Bitcoin Cash, Ethereum Classic | SegWit, Taproot |

This table helps beginners quickly compare the practical implications of each type of fork.

Real-World Implications for Users

Credit from Master The Crypto

Crypto forks affect participants differently depending on their type:

- Hard Forks: Users may need to claim new tokens, update wallets, or manage two separate chains. Exchanges often provide guidance, but attention is required to avoid loss of funds.

- Soft Forks: Typically seamless for users who update their wallets or nodes. While less risky, ignoring updates can sometimes lead to minor issues in transaction validation or network participation.

Market reactions often differ as well. Hard forks can lead to volatility as new coins appear, while soft forks usually have minimal price impact.

Best Practices Around Crypto Forks for Beginners

To navigate forks safely:

- Keep wallets and nodes updated according to official announcements.

- Monitor news from developers or blockchain foundations for upcoming forks.

- Understand exchange policies regarding hard fork token distribution.

- Be cautious with unverified third-party software claiming to handle forked assets.

- Consider holding a small amount in secure wallets if participating in contentious forks.

These steps help users maintain security and be ready for any fork event without confusion.

Conclusion: Mastering Crypto Forks for Beginners

Crypto forks for beginners are not just technical events—they reflect the ongoing evolution of blockchain networks and decentralized governance. Hard forks can create entirely new cryptocurrencies, while soft forks refine existing protocols without splitting the chain. By understanding the causes, differences, and implications of forks, users can safeguard their holdings, follow network developments, and make informed decisions. Learning about crypto forks for beginners provides a foundational understanding of how blockchains adapt and grow over time.