What If You Could Ditch Banks Forever? Exploring the Rise of Bankless Payments

Bankless Payments: What If Banks Disappeared Tomorrow?

It’s a wild thought: waking up in a world where bank branches don’t exist, and checking accounts are just… obsolete. No overdraft fees. No long wait times. No need for paperwork just to access your own money. This isn’t a sci-fi movie—it’s the question driving real-life conversations around bankless payments.

In this what-if scenario, we’re not talking about some far-fetched, crypto-only dystopia. We’re talking about a world where anyone can spend, send, and store money using decentralized or alternative tools—with zero reliance on traditional banks.

Sound radical? It’s closer than you think.

What Are Bankless Payments, Really?

Let’s define the premise. Bankless payments refer to any method of transferring money that skips the traditional banking infrastructure. No bank account. No debit card. No brick-and-mortar branch in sight.

This includes:

- Mobile wallets (like Venmo, PayPal, or Cash App)

- Cryptocurrencies (Bitcoin, Ethereum, USDT)

- Prepaid debit cards

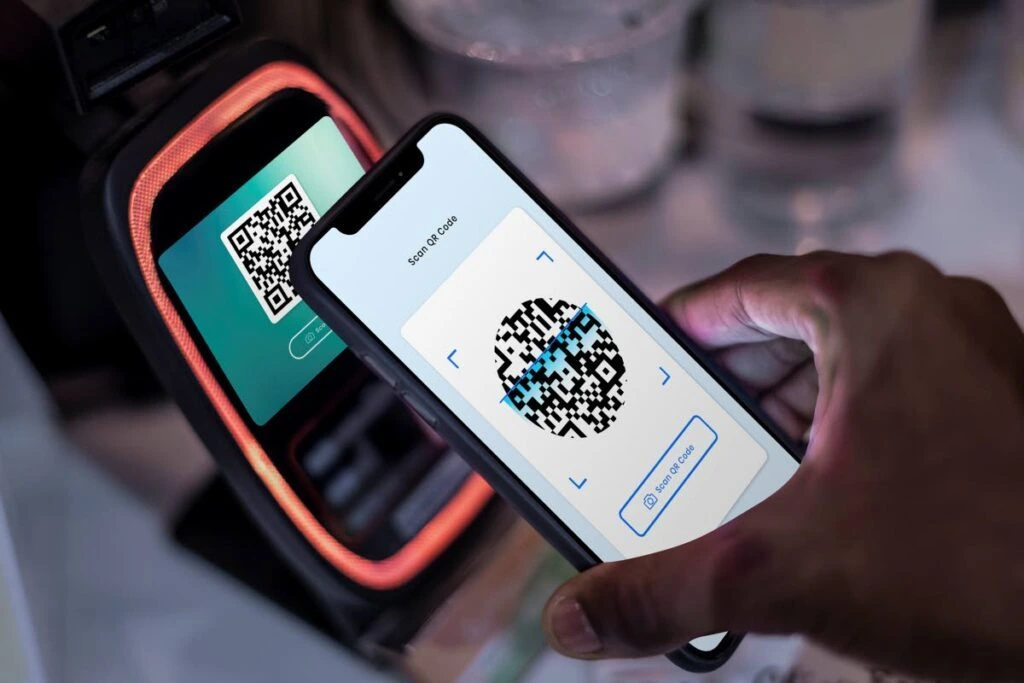

- QR-based cashless systems (common in Asia and Africa)

- Digital-only financial apps like Wise or Revolut

In our hypothetical, these systems become the default, not the workaround.

What If Everyone Went Bankless?

Imagine if 80% of the population used only non-bank systems. What would that look like?

Fewer barriers: No ID or credit history required to start. Just a phone number or email.

More global access: Migrant workers could send money home in seconds. Freelancers in rural areas could get paid without begging for a Swift code.

Faster everything: No more waiting three days for a transfer. With crypto or mobile apps, money moves instantly.

More privacy: Fewer data brokers, fewer third parties tracking your purchases.

It’s not a fantasy. In many parts of the world—Nigeria, El Salvador, the Philippines—it’s already happening.

What If Bankless Systems Replaced Everyday Banking?

Let’s zoom in on daily life.

Groceries? Paid through your phone’s wallet.

Rent? Transferred via stablecoin or mobile cash app.

Paychecks? Deposited into a digital wallet, possibly as crypto.

Bills? Auto-paid through a smart contract or app.

What was once a headache of routing numbers and bank holds becomes frictionless. Imagine a world where even food delivery balances act like a wallet—and they do, in some apps already.

We’d be talking about a new financial default—no banks, no problem.

What If It All Went Wrong?

No what-if scenario is complete without playing devil’s advocate.

What happens when:

- You lose access to a crypto wallet with no recovery method?

- A shady app with no regulation disappears overnight—with your funds?

- A landlord or employer still insists on a “real” bank account?

And what about scams? With fewer guardrails, users can be more vulnerable. Bankless doesn’t mean riskless.

Also, while decentralization offers freedom, it can also mean less legal protection. You can’t call a fraud hotline for your lost Bitcoin.

So no, it’s not a utopia. It’s a new frontier—with real trade-offs.

What If You Want to Try Bankless Payments Today?

You don’t have to jump in with both feet. Try these low-risk entry points:

- Use a digital wallet for simple purchases—split a bill or buy coffee.

- Load a prepaid debit card to cover weekly expenses.

- Send a tiny crypto payment to a friend—just to see how it works.

- Test out apps like Wise or Revolut for foreign currency transfers.

In other words, dip a toe into the bankless waters. You might not be ready to abandon your bank entirely—but you’ll learn what’s possible.

What If This Is Just the Beginning?

Bankless payments aren’t just a trend—they’re a peek at a possible financial future. One where traditional banks become optional. Where money moves at the speed of Wi-Fi. And where people take control of their own transactions.

Will banks vanish completely? Probably not.

But what if they’re no longer required?

That possibility is no longer hypothetical. It’s happening—quietly, steadily, globally. The real question is: Are you ready for a world where the bank is no longer the middleman?

Relevent news: Here