Top 10 Cross-Border Remittance Crypto Solutions in 2025: Exploring the Future of Global Money Transfers

Top 10 Cross-Border Remittance : Remittances are more than financial transactions—they are lifelines that sustain families, communities, and entire economies across the globe. In 2025, remittances account for hundreds of billions of dollars annually, with countries in Asia, Africa, and Latin America relying heavily on these inflows. Yet, despite their importance, traditional remittance channels remain costly and slow, often taking days to settle while charging fees that eat into hard-earned money.

Blockchain technology and cryptocurrencies are stepping in as problem solvers. By offering speed, transparency, and reduced fees, crypto remittance solutions are becoming increasingly relevant. 2025 marks a turning point because of growing adoption by fintech platforms, the rise of stablecoins that reduce volatility, and improving regulatory clarity. Together, these forces are setting the stage for crypto to become a mainstream remittance option.

Key Factors Driving Crypto Remittance Adoption

Several trends explain why crypto remittance has reached new heights in 2025. The first is speed: blockchain reduces settlement time from several days to just minutes. For families who depend on urgent transfers, this can make an enormous difference. Cost efficiency is another major driver, as blockchain cuts out intermediaries and dramatically reduces fees compared to services like Western Union or traditional bank wires.

Financial inclusion is also central. Around 1.4 billion people worldwide remain unbanked, and many more are underbanked. Crypto wallets accessible via smartphones allow these populations to participate in digital remittance systems without needing traditional bank accounts. Stablecoins and central bank digital currencies (CBDCs) are emerging as powerful tools to address volatility concerns, making transfers more reliable. And finally, partnerships between fintechs, banks, and blockchain networks are building hybrid solutions that blend traditional trust with modern efficiency.

Methodology for Selection – Top 10 Cross-Border Remittance

To create a meaningful list of the top 10 cross-border remittance crypto solutions in 2025, several evaluation criteria were used. Transaction speed and scalability are critical, since delays and network congestion undermine user experience. Cost-effectiveness was measured by average fees charged for sending different transfer amounts. Global coverage matters too, as remittance solutions often specialize in certain regions but struggle to scale worldwide.

Compliance and regulatory acceptance were also factored in, since remittance is a tightly regulated industry. Platforms that integrate anti-money laundering (AML) and know-your-customer (KYC) processes are better positioned for growth. Lastly, accessibility plays a big role—solutions with mobile-first apps, user-friendly interfaces, and fiat on/off ramps are more practical for everyday use. Adoption by real-world remittance providers, banks, or fintechs serves as proof of traction.

Top 10 Cross-Border Remittance Crypto Solutions in 2025

1. Ripple (XRP Ledger & RippleNet)

Source: Crypto Ninjas

Ripple has become synonymous with institutional-grade remittance solutions. Through its RippleNet network and On-Demand Liquidity (ODL), Ripple enables financial institutions to move money across borders instantly without the need for pre-funded accounts. This eliminates one of the biggest inefficiencies in traditional systems. Ripple’s partnerships with banks in Asia-Pacific, the Middle East, and Latin America show that it has gone far beyond pilot projects. In 2025, Ripple is less a startup disruptor and more a cornerstone infrastructure provider for global remittance flows.

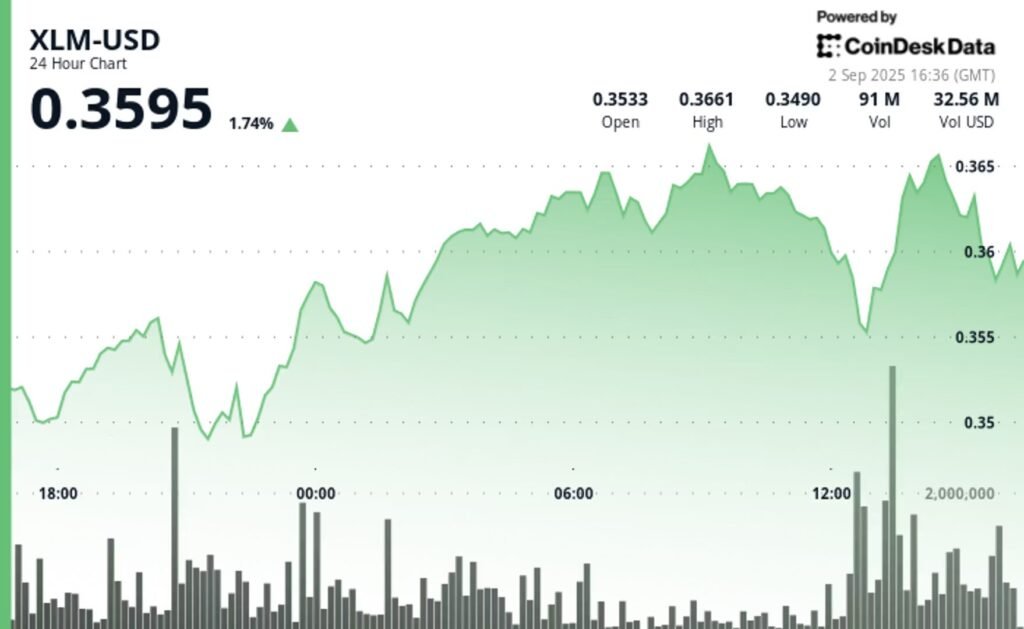

2. Stellar (XLM & MoneyGram Access)

Source: Coin market cap

While Ripple has focused on institutional clients, Stellar has carved out a space in retail remittances. Its partnership with MoneyGram provides a bridge between fiat currencies and digital assets, enabling users to cash in and out at physical locations. This is especially powerful in regions like sub-Saharan Africa and Southeast Asia, where access to digital banking remains limited. Stellar’s low transaction costs and open-source ecosystem make it a practical option for migrant workers sending money home. By prioritizing financial inclusion, Stellar remains one of the most important crypto remittance solutions today.

3. Top 10 Cross-Border Remittance : Circle (USDC Transfers)

Source: Bankless times

Stablecoins have changed the game for cross-border payments, and Circle’s USDC leads the pack. Pegged to the U.S. dollar and backed by regulated reserves, USDC combines stability with blockchain efficiency. In 2025, it has expanded into multiple payment corridors thanks to partnerships with Visa, Stripe, and numerous fintech apps. USDC’s reliability has made it a preferred medium for remittances, particularly for users who want to avoid the volatility of traditional cryptocurrencies. Circle’s growing influence demonstrates how stablecoins are bridging the gap between fiat and digital remittance.

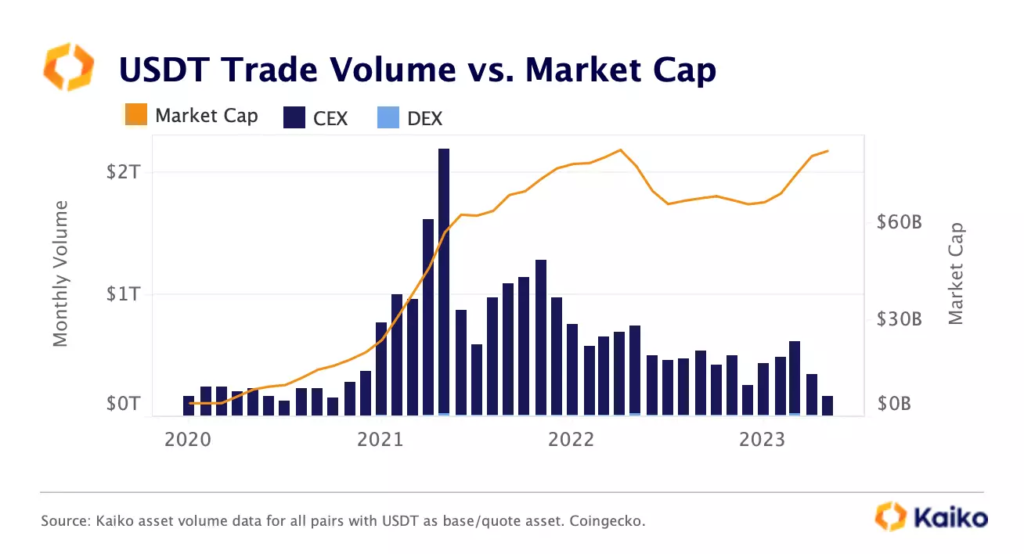

4. Tether (USDT in Emerging Markets)

Source: Kaiko

Despite criticism over its reserves, Tether’s USDT remains the most widely used stablecoin in global markets. For remittance, its strength lies in accessibility. It is available across nearly every exchange and wallet, making it a convenient tool for sending funds internationally. In countries with volatile currencies, such as Argentina or Nigeria, USDT functions as a digital dollar that holds value far better than local money. Migrant workers frequently rely on Tether for sending money home, showing that usability sometimes outweighs regulatory concerns in real-world adoption.

5. Lightning Network (Bitcoin Layer 2)

Source: Tastycrypto

Bitcoin is still the world’s largest cryptocurrency, but it was never designed for everyday micro-transactions. The Lightning Network, a second-layer scaling solution, has transformed that reality by enabling near-instant, low-cost transfers. In remittance, Lightning is especially useful for smaller payments where traditional fees would be prohibitive. Startups in Latin America and Southeast Asia are integrating Lightning into their services, proving that Bitcoin can indeed play a role in day-to-day cross-border payments. For users who trust Bitcoin’s brand but want faster settlements, Lightning offers the best of both worlds.

6. Celo (Mobile-First Remittance Network)

Source: Wazirx

Celo was built with a focus on mobile-first economies, and that vision is paying off in 2025. Designed for smartphones, Celo makes sending and receiving money as easy as sending a text message. It integrates directly with mobile money systems common in Africa and parts of Asia, which means users don’t need to adapt to entirely new infrastructures. Celo’s ecosystem includes stablecoins pegged to local currencies, further reducing volatility concerns. By addressing the specific needs of underserved regions, Celo stands out as a remittance solution with real-world impact.

7. Airwallex (Blockchain-Enabled Business Remittance)

Although consumer remittances dominate public conversations, small and medium enterprises (SMEs) also struggle with costly cross-border transfers. Airwallex leverages blockchain technology to streamline business remittances, offering multi-currency wallets and faster settlements for e-commerce and global trade. By targeting SMEs, Airwallex is filling a gap often overlooked by consumer-focused platforms. Its blockchain integration doesn’t eliminate banks but makes them more efficient, showing how hybrid systems can support both individuals and businesses.

8. Worldcoin / AI-Powered Remittance Platforms

Worldcoin and other emerging platforms are experimenting with the intersection of blockchain and artificial intelligence. In remittance, AI can optimize routes, predict transaction costs, and reduce settlement inefficiencies. While Worldcoin has attracted attention for its identity-verification model, its potential in remittance lies in automating decision-making for users. Imagine sending money abroad and having AI instantly calculate the cheapest and fastest blockchain route. Though still in early stages, these innovations may redefine how digital remittances function in the coming decade.

9. Zenus Bank

Source: GFTS

Zenus Bank presents a different approach by blending traditional finance with blockchain tools. It offers international clients access to U.S. bank accounts while supporting crypto-based remittance flows. For individuals and businesses who want the reliability of traditional banking alongside the efficiency of blockchain transfers, Zenus provides a compelling option. By straddling two financial worlds, it is pioneering hybrid models that could become more common as regulators warm to digital solutions.

10. BOSS Money (Africa-Focused Remittance)

Africa has some of the highest remittance fees globally, making blockchain innovation especially valuable. BOSS Money is tackling this challenge by building partnerships with fintech startups that use blockchain rails. This enables faster and cheaper transfers while still ensuring local accessibility through physical outlets. For families who depend on remittance income, every percentage point saved in fees can make a tangible difference. By focusing on underserved regions, BOSS Money highlights the humanitarian side of crypto remittance adoption.

Comparative Analysis -Top 10 Cross-Border Remittance

Across the top 10, each platform excels in different areas. Ripple dominates institutional corridors, while Stellar leads in cash-to-crypto integration. Circle and Tether power stablecoin transfers, with Circle focusing on regulatory alignment and Tether on global ubiquity. Lightning and Celo demonstrate how technology can adapt to micro-payments and mobile-first societies. Airwallex and Zenus show the importance of hybrid solutions for businesses and banks. Meanwhile, Worldcoin and BOSS Money bring innovation and inclusion into underserved areas.

Top 10 Cross-Border Remittance : Challenges & Risks Ahead

Despite the progress, crypto remittances face hurdles. Regulations remain fragmented, creating uncertainty for providers and users alike. Stablecoins, while popular, are under increasing scrutiny from regulators. Cybersecurity risks, including scams and phishing attacks, continue to threaten trust in digital platforms. Lastly, gaps in internet and mobile infrastructure mean that certain regions remain excluded from the benefits of crypto remittance.

Top 10 Cross-Border Remittance : Future Outlook (2025–2030)

Looking ahead, several trends are likely to shape remittance. Central bank digital currencies will begin to integrate with existing crypto networks, providing new settlement options. Multi-chain interoperability will allow remittance to move seamlessly across different blockchains. AI-driven optimization will reduce costs even further by automating decisions. And as traditional banks continue to form partnerships with fintechs, the line between legacy and blockchain systems will continue to blur.

Conclusion – Top 10 Cross-Border Remittance

The top 10 cross-border remittance crypto solutions in 2025 illustrate how blockchain and digital money transfers are rewriting the rules of global payments. By cutting costs, speeding up settlements, and expanding financial access, these platforms are gradually displacing outdated models. As stablecoins, CBDCs, and AI-driven tools continue to grow, 2025 may well be remembered as the year crypto remittance moved from niche to mainstream, reshaping how money flows across the world.