Top 10 Oracles Shaping Web3 in 2025: The Data Bridges Driving Smart Contract Innovation

Top 10 Oracles : In the decentralized world of blockchain, smart contracts are only as powerful as the data they can access. While these contracts are trustless and autonomous, they lack direct access to external information such as asset prices, weather data, sports results, or AI-driven predictions. This is where blockchain oracles come in. Acting as secure data bridges, oracles feed real-world information into blockchains, enabling advanced decentralized applications (dApps) to function across DeFi, supply chain, gaming, insurance, and beyond.

By 2025, the oracle landscape has matured, with leading projects providing reliable, scalable, and multi-chain solutions. These networks not only power Web3’s financial infrastructure but also play a pivotal role in the growth of cross-chain interoperability, decentralized AI, and enterprise adoption. In this article, we explore the Top 10 Blockchain Oracles Shaping Web3 in 2025—highlighting their unique features, ecosystems, and real-world impact.

Top 10 Blockchain Oracles Shaping Web3 in 2025

1. Chainlink (LINK): The Market Leader in Decentralized Oracles

Source: Across

Chainlink remains the undisputed leader in the oracle sector. With a vast ecosystem of data providers and node operators, it powers thousands of dApps across Ethereum, Polygon, BNB Chain, and more. Its Chainlink Data Feeds secure billions in DeFi, while new services like CCIP (Cross-Chain Interoperability Protocol) and Proof of Reserve strengthen its dominance. By 2025, Chainlink is more than just a price feed provider—it is the backbone of enterprise and multi-chain Web3 infrastructure.

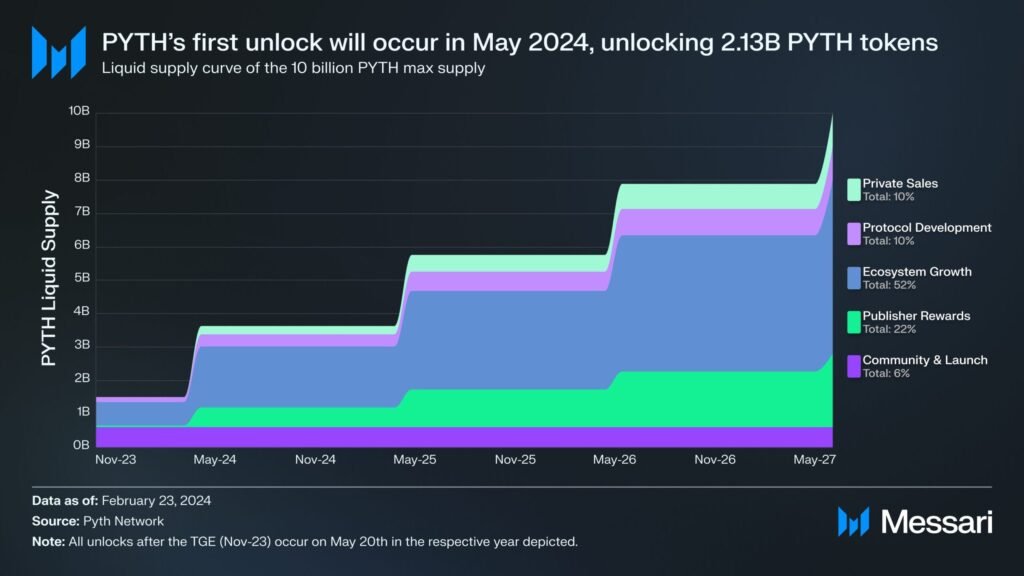

2. Pyth Network (PYTH): High-Frequency Market Data for DeFi

Source: Messari

The Pyth Network specializes in delivering high-frequency financial market data directly from exchanges and trading firms to blockchains. Unlike other oracles that aggregate external APIs, Pyth integrates with institutional data providers, ensuring ultra-low latency and accuracy. It’s especially popular among DeFi traders, derivatives platforms, and automated market makers (AMMs) that require real-time pricing. By 2025, Pyth has expanded across Solana, Ethereum Layer-2s, and other high-performance chains.

3. Band Protocol (BAND): Top 10 Oracles – Scalable Cross-Chain Data Oracle

Source: Thirdweb

Band Protocol continues to stand out as a fast and cost-efficient oracle solution. Built on its own Cosmos-SDK-based blockchain, Band offers interoperability across multiple chains. Its lightweight infrastructure makes it attractive for developers who need reliable data feeds without heavy costs. By 2025, Band Protocol has secured integrations in both DeFi applications and traditional enterprises looking to bridge Web2 and Web3 systems.

4. API3 (API3): Top 10 Oracles – First-Party Oracle Providers

Source: Binance

API3 takes a unique approach by empowering traditional API providers to connect their data directly to blockchain networks through Airnodes. This removes the reliance on third-party middlemen and reduces trust assumptions. With its decentralized autonomous organization (DAO) governance, API3 has gained traction among developers seeking first-party, tamper-proof data feeds for insurance, IoT, and enterprise-grade applications.

5. UMA (UMA Protocol): Optimistic Oracle for DeFi

Unlike traditional oracles, UMA uses an optimistic oracle model, where data is proposed and only disputed if incorrect. This design ensures flexibility and scalability, making UMA ideal for synthetic assets, prediction markets, and DAO governance. By 2025, UMA is powering innovative financial contracts and has expanded into AI-driven data verification for decentralized systems.

6. DIA (Decentralized Information Asset): Community-Driven Data Feeds

DIA positions itself as the “Wikipedia of financial data,” offering transparent, open-source, and community-verified data feeds. Its model ensures data is traceable and customizable, appealing to developers who value auditable and transparent oracles. By 2025, DIA has established itself as a preferred oracle in Europe’s regulated crypto markets and among DeFi protocols requiring compliance-ready data.

7. Nest Protocol (NEST): Top 10 Oracles – Oracle for On-Chain Price Discovery

Source: Supra

Nest Protocol introduces a decentralized price oracle mechanism where miners provide quotes and earn rewards based on accuracy. This on-chain price discovery system ensures tamper-resistant data and high decentralization. By 2025, Nest has gained adoption in stablecoin ecosystems and derivatives platforms where accurate, manipulation-resistant pricing is critical.

8. Tellor (TRB): Decentralized Oracle with Miner Incentives

Source: IQ.wiki

Tellor uses a mining-based model where reporters submit data, and disputes are resolved through staking and slashing mechanisms. This design incentivizes accuracy while maintaining decentralization. Tellor is widely adopted in Ethereum DeFi protocols, prediction markets, and DAOs, and by 2025 it has expanded to multiple EVM-compatible chains with strong community-driven governance.

9. Witnet (WIT): Oracle for Decentralized Data Verification

Source: Witnet.io

Witnet specializes in providing trustless and censorship-resistant oracles. It focuses on delivering data to smart contracts in a decentralized manner, with robust cryptoeconomic incentives ensuring reliability. By 2025, Witnet is widely used for use cases beyond DeFi—such as NFT royalties, insurance automation, and IoT applications—making it a versatile player in the oracle space.

10. Razor Network (RAZOR): Fast and Secure Oracle for DeFi

Source: Cryptonews

Razor Network provides low-latency data feeds with a focus on scalability, speed, and security. Its delegated proof-of-stake consensus allows for fast updates, making it particularly useful for applications such as prediction markets, gaming, and decentralized insurance. By 2025, Razor Network has become a competitive choice for developers seeking a balance between decentralization and high performance.

Comparison Table: Top 10 Oracles

| Oracle Project | Unique Strength | Primary Use Case | Key Ecosystem Presence |

|---|---|---|---|

| Chainlink (LINK) | Largest oracle network, CCIP protocol | DeFi, Enterprise, Multi-chain | Ethereum, Polygon, BNB Chain, more |

| Pyth Network (PYTH) | High-frequency financial data | DeFi trading & derivatives | Solana, Ethereum L2s, Cosmos |

| Band Protocol (BAND) | Cross-chain, fast & scalable | DeFi & enterprise integrations | Cosmos, Ethereum, Binance Chain |

| API3 (API3) | First-party Airnodes for APIs | Insurance, IoT, Enterprise | Ethereum, Polygon, Arbitrum |

| UMA Protocol (UMA) | Optimistic oracle model | Synthetic assets, Prediction | Ethereum, Multi-chain |

| DIA (DIA) | Community-driven, auditable feeds | Regulated markets, DeFi | Europe-focused, Ethereum, Polygon |

| Nest Protocol (NEST) | On-chain price discovery mechanism | Stablecoins, Derivatives | Ethereum |

| Tellor (TRB) | Mining & staking-based incentives | DeFi, DAOs, Prediction markets | Ethereum, EVM chains |

| Witnet (WIT) | Censorship-resistant oracle | NFTs, IoT, Insurance | Multi-chain |

| Razor Network (RAZOR) | Fast, low-latency oracle | Gaming, Prediction, Insurance | Ethereum, Polygon |

Conclusion

The oracle sector is one of the most important pillars of Web3, as smart contracts cannot function without reliable real-world data. From Chainlink’s enterprise dominance to Pyth’s real-time market feeds and API3’s first-party solutions, each oracle project offers unique advantages that shape the future of decentralized applications.

As we move deeper into 2025, oracles are not just powering DeFi—they’re enabling AI-driven applications, powering NFT innovations, and connecting entire industries to blockchain. These Top 10 Blockchain Oracles Shaping Web3 in 2025 will continue to define the boundaries of what’s possible in a truly decentralized, data-driven digital economy.