Crypto Custody Explained: How Beginners Can Choose Between Self-Custody and Third-Party Services

Summary

- Introduction: Crypto Custody Explained

- What Does Crypto Custody Mean?

- Self-Custody: Taking Full Ownership

- Third-Party Custody: Trusting Institutions

- Side-by-Side Comparison of Custody Models

- Best Practices for Storing Crypto Safely

- How Beginners Typically Start

- The Institutional Landscape

- The Future of Crypto Custody

- Conclusion: Choosing the Right Custody Model

Introduction: Crypto Custody Explained

When people first buy cryptocurrency, the excitement usually centers on price movements, exchanges, and trading strategies. Yet one question is often overlooked: where should those assets be stored? This is where crypto custody explained becomes essential.

Custody is not about speculation or investment returns — it is about safety and access. The person or institution that holds your private keys controls your crypto. Whether you keep the keys yourself (self-custody) or entrust them to a provider (third-party custody) can determine not just convenience, but whether your assets are ultimately secure.

What Does Crypto Custody Mean?

Crypto custody refers to the storage and management of private keys, the cryptographic codes that prove ownership of coins on a blockchain. Losing access to a private key is equivalent to losing the asset. Unlike a forgotten bank password, there is no “reset” button.

There are two major models:

- Self-Custody — the owner holds their private keys directly, usually through wallets or offline devices.

- Third-Party Custody — a custodian such as an exchange, broker, or regulated institution holds the keys on behalf of clients.

Both models are widely used. Research from Crypto.com (2024) estimated that about 35% of retail users prefer self-custody wallets, while the majority still keep assets on centralized platforms.

Self-Custody: Taking Full Ownership

Credit from CMCC Global

Self-custody means you take responsibility for your own keys. This approach is favored by long-term investors, privacy advocates, and those skeptical of centralized platforms.

Key Features

- Assets are accessed through private keys or seed phrases.

- Wallets may be hot (connected to the internet) or cold (offline storage, such as hardware wallets).

- The user alone has the power — and the responsibility — to safeguard funds.

Strengths

- Maximum Control: Nobody else can freeze or seize your coins.

- Privacy Protection: No need to share personal information with institutions.

- Security Against Platform Failures: Hacks or bankruptcies at exchanges cannot touch your holdings.

Weaknesses

- Risk of Irreversible Loss: A misplaced seed phrase can mean funds are gone forever.

- Learning Curve: Proper storage and backup methods require technical awareness.

- No Customer Helpdesk: Mistakes cannot be reversed by calling support.

Real case example: In 2021, a German programmer famously lost access to over $200 million in Bitcoin due to a forgotten password to his hardware wallet. This illustrates the unforgiving nature of self-custody.

Third-Party Custody: Trusting Institutions

Third-party custody places private keys with a custodian. These services may be exchanges like Coinbase, or specialized firms such as BitGo or Anchorage Digital. For institutions managing billions in crypto, professional custody is often legally required.

Benefits

- Ease of Use: Accounts resemble online banking, with intuitive interfaces.

- Additional Services: Some custodians offer staking, lending, or insurance.

- Backup and Recovery: Password resets and account recovery options reduce the risk of total loss.

Drawbacks

- Counterparty Risk: Funds depend on the custodian’s solvency and security. The collapse of FTX in 2022 is a stark reminder.

- Lower Privacy: Know-Your-Customer (KYC) procedures mean personal information is tied to holdings.

- Possible Restrictions: Withdrawals may be delayed or frozen due to compliance rules.

Crypto Custody Explained: Side-by-Side Comparison

| Category | Self-Custody | Third-Party Custody |

|---|---|---|

| Control | 100% in the hands of the user | Custodian controls access to keys |

| Security | Dependent on personal safeguards | Institutional-grade protections, but hack risk |

| Ease of Use | More complex, technical responsibility | User-friendly, designed for mainstream use |

| Privacy | High, no identity needed | Lower, tied to KYC requirements |

| Recovery Options | None if keys are lost | Usually available (password resets, support) |

| Counterparty Risk | None | Significant (custodian failure possible) |

| Costs | Hardware wallet costs ($70–$200) | May involve custody or withdrawal fees |

Best Practices for Storing Crypto Safely

Credit from European Blockchain Association

Regardless of whether you choose self-custody or a custodian, certain practices significantly improve security.

- Use Hardware Wallets for Long-Term Storage

Devices like Ledger Nano X or Trezor Model T keep keys offline, away from online threats. - Enable Multi-Factor Authentication

On custodial services, always enable two-factor authentication (2FA) to reduce account theft. - Maintain Backups of Recovery Phrases

Store copies securely in multiple physical locations (e.g., safe deposit box, fireproof safe). - Keep Software Updated

Wallet applications and custodial platforms release patches for vulnerabilities — ignoring updates increases risks. - Diversify Storage

Avoid keeping all assets in one place. Many investors combine small custodial accounts for trading and large cold-storage wallets for reserves.

How Beginners Typically Start

For someone completely new to crypto, third-party platforms often feel more approachable. The interface resembles online banking, and customer support is available. This can reduce anxiety while learning the basics.

Over time, as knowledge and confidence grow, many shift toward self-custody to gain greater independence. A hybrid approach is common:

- Trading funds remain on an exchange for liquidity.

- Savings and long-term holdings move into cold storage under self-custody.

This staged transition balances convenience with security.

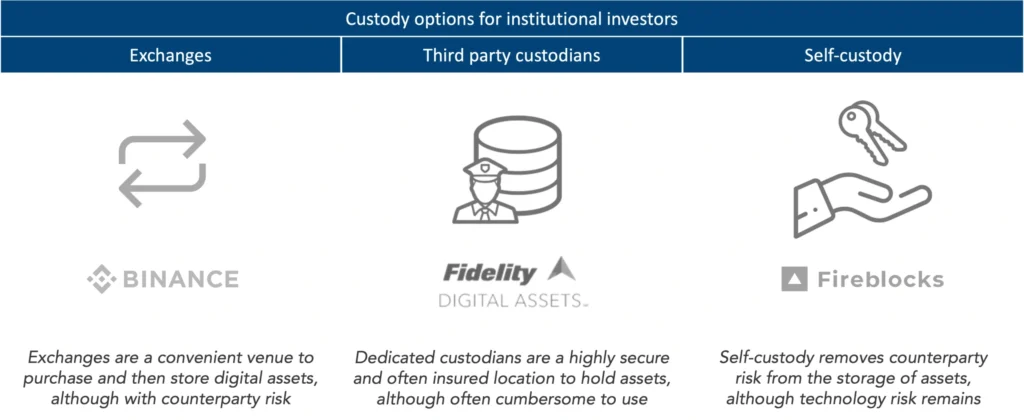

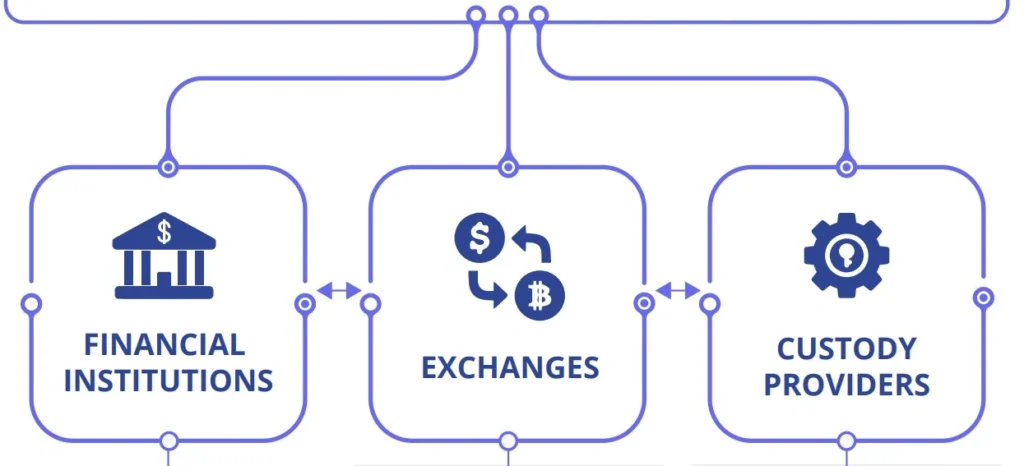

The Institutional Landscape

Credit from Zerocap

While retail users debate between wallets and exchanges, institutions operate under stricter frameworks. Banks, hedge funds, and family offices dealing with crypto must often use regulated custodians.

For example:

- Anchorage Digital is a U.S. federally chartered crypto bank offering qualified custody.

- Coinbase Custody provides insurance-backed services and is used by many funds.

These custodians illustrate how custody is not only about individuals — it is a cornerstone of institutional crypto adoption.

The Future of Crypto Custody

The custody debate is evolving alongside technology:

- Multi-Party Computation (MPC): A cryptographic method allowing multiple parties to jointly manage private keys without revealing them fully.

- Hybrid Models: Some providers now offer shared custody, where clients retain partial control alongside the custodian.

- Regulatory Developments: Governments are drafting clearer rules on how custodians must protect user assets, aiming to prevent another FTX-style collapse.

For beginners, this means more options will become available, combining flexibility with robust safeguards.

Conclusion: Crypto Custody Explained

Crypto custody explained is ultimately about who holds the keys — and with them, the power over digital assets. Self-custody grants maximum independence but demands discipline. Third-party custody reduces complexity but introduces reliance on institutions.

There is no single “best” method. The right choice depends on your experience, risk tolerance, and long-term goals. For many, a blended approach works best: using custodial accounts for active trading, while securing the bulk of assets through self-custody in cold storage.

By understanding both models and applying best practices, beginners can take the first steps in crypto not just with excitement, but with confidence that their assets are well protected.