Top 10 Regulatory Trends Shaping Crypto in 2025

Top 10 Regulatory Trends: As digital assets step deeper into mainstream finance, 2025 marks a shift that cannot be ignored. Institutional adoption is rising, governments are asserting more control, and regulatory clarity is beginning to replace uncertainty. Yet, the challenge remains: how do we encourage innovation while protecting investors and ensuring market stability?

The top 10 regulatory trends unfolding this year highlight the crossroads between compliance and progress. From stablecoin oversight to green crypto rules, these changes will define the next chapter of global digital finance.

1. Global Push for Regulatory Alignment

Source: Daily Sabah

The crypto market doesn’t stop at national borders, but regulation often does. In 2025, momentum is building toward international standards for digital assets. Groups like the Financial Stability Board (FSB) and the IMF are urging countries to coordinate, aiming for shared rules on stablecoins, AML enforcement, and tax reporting.

This trend matters because fragmented oversight creates inefficiencies and opens doors for arbitrage. By working toward harmonization, global regulators hope to build a safer, more predictable environment for investors and institutions alike.

2. United States: Policy Clarity at Last

Source: CS

After years of uncertainty, the U.S. is inching closer to a coherent regulatory framework. A series of executive directives and new bills in Congress, including proposals for a Digital Asset Market Structure Act, are clarifying how different tokens and exchanges should be classified.

The ongoing dispute between the SEC and CFTC over crypto jurisdiction remains, but the trend is toward compromise. With clearer boundaries, U.S. institutions may finally embrace crypto markets more confidently, spurring wider adoption.

3. Europe’s MiCA Framework Comes Alive

Source: Dotfile

The Markets in Crypto-Assets Regulation (MiCA) is no longer just policy—it’s being enforced across the EU. From licensing rules for exchanges to stringent consumer protection standards, MiCA is reshaping Europe’s digital asset landscape.

The framework is already influencing global debates. Countries outside Europe, including the UK and parts of Asia, are weighing similar measures. For crypto businesses, MiCA represents both a challenge—higher compliance costs—and an opportunity: greater long-term certainty.

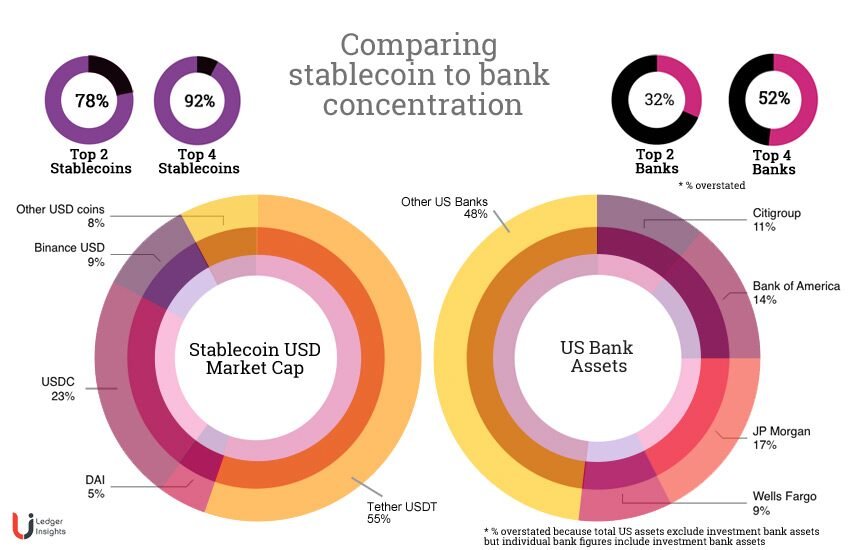

4. Stablecoins and Central Bank Digital Currencies

Source: LI

Stablecoins are moving from the periphery to the financial core. Regulators now demand audits, strong reserves, and transparency from issuers. At the same time, central banks are pressing ahead with CBDCs, from China’s digital yuan to pilots in Europe and discussions in the U.S.

The coexistence of public and private digital currencies raises new questions: who will dominate cross-border payments, and what role will stablecoins play once CBDCs mature? The regulatory landscape in 2025 is beginning to shape those answers.

5. AML Rules and the Travel Rule Expansion

The FATF Travel Rule, long debated, is now firmly in effect in many jurisdictions. Exchanges and custodians must share sender and recipient details for transactions, creating a tighter net against illicit finance.

But compliance is proving heavy for smaller operators, potentially consolidating power in the hands of larger exchanges. For DeFi platforms, regulators are exploring how to impose AML checks in systems without central control—a challenge that remains unresolved.

6. DeFi Oversight: Between Code and Compliance

Source: Rapid Innovation

Decentralized finance was once viewed as outside regulators’ reach. That narrative is fading. In 2025, policymakers are pressing DeFi projects to adopt smart contract audits, AML integration, and licensing structures.

The debate is intense: can DeFi remain decentralized while meeting compliance obligations? Some governments are piloting “responsible DeFi” frameworks, while others prefer to regulate at the on-ramps—exchanges, custodians, and front-end providers. The results of these experiments will influence DeFi’s trajectory.

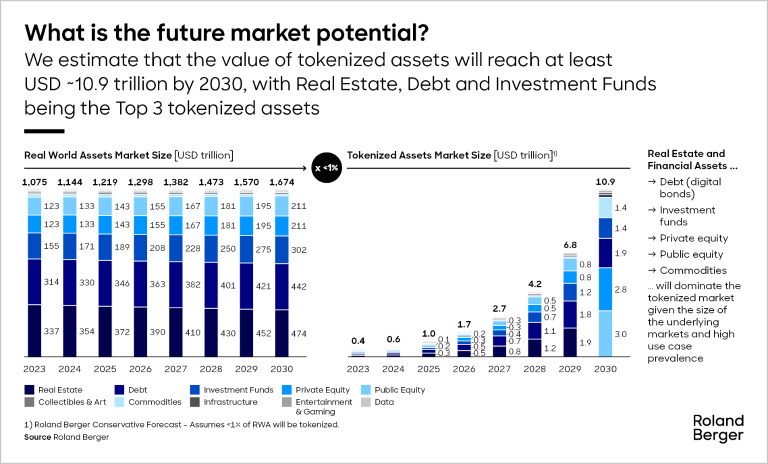

7. NFTs and the Regulation of Digital Assets

Source: Roland Berger

NFTs are evolving beyond art and collectibles, and regulators are paying closer attention. The big question is whether certain NFTs should be treated as securities when they promise returns.

Tokenization of real-world assets (RWAs)—such as property or government bonds—is also accelerating. Regulators are adapting securities and tax rules for these instruments, while copyright and consumer protection remain hot topics for NFT creators and buyers alike.

8. Top 10 Regulatory Trends : Stricter Taxation and Reporting Standards

Source: Action Law

Governments are closing the gap on crypto taxation. In 2025, the IRS, HMRC, and EU authorities have expanded rules requiring exchanges to integrate automated tax tools. Individuals and institutions must now report digital holdings more comprehensively.

Cross-border cooperation is tightening too, making tax evasion through crypto increasingly difficult. For many, the shift signals the end of crypto’s “tax gray zone” and the beginning of full integration with financial reporting systems.

9. Top 10 Regulatory Trends : Security, Fraud Prevention, and Investor Safeguards

Source: Linkedin

Fraud and hacks have cost investors billions, and regulators are responding with stricter cybersecurity and custody requirements. Licensed exchanges may soon be required to carry insurance, offer compensation mechanisms, and undergo regular third-party audits.

At the same time, consumer protection rules are becoming more forceful. Governments are pushing exchanges to improve transparency and establish fraud prevention programs. Regulatory sandboxes continue to allow room for innovation but with guardrails firmly in place.

10. Top 10 Regulatory Trends : ESG and the Rise of Green Crypto Rules

Source: FN

Environmental impact is no longer an afterthought in crypto regulation. Europe, in particular, is pressing for carbon disclosure from miners and exploring incentives for renewable-powered operations.

Investors are also shifting behavior, with ESG-conscious portfolios preferring projects that demonstrate sustainability. While Bitcoin remains under scrutiny for its energy usage, broader industry momentum suggests that aligning with green regulation will soon be a requirement, not a choice.

Conclusion – Top 10 Regulatory Trends

The top 10 regulatory trends in crypto for 2025 highlight a maturing industry where compliance and innovation must coexist. From MiCA’s rollout and stablecoin laws to ESG mandates and taxation, these developments are pushing digital assets into a new era of accountability.

The journey ahead won’t be without friction, but the long-term effect is clear: stronger investor trust, broader institutional participation, and a global framework that could finally stabilize crypto markets. For stakeholders across the ecosystem, adapting to this regulated reality is no longer optional—it’s essential.