Top 10 Stablecoins in 2025: Leading the Future of Digital Money

Top 10 Stablecoins : The cryptocurrency market has always been marked by volatility, and stablecoins emerged as a solution to balance that unpredictability. These digital assets, pegged to fiat currencies like the U.S. dollar, have become indispensable for traders, investors, and even governments experimenting with digital money.

As 2025 unfolds, stablecoins are no longer just a tool for crypto traders. They have become integral to remittances, decentralized finance (DeFi), and payments worldwide. With regulations tightening and adoption expanding, this year marks a defining moment for the industry. In this article, we highlight the top 10 stablecoins in 2025 and analyze their role in shaping the financial landscape.

Why Stablecoins Matter More Than Ever

Stablecoins now represent a growing share of the crypto market. They are the lifeblood of DeFi lending, the backbone of most trading pairs, and increasingly, a payment method in everyday commerce. For users in countries battling inflation, stablecoins offer an accessible digital form of dollarization.

Global regulations are catching up, particularly in the U.S. and EU, where lawmakers are pushing for tighter rules on reserve backing and consumer protections. This evolving landscape makes 2025 a pivotal year — one where stablecoins are moving from speculative use to mainstream financial infrastructure.

How We Ranked the Top Stablecoins

When compiling this list of the top 10 stablecoins, several factors guided the selection:

- Market size and liquidity – how much volume flows through the token.

- Adoption across exchanges and DeFi protocols – breadth of usage.

- Transparency and audits – clarity around reserves.

- Peg mechanism – whether fiat-backed, crypto-collateralized, or algorithmic.

- Global accessibility – adoption across geographies and industries.

The Top 10 Stablecoins of 2025

1. Tether (USDT)

Source: 99Bitcoins

Still the undisputed leader by market cap, USDT remains the most liquid stablecoin globally. Despite ongoing skepticism about its reserves, Tether dominates both centralized and decentralized markets. It continues to serve as the default settlement currency for millions.

2. USD Coin (USDC)

Source: Linkedin

Issued under strict regulatory oversight, USDC has become the institutional favorite. Its reputation for transparency and compliance has fueled partnerships with banks, fintechs, and payment providers, making it a cornerstone of regulated crypto finance.

3. First Digital USD (FDUSD)

Born out of Asia’s fast-moving digital asset ecosystem, FDUSD has quickly established itself in the Binance universe. With its focus on transparency and liquidity, it represents the growing regional power shaping the global stablecoin market.

4. Dai (DAI)

Source: NowPayments

DAI remains the most significant decentralized stablecoin. Built on Ethereum and governed by MakerDAO, it offers a non-custodial alternative. While it faces hurdles in maintaining scalability, DAI is essential for DeFi purists seeking decentralization.

5. TrueUSD (TUSD)

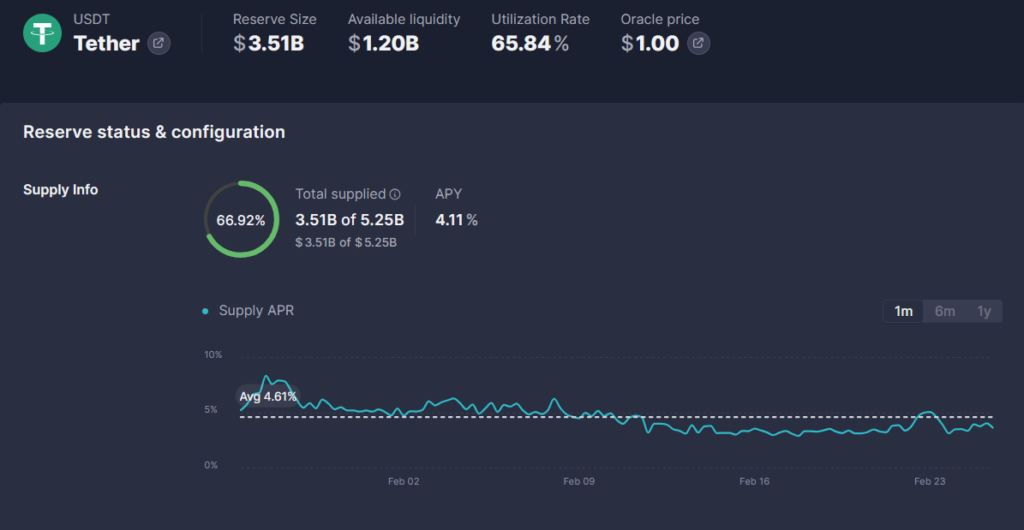

Source: Redhat

With its real-time attestations, TUSD has earned credibility as one of the more transparent fiat-backed stablecoins. Its adoption is particularly strong in Asia, though it remains smaller compared to giants like USDT and USDC.

6. PayPal USD (PYUSD)

PayPal’s entry into stablecoins brought crypto to millions of mainstream users. Integrated with PayPal and Venmo, PYUSD pushes stablecoins into everyday payments, bridging the gap between Web2 finance and Web3 ecosystems.

7. Binance USD (BUSD)

Once a leading player, BUSD has struggled under U.S. regulatory pressure. While its market share has declined, it still plays a role internationally through Binance’s global reach. Its future remains uncertain but not irrelevant.

8. Gemini Dollar (GUSD)

Source: Gemini

Backed by New York trust laws, GUSD is one of the most regulated stablecoins. Though adoption is niche, it has found a role in institutional DeFi protocols that prioritize compliance and security.

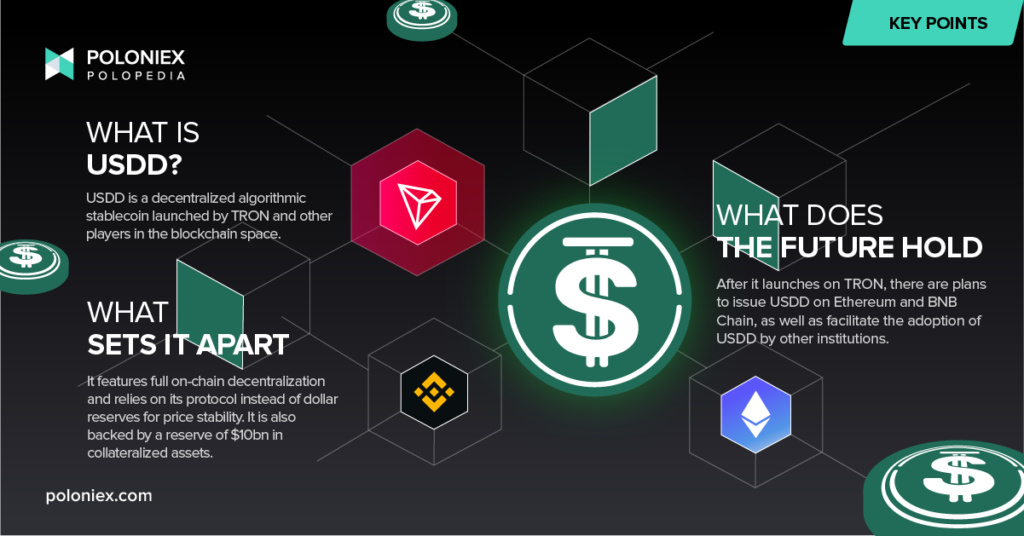

9. USDD (TRON)

Source: Medium

TRON’s stablecoin USDD takes a hybrid approach with partial collateralization. Its growth has been strongest in emerging markets where TRON maintains a significant user base. However, risks tied to algorithmic stability remain.

10. Regional Stablecoins (EURS, XSGD, Stably USD)

Source: the block

A wave of regional stablecoins is rising, from Singapore’s XSGD to Europe’s EURS. These tokens support local remittance and settlement needs, highlighting the shift toward diversification beyond USD-denominated coins.

Comparing the Leading Stablecoins – Top 10 Stablecoins

A snapshot comparison reveals the diversity of the sector. USDT dominates in liquidity, USDC leads in compliance, DAI holds the decentralized crown, while newer entrants like FDUSD and PYUSD are pushing adoption into fresh territories.

This mix of centralized and decentralized models shows the industry’s split personality — balancing transparency, efficiency, and trust.

Challenges Ahead – Top 10 Stablecoins

The stablecoin sector faces mounting pressure from regulators worldwide. Questions around reserve safety, risks of depegging, and centralization continue to loom. At the same time, central bank digital currencies (CBDCs) could emerge as a direct competitor, potentially reshaping the role of private stablecoins.

Looking Beyond 2025 – Top 10 Stablecoins

Future trends suggest consolidation around a handful of dominant players, while regional coins carve out localized roles. Multi-currency stablecoins may gain traction as global commerce seeks alternatives to dollar-only models.

As partnerships with banks, fintechs, and even governments grow, stablecoins are poised to become the backbone of international finance.

Conclusion – Top 10 Stablecoins

The top 10 stablecoins in 2025 showcase a sector that has matured into a vital financial tool. From USDT and USDC’s dominance to the rise of FDUSD, PYUSD, and regional players, stablecoins now shape global money flows.

As regulation deepens and adoption expands, these digital dollars will continue redefining how value is stored and transferred across borders.