Uphold Exchange Review 2025: Is It Still Worth Using?

When people look up Uphold exchange review, they usually want to know whether this platform is more than just another crypto trading app. The truth is, Uphold has positioned itself as a multi-asset platform that blends cryptocurrency, stocks, precious metals, and even carbon credits into a single wallet. This makes it quite different from the usual exchanges that stick to digital coins only. By 2025, it has gained attention as a tool for traders who want flexibility across asset classes without juggling multiple accounts.

Features That Stand Out

One of the most striking things about Uphold is how it merges traditional finance with the digital asset world. Users can hold Bitcoin alongside U.S. equities or even gold, all in one account. This versatility is often highlighted in Uphold exchange review discussions, as it reduces the friction of moving funds between platforms.

The platform also provides instant conversions between assets. For instance, a trader can swap ETH to Tesla stock without first converting to USD. This cross-asset conversion is not only convenient but also sets Uphold apart from most competitors.

Uphold Exchange Review: Fees and Pricing

While Uphold doesn’t advertise itself as the cheapest exchange, it avoids the complexity of tiered fee structures. The spread-based pricing model means that instead of a fixed trading fee, costs are baked into the buy and sell price. This can sometimes feel less transparent compared to flat fees, but it does simplify the experience for new traders.

Compared to platforms that charge standard trading commissions, Uphold’s spreads usually range from 0.8% to 1.2% on major crypto pairs. For less liquid assets like precious metals or smaller altcoins, spreads may be higher. Some users in 2025 see this as a trade-off: you pay slightly more per transaction, but you get access to a much broader market under one roof.

Uphold Exchange Review: Security and Trustworthiness

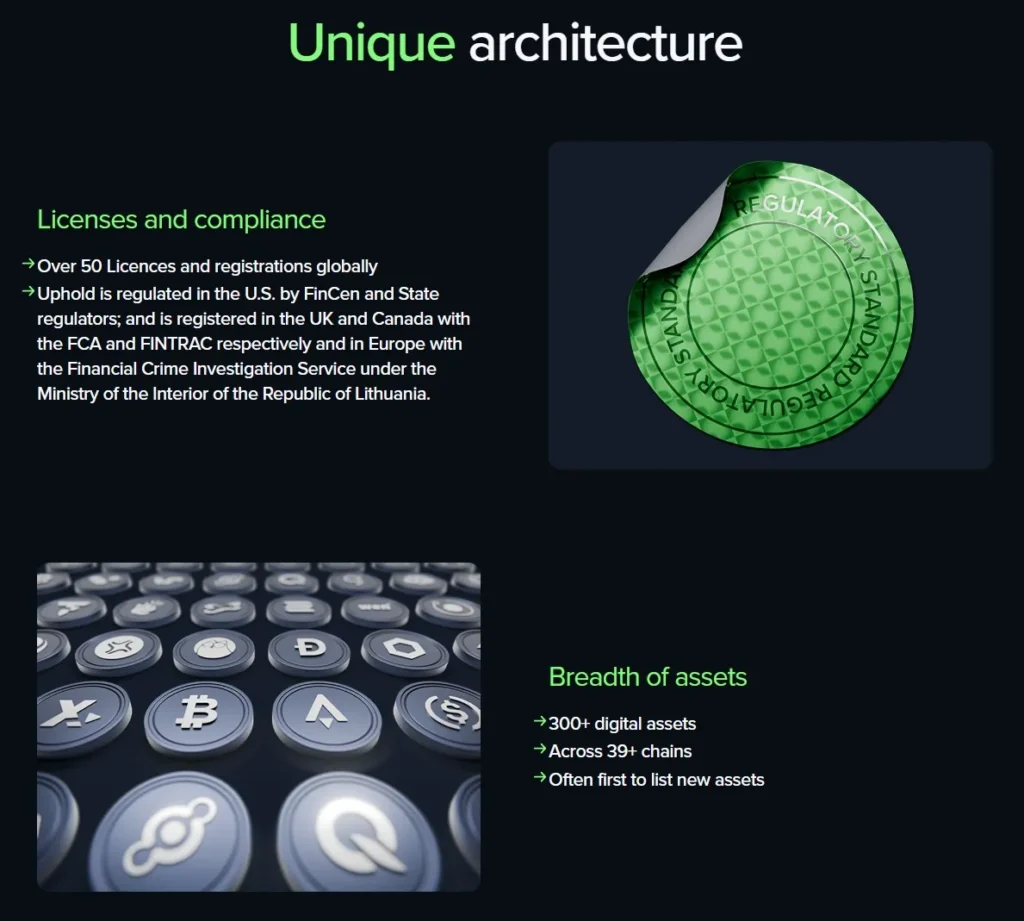

Security remains a hot topic in every Uphold exchange review. The platform applies a strong compliance-first approach, which appeals to users who worry about regulatory oversight. It holds licenses in multiple jurisdictions and has built a reputation for transparency.

Unlike certain exchanges that keep customers in the dark about reserves, Uphold publishes an “asset transparency page” showing real-time proof of reserves. This means clients can verify that their funds are backed 1:1, an extra step toward building trust.

Supported Assets and Market Reach

By 2025, Uphold supports over 250 digital assets, alongside fiat currencies, equities, and commodities. This makes it an attractive choice for users who don’t want to be limited to crypto. The ability to trade across so many markets gives it a “one-stop-shop” appeal.

The exchange also integrates with global payment systems, making deposits and withdrawals easier for users across regions. Whether someone is in the U.S., Europe, or Asia, Uphold provides ways to fund accounts through bank transfers, debit cards, and crypto wallets.

Uphold Exchange Review: Pros and Cons of Uphold

Here’s a quick comparison of what stands out in 2025:

| Pros | Cons |

|---|---|

| Multi-asset platform (crypto, stocks, metals, carbon credits) | Spread fees can be higher than flat-fee exchanges |

| Cross-asset conversions without extra steps | Not ideal for high-frequency or professional day traders |

| Strong regulatory compliance and proof of reserves | Limited advanced trading features compared to pro exchanges |

| Over 250 cryptocurrencies supported | Customer support response times can be slow |

Final Thoughts: Is Uphold Right for You?

This Uphold exchange review shows a platform that’s not competing to be the cheapest, but to be the broadest. It appeals to users who value having crypto, equities, and commodities in one wallet. For newcomers, the simplicity of its spread-based pricing can be reassuring. For more advanced traders, the lack of deep charting tools or advanced order types may feel limiting.

In 2025, Uphold stands as a strong option for multi-asset investors and casual crypto users who want an easy, regulated way to manage different types of assets. Whether it’s the best choice depends on what you prioritize—low fees, advanced trading tools, or flexibility across markets.