Crypto.com Exchange Review: What You Need to Know in 2025

This Crypto.com exchange review isn’t written to sound like a brochure. It’s more of a real-world look at how the platform feels in 2025, after years of being in the spotlight. When Crypto.com first made noise with its flashy marketing and stadium naming rights, many traders brushed it off as hype. Now, after surviving a rough patch with a major hack and market downturn, it’s fair to ask—what’s the actual experience today?

Crypto.com Exchange Review: Trading Fees and Daily Use

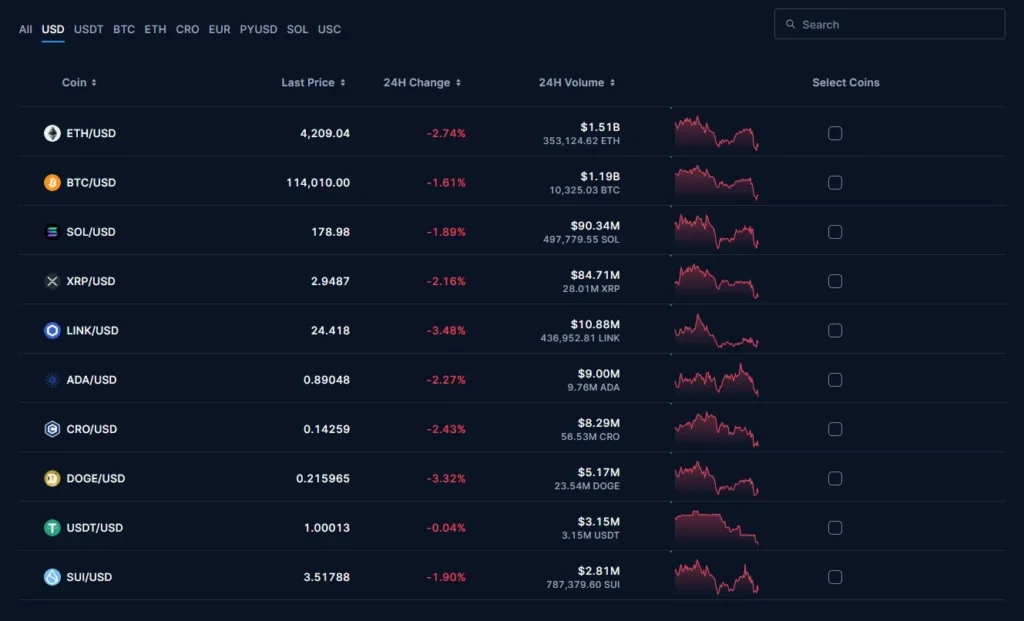

Let’s be honest: fees are the first thing most traders check. On Crypto.com, spot trading fees start at 0.075%, which puts it slightly below many competitors. If you’re staking CRO tokens, the rate gets even lower. For high-frequency traders, this matters a lot. If you only trade occasionally, the savings won’t change your life, but at least it’s not eating into profits unnecessarily.

The app design is where Crypto.com shines. It feels built for mobile first—everything loads quickly, charts are clean, and placing trades doesn’t require digging through confusing menus. I’ve tested exchanges that bury important tools behind endless tabs; Crypto.com avoids that.

Crypto.com Exchange Review: Security and Trust

Now, about the elephant in the room. Yes, Crypto.com was hacked in 2022, and that memory hasn’t completely faded. But here’s the thing: they refunded users, tightened security, and added more compliance checks. Today, they use multi-factor authentication, cold storage, and regulatory oversight across several regions.

Does that mean it’s bulletproof? Of course not. No exchange is. But in a space where newer platforms vanish overnight, Crypto.com at least has the track record of owning up to mistakes and moving forward.

Beyond Trading: Cards and Staking

What makes Crypto.com different is its push to be more than just an exchange. The Crypto.com Visa card gives cashback rewards, higher if you stake CRO. On paper, this sounds great—you spend, you earn crypto back. In practice, you’ll need to lock up a decent amount of CRO for months to unlock the bigger perks. For some people, that’s fine. For others, it feels like too much risk tied to one token.

Staking itself is another attraction. Coins like ETH, BTC, and USDT all have yields, and the app shows rewards clearly. I’ve seen users treat it as a mini savings account, though the usual warning applies: yields in crypto are never guaranteed.

Crypto.com Exchange Review: Pros vs Cons in Reality

| What Works | What Doesn’t |

|---|---|

| Competitive fees, even better with CRO staking | Best rewards locked behind CRO commitments |

| User-friendly mobile app with solid features | Withdrawal fees can feel higher than rivals |

| Security improved after past hack, strong compliance | Hack reputation still lingers in community memory |

| Extra perks: Visa card, staking rewards, NFTs | Heavily dependent on CRO token’s long-term value |

Final Thoughts

After writing this Crypto.com exchange review, my impression is that it’s still one of the stronger names in crypto trading for 2025. It balances low fees with lifestyle perks and a polished mobile experience. But it’s not perfect. The CRO dependency makes rewards feel a little restrictive, and old security scars won’t vanish overnight.

If you’re a trader who values both usability and extra perks like cashback cards, Crypto.com is worth considering. If you hate the idea of locking funds in CRO just for better benefits, you might want to explore alternatives.

Either way, it’s a platform that has survived hype, setbacks, and competition—so in a market where many exchanges fade quickly, that resilience itself says something.