Top 10 DAOs Driving Web3 Governance in 2025: How Decentralized Organizations Are Changing the Rules

The Top 10 DAOs of 2025 tell the story of how blockchain-native organizations are moving from experiments to global governance models. A DAO—short for Decentralized Autonomous Organization—operates through smart contracts and collective decision-making, where communities, not corporations, decide the future of a project.

By 2025, DAOs are no longer niche. They govern multi-billion-dollar ecosystems across DeFi, NFTs, Layer-2 scaling, and virtual worlds. Their decisions affect everything from lending rates and liquidity pools to digital identity and metaverse land policies. What sets them apart is their commitment to transparency, automation, and community-led governance—values that sit at the heart of Web3.

Why DAOs Matter for Web3 Governance

Unlike traditional organizations, DAOs publish every decision, treasury movement, and governance proposal on the blockchain. This transparency ensures accountability while smart contracts handle execution, reducing reliance on intermediaries.

Equally important is inclusivity. Anyone holding governance tokens can participate—whether they live in New York, Nairobi, or New Delhi. This borderless nature makes DAOs more global and diverse than many conventional governance models.

At their best, DAOs also align incentives. Members gain influence through participation, staking, or long-term commitment, ensuring those invested in the ecosystem’s success help guide its direction. This dynamic creates communities that feel ownership beyond financial returns.

Top 10 DAOs Leading Web3 Governance in 2025

The following DAOs are not just shaping their own ecosystems; they are defining how decentralized governance works at scale.

1. Uniswap DAO

Source: Decrypt

The beating heart of decentralized exchanges, Uniswap DAO decides how liquidity pools are structured, how fees are distributed, and how the protocol evolves. With billions in trading volume, its governance decisions ripple across the entire DeFi sector.

2. MakerDAO

Source: Cryptodnes

MakerDAO oversees the DAI stablecoin, ensuring its peg remains reliable during volatile markets. Governance votes cover collateral types, risk frameworks, and interest models, making it a cornerstone of financial stability in the decentralized economy.

3. Aave DAO

Source: Cryptopolitan

Aave DAO governs one of the most widely used decentralized lending platforms. From cross-chain deployments to risk parameters, the community votes on how the protocol adapts to new financial landscapes. Its decisions directly shape lending markets across Web3.

4. Compound DAO

Focused on decentralized money markets, Compound DAO enables users to lend and borrow crypto while governance handles protocol upgrades and interest rate policies. By 2025, its governance framework is increasingly relevant as institutions explore DeFi integrations.

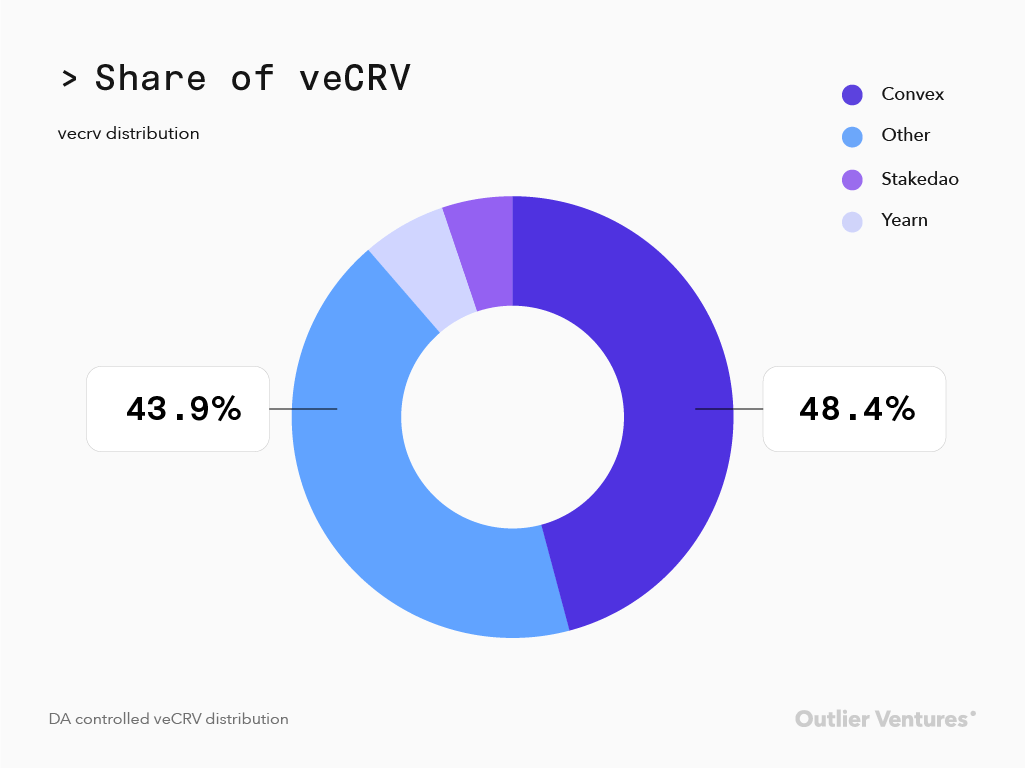

5. Curve DAO

Source: Outlier Ventures

Known for its unique vote-escrow model (veCRV), Curve DAO balances short-term liquidity rewards with long-term ecosystem growth. Its governance over stablecoin liquidity pools makes it one of the most influential DAOs in the DeFi landscape.

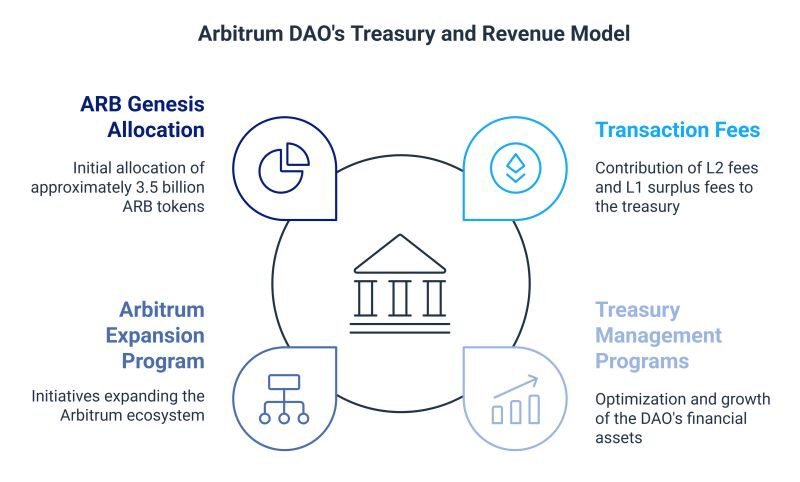

6. Arbitrum DAO

Source: Linkedin

As Ethereum’s leading Layer-2 scaling network, Arbitrum DAO governs upgrades, incentive structures, and treasury funding. With Ethereum congestion still a challenge, Arbitrum DAO plays a key role in scaling blockchain adoption in 2025.

7. ENS DAO

The Ethereum Name Service DAO controls the future of decentralized domain names—vital for identity and accessibility in Web3. Its votes decide pricing, governance funding, and community initiatives, making it central to the blockchain identity layer.

8. Gitcoin DAO

Source: GiftHub

Focused on funding public goods, Gitcoin DAO uses quadratic funding to ensure community priorities shape developer grants. In 2025, it stands as a global model for decentralized philanthropy and sustainable innovation funding.

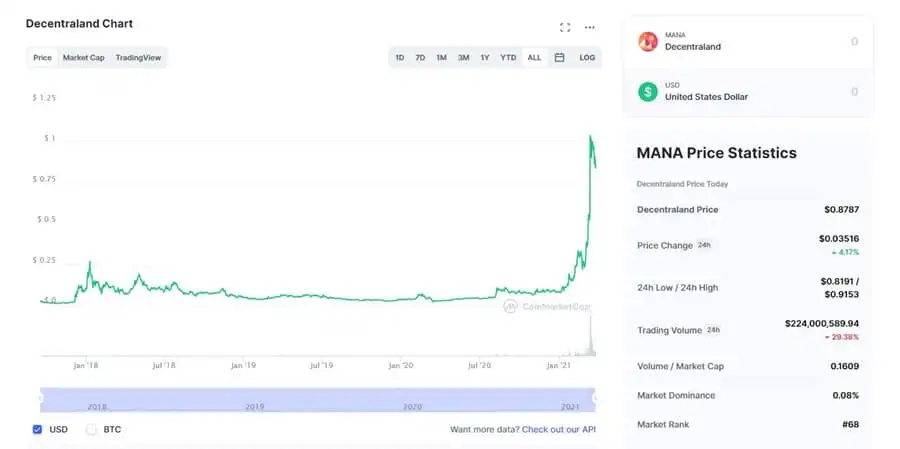

9. Decentraland DAO

Source: Coinbureau

In the metaverse, Decentraland DAO governs land, experiences, and virtual economies. Its model demonstrates how communities can govern entire digital societies, setting precedents for future metaverse platforms and digital governance systems.

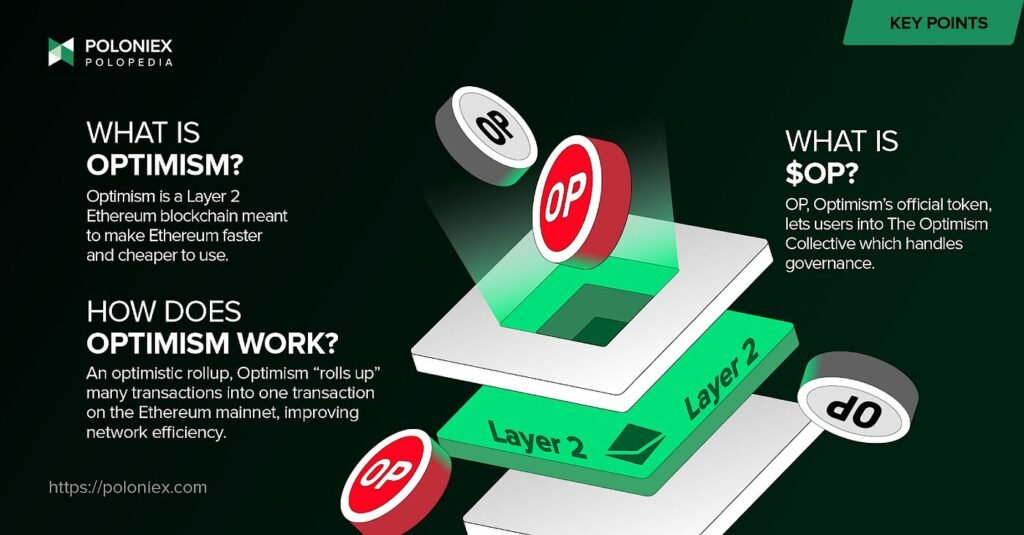

10. Optimism Collective

Source: Medium

An evolution of traditional DAOs, the Optimism Collective ties governance to retroactive public goods funding. It rewards projects that prove real-world value, pushing the boundaries of how decentralized communities can align profit with social impact.

Quick Comparison: The Top 10 DAOs at a Glance

| DAO | Sector | Governance Model | 2025 Relevance |

|---|---|---|---|

| Uniswap DAO | DeFi (DEX) | Token-based with community input | Sets standards for decentralized exchange governance |

| MakerDAO | DeFi (Stablecoin) | Token-based, risk parameters | Maintains DAI peg and financial stability |

| Aave DAO | DeFi (Lending) | Delegated & token voting | Expanding cross-chain and institutional DeFi |

| Compound DAO | DeFi (Money Markets) | Token-based governance | Bridges DeFi with traditional finance |

| Curve DAO | DeFi (Liquidity) | Vote-escrow (veCRV) system | Long-term incentives and stablecoin dominance |

| Arbitrum DAO | Layer-2 Scaling | Community-driven proposals | Crucial for Ethereum scalability |

| ENS DAO | Web3 Identity | Token-based, hybrid discussions | Governs decentralized naming & identity |

| Gitcoin DAO | Public Goods | Quadratic funding model | Funds open-source and community projects |

| Decentraland DAO | Metaverse | Token voting + landholder influence | Experiments in virtual society governance |

| Optimism Collective | Public Goods | Retroactive impact-based model | Aligns governance with social good outcomes |

Top 10 DAOs : Lessons from DAO Governance in Action

The DAO ecosystem has had both high points and hard lessons. Successful proposals in Uniswap and Gitcoin have directed millions into ecosystem growth, proving community-led funding can scale. On the other hand, early failures like the 2016 DAO hack revealed the risks of unchecked smart contract vulnerabilities. These experiences shaped today’s best practices: rigorous audits, open deliberation, and adaptive governance models that prioritize both security and inclusivity.

The Road Ahead: Top 10 DAOs – Future Trends for DAOs

The next wave of DAOs will likely integrate AI-powered analytics to guide community decisions. Cross-chain DAOs will emerge, spanning multiple blockchains for broader interoperability. Regulatory frameworks are slowly catching up, offering DAOs legal recognition in some jurisdictions. Beyond crypto, DAOs may soon govern charities, cooperatives, and even political initiatives, bringing decentralized governance into mainstream life.

Conclusion : Top 10 DAOs

The Top 10 DAOs of 2025 showcase how decentralized governance has matured into one of Web3’s defining features. From financial protocols like MakerDAO to digital identity stewards like ENS, these organizations prove that communities can successfully manage ecosystems worth billions.

Their continued evolution suggests that DAOs are not just shaping crypto but reshaping governance itself. As DAOs expand beyond digital assets into broader societal use cases, they could mark the beginning of a new era of collective, transparent, and global decision-making.