Understanding Stablecoins: A Beginner’s Guide to Crypto Stability

In a world where the price of Bitcoin can drop 20% overnight and headlines shift with every market turn, stability often feels elusive in crypto. This is where stablecoins for beginners comes into sharp focus. These digital assets offer a much-needed anchor in the fast-moving world of decentralized finance (DeFi), enabling payments, savings, and trades with far less turbulence.

Stablecoins are not a futuristic concept anymore. They’re already being used to move billions daily, both in the hands of everyday users and institutional players. But what are they, really? And why are they becoming central to the digital finance conversation?

What Are Stablecoins and Why Do They Matter?

Credit from Brookings Institution

Stablecoins are a type of cryptocurrency specifically designed to minimize price volatility. Unlike Bitcoin or Ethereum, whose prices can fluctuate wildly, stablecoins are pegged to the value of traditional assets—usually fiat currencies like the U.S. dollar (USD), but sometimes also to commodities like gold.

The logic is straightforward: combine the efficiency of crypto (speed, transparency, and decentralization) with the price predictability of fiat. The result is a hybrid asset that can function as a digital dollar in ecosystems where banks don’t reach or where crypto innovation is outpacing regulation.

Their importance lies in their utility. For crypto traders, stablecoins offer a place to “park” funds without converting back to fiat. For DeFi platforms, they serve as the primary medium for lending, borrowing, and yield-generating strategies.

Stablecoins for Beginners: How Do Stablecoins Stay Stable?

Credit from Medium

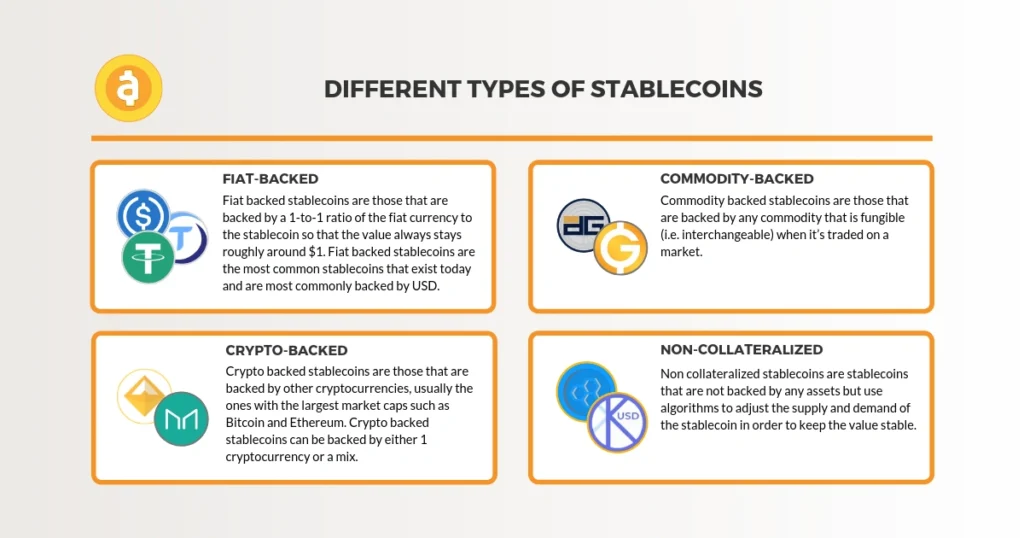

The stability of stablecoins hinges on how they maintain their peg. There are several approaches:

1. Fiat-Backed Stablecoins

These are backed 1:1 by reserves held in banks or custodians. Think of each digital coin as a token representing one real-world dollar. The most well-known examples—USDC (USD Coin) and USDT (Tether)—fall into this category. Their stability relies on trust: users must believe the issuer is holding the necessary reserves and operating transparently.

2. Crypto-Backed Stablecoins

These stablecoins are backed by cryptocurrencies instead of fiat. Because crypto is volatile, they’re often overcollateralized. For instance, to mint $100 worth of DAI (a popular decentralized stablecoin), you may need to lock in $150 worth of Ethereum. The excess buffer helps absorb price swings.

3. Algorithmic Stablecoins

These use software protocols to control supply and demand. If the price rises above the peg, new coins are minted. If it drops, supply contracts. The model is elegant in theory but fraught with risk. The collapse of TerraUSD in 2022 showed how quickly an algorithmic stablecoin can unravel if confidence disappears.

4. Commodity-Backed Stablecoins

Less common, these are backed by real-world assets like gold. For instance, PAX Gold (PAXG) gives holders ownership of actual, physical gold stored in vaults.

Why Stablecoins Are Gaining Traction

Stablecoins for Beginners who are new to crypto might ask: Why not just use regular money through a bank app?

Here’s where stablecoins carve out their niche:

- Global Transfers: Sending USDT from Malaysia to a friend in Brazil can take seconds and cost pennies—compared to slow, expensive bank wires.

- DeFi Participation: Many decentralized platforms require stablecoins to lend, borrow, or earn interest.

- Protection Against Inflation: In countries with weak currencies, stablecoins offer a gateway to USD-like stability without needing a U.S. bank account.

- Programmable Money: Developers can build applications around stablecoins—automated payrolls, escrow contracts, or even stablecoin-based games.

Stablecoins for Beginners: Risks and Trade-Offs

Stablecoins may feel “stable,” but they’re not risk-free.

- Trust in Issuers: Fiat-backed coins like USDT have faced scrutiny over whether their reserves are fully transparent.

- Smart Contract Risks: Crypto-backed coins rely on code. If there’s a bug, user funds can be lost.

- Regulatory Uncertainty: Governments are increasingly eyeing stablecoins as they grow. Some see them as a risk to monetary sovereignty.

- Algorithmic Collapse: Algorithm-based models can fail catastrophically if market confidence disappears.

Real-World Use Cases and Adoption

You don’t have to be a crypto trader to see stablecoins in action:

- Startups and freelancers are now accepting USDC for cross-border payments.

- Charities use stablecoins to get funds directly into disaster zones, bypassing slow banking systems.

- Remittances powered by stablecoins often cut costs by 50% or more compared to traditional services.

Even companies like Visa and PayPal have begun integrating stablecoin payments into their platforms, indicating growing institutional trust.

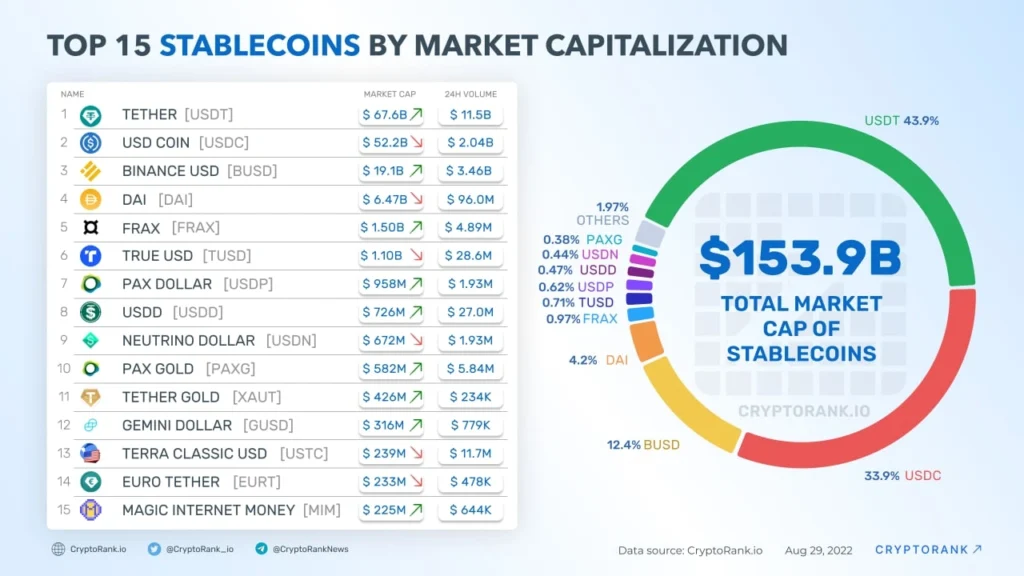

Popular Stablecoins You Should Know

Credit from Cryptorank News

- USDC: Issued by Circle, known for transparency and U.S. regulation alignment.

- USDT (Tether): Most widely used, but sometimes questioned for reserve clarity.

- DAI: Decentralized and crypto-collateralized. Fully open-source and managed via MakerDAO.

- PAXG: Pegged to gold—appeals to those who value precious metal exposure.

- FRAX: A partially algorithmic stablecoin model trying to find middle ground.

Each has its strengths and ideal use case, depending on what the user prioritizes—whether it’s decentralization, regulatory compliance, or liquidity.

Stablecoins for Beginners: The Future of Stablecoins

As regulation tightens and central banks explore their own digital currencies (CBDCs), stablecoins may evolve or be absorbed into broader monetary frameworks.

Already, some governments are moving to require real-time audits and licensing for issuers. Others are launching public-private pilots that allow stablecoins to operate within regulated financial rails.

Still, for now, stablecoins remain the backbone of the crypto economy—providing reliability in a world known for volatility.

Conclusion: Why Stablecoins for Beginners Matter

Understanding stablecoins for beginners is more than just decoding another crypto term—it’s about grasping a foundational shift in how value moves across borders and systems. Whether you’re a cautious investor, a freelancer abroad, or simply crypto-curious, stablecoins open the door to participation without the rollercoaster volatility.

For those just starting out, these digital dollars might just be the safest place to start.