How MACD RSI for Forex Indonesia Shapes Smarter Technical Strategies in 2025

MACD RSI for Forex Indonesia: In 2025, momentum strategies are gaining new momentum — especially among Indonesian forex traders looking to gain a consistent edge. Currency volatility, particularly with IDR-based pairs, is being influenced by global risk sentiment, inflation changes, and commodity price fluctuations. These dynamics have pushed traders to adopt tools that help them quickly interpret shifts in market behavior. The combination of MACD RSI for Forex Indonesia has proven especially effective, offering traders a balance between identifying trend direction and measuring strength before making entry decisions.

What MACD Reveals About Trend Structure in IDR Markets

MACD — the Moving Average Convergence Divergence — is a foundational indicator for detecting trend shifts. It captures the relationship between two moving averages, highlighting potential reversals and continuation signals. For forex traders in Indonesia in 2025, MACD is particularly useful when volatility spikes around events such as BI rate decisions or global commodity moves. When the MACD line crosses above its signal line, and price confirms the move, Indonesian traders often treat it as a sign of growing momentum. In fast-moving markets, MACD serves as the heartbeat monitor for potential breakouts.

MACD RSI for Forex Indonesia: How RSI Validates Momentum Behind the Move

Source: TabTrader

While MACD helps identify trends, RSI adds clarity to the quality of those moves. RSI — the Relative Strength Index — evaluates overbought and oversold levels, providing a snapshot of market strength. In 2025’s Indonesian forex environment, traders are relying on RSI not just for reversal points, but also for confirmation. If RSI rises above 50 following a bullish MACD crossover, it suggests a sustainable upside push. On the flip side, bearish divergence between price and RSI can hint that upward momentum is losing steam, prompting caution. RSI becomes the tool to filter out misleading MACD signals.

MACD RSI for Forex Indonesia: Using MACD and RSI Together: A 2025 Blueprint for Indonesian Traders

The real edge comes from combining MACD and RSI. Indonesian traders in 2025 are building strategies that begin with MACD identifying trend direction, then validating the move with RSI. A rising MACD line with RSI trending toward the 60–70 zone typically suggests strong buying momentum. This dual-indicator approach helps avoid weak signals that often occur when indicators are used in isolation. It’s a powerful method when applied to trending pairs like USD/IDR or EUR/IDR, especially during active sessions. MACD RSI for Forex Indonesia isn’t just a setup — it’s now a strategic standard.

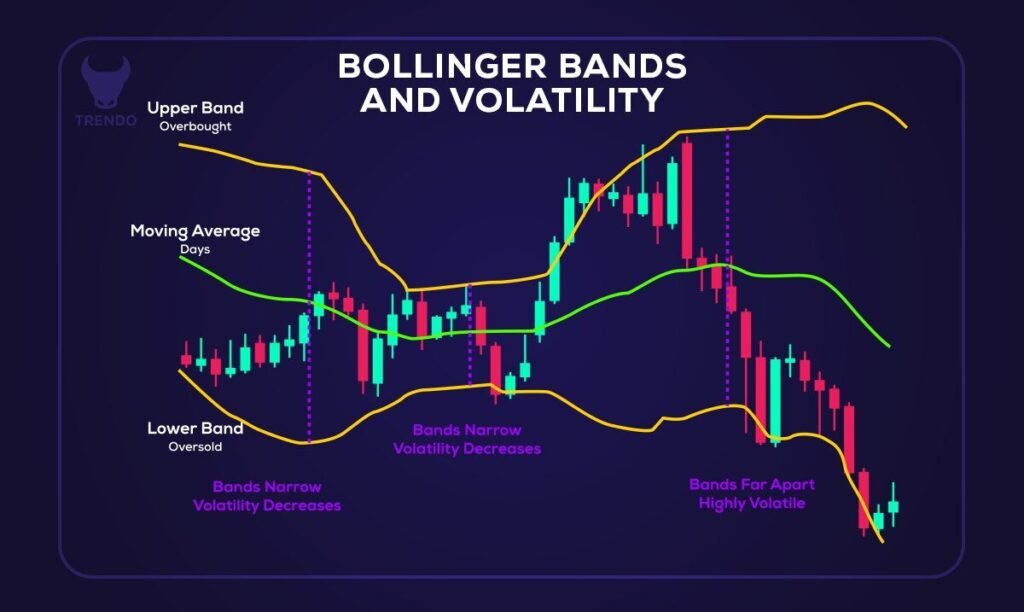

MACD RSI for Forex Indonesia: Why Adding Bollinger Bands Creates Visual Confirmation

Source: Fxtrendo

To enhance accuracy, many Indonesian traders are overlaying Bollinger Bands with MACD and RSI. Bollinger Bands provide a visual sense of volatility and price extremes. In 2025, traders often look for price to break above the upper band alongside bullish MACD-RSI signals — a sign that a breakout may be genuine rather than temporary. If price pierces the lower band but RSI and MACD suggest reversal strength, it could be a prime bounce setup. Bollinger Bands serve as a third layer of confirmation in a market where clarity often hides behind volatility spikes.

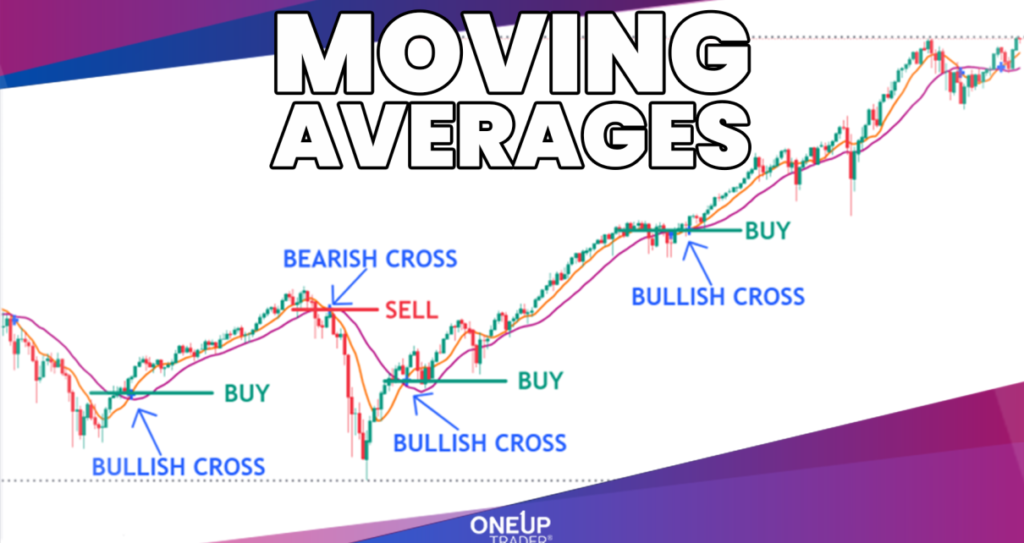

Moving Averages to Anchor the Trend

Source: OneUp Trader

Another complementary tool used in 2025 by Indonesian forex traders is the exponential moving average (EMA). The 50-period EMA is often added to the chart to confirm the broader trend direction. When MACD and RSI both give a bullish signal and price holds above the EMA, the trader gains more confidence in entering long positions. This moving average acts like a trend filter — helping traders avoid setups that go against the prevailing direction. It also reduces noise in sideways markets, which remain a common feature in Asia-Pacific forex sessions.

Stochastic Oscillator: Finer Timing Inside the Setup

Some traders in Indonesia go even further by introducing the stochastic oscillator as an entry timing tool within the MACD-RSI framework. When stochastic readings line up with a bullish RSI and MACD crossover — especially in oversold territory — it offers additional precision. For instance, if MACD flips bullish and RSI supports it, but stochastic has not yet turned, the trader might wait. Once stochastic confirms, the setup gains stronger potential. This layering technique is helping 2025 Indonesian traders reduce premature entries and align with short-term market momentum.

Why News, Timing, and Market Sentiment Still Matter

Source: BrokerXplorer

Although MACD and RSI are effective, 2025 reminds Indonesian traders that technical indicators alone are not enough. Data releases, central bank cues, and unexpected global headlines can all disrupt technical setups. Many Indonesian traders now combine indicator-based signals with real-time sentiment analysis — monitoring key economic calendars, using sentiment gauges, or reacting to geopolitical news. In this environment, MACD RSI for Forex Indonesia is not a prediction tool, but a guide for structured analysis in an unpredictable world.

Conclusion: MACD and RSI Are a Smart Combo for Indonesian Forex Traders

As more traders in Indonesia embrace technical trading in 2025, MACD and RSI continue to prove their worth. Their combined ability to show direction and strength makes them a go-to framework for both new and experienced traders. With volatility likely to remain high, traders are advised to master these indicators and apply them thoughtfully — ideally in combination with volatility tools and market awareness. Whether you’re scalping IDR pairs or holding positions through macro events, the MACD RSI for Forex Indonesia strategy is a reliable companion in your trading toolkit.