Rupiah Forecast 2025: Will the IDR Withstand Global Financial Headwinds?

A Currency Balancing Growth and Fragility

The Rupiah Forecast 2025 captures a complex moment for Indonesia’s currency. With steady GDP growth, a growing digital sector, and policy continuity at home, there are reasons to believe in the Rupiah’s relative stability. But at the same time, global macroeconomic risks, from high U.S. interest rates to ongoing geopolitical tensions, continue to shape the flow of capital — often pulling emerging market currencies into uncertain territory. As the world looks for clearer financial direction, the Rupiah remains tethered to both optimism and caution. The key question now is: can it hold steady, or will headwinds prove too strong?

The Weight of the U.S. Dollar Still Casts a Shadow

Source: Coincodex

One of the largest challenges for the IDR in 2025 is the continued strength of the U.S. dollar. Despite hopes that the Fed might begin easing by mid-year, robust employment data and persistent inflation in the U.S. have delayed a firm pivot. The result is capital flowing toward safer, higher-yielding dollar assets, draining demand from emerging market currencies. For Indonesia, this dynamic has weakened the Rupiah’s momentum, even as domestic fundamentals remain sound. The Rupiah forecast 2025 hinges, in large part, on when — and how quickly — this global tide begins to shift.

Trade Is Holding for Now, But the Margin Is Narrowing

Indonesia’s trade surplus has been a consistent anchor for the Rupiah over the past few years. Exports of commodities like coal, nickel, and palm oil have provided steady foreign exchange inflows. Yet in 2025, analysts are watching these numbers more closely. Global commodity prices have begun to soften, and demand from major partners, including China, is no longer as robust. At the same time, Indonesia’s import appetite is rising — driven by consumer goods, capital equipment, and fuel. If the trade surplus narrows significantly, the IDR outlook could face sharper downside pressure in the months ahead.

Domestic Growth Steady, but Not Immune to Shocks

Indonesia’s internal growth story remains one of cautious strength. Forecasts project GDP growth near 5% in 2025, fueled by consumption, infrastructure, and digital investment. Inflation is generally under control, thanks to careful policy by Bank Indonesia. Still, risks remain. A sudden rise in energy prices, food supply disruptions, or external shocks could change inflation expectations — and by extension, investor sentiment. The Rupiah forecast depends not only on real economic performance, but also on whether Indonesia can maintain a sense of stability while navigating these external vulnerabilities.

Central Bank Strategy: Rupiah Forecast 2025- Stability Through Caution

Soource: Sah! News

Bank Indonesia’s cautious but consistent approach has helped buffer the IDR from deeper swings in recent years. Its mix of interest rate policy, foreign exchange intervention, and forward guidance has maintained a stable tone in currency markets. For 2025, that role becomes even more important. Should global volatility intensify, the central bank may need to act quickly to reassure markets. On the other hand, if inflation remains contained, it could signal a more accommodative stance to support growth. The credibility and responsiveness of Bank Indonesia is central to the Rupiah forecast 2025 staying on track.

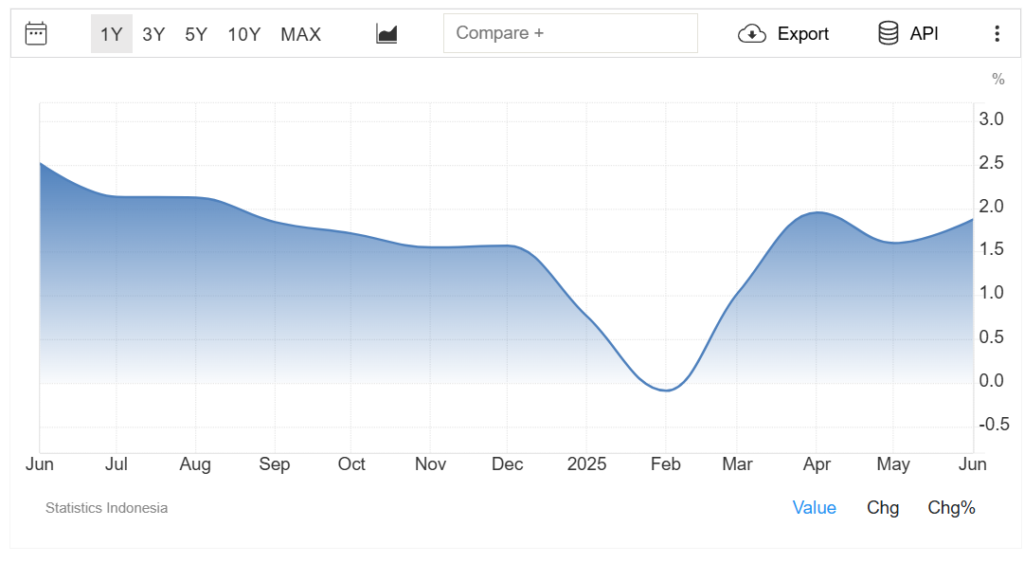

Capital Markets: Rupiah Forecast 2025- Cautious Flows, Shifting Risk Appetite

Source: TradingEconomics

Investor behavior in 2025 is highly fluid. While Indonesia continues to attract long-term capital in sectors like green energy, mining, and infrastructure, portfolio flows remain volatile. The IDR is sensitive to fluctuations in global sentiment — often reacting quickly to changes in U.S. yields, risk ratings, or external events. Foreign investors may reduce holdings not due to domestic factors, but because of broader portfolio rebalancing. This makes the Rupiah vulnerable to short-term swings, especially during periods of global uncertainty or capital flight from emerging markets.

How the Rupiah Stacks Up Against Regional Peers

In a regional comparison, the Indonesian Rupiah continues to perform better than several other emerging currencies. Its moderate inflation rate, stable political landscape, and responsible fiscal management help maintain relative strength. However, being part of the broader emerging market narrative means the IDR can still face pressure even if Indonesia’s fundamentals look strong. As part of the emerging market currencies outlook 2025, the Rupiah is positioned as a middle-tier performer — not the most fragile, but not the safest haven either.

Conclusion: Rupiah Forecast 2025- A Year of Watching, Not Rushing

The Rupiah Forecast 2025 doesn’t suggest a dramatic breakout or breakdown — but rather a year where every shift must be monitored closely. The currency’s path will be influenced by global policy shifts, domestic discipline, and investor mood. While Indonesia has the tools to manage volatility, it cannot entirely insulate itself from global currents. For businesses and market participants, this means staying informed, hedging where necessary, and avoiding overreaction to noise. In this climate, calm and clarity may prove to be Indonesia’s most valuable currency asset.